Food Lion 2012 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2012 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

136 // DELHAIZE GROUP FINANCIAL STATEMENTS’12

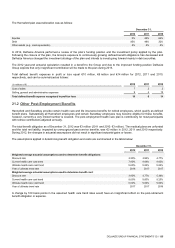

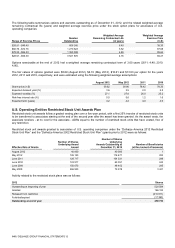

21.3 Share-Based Compensation

Delhaize Group offers share-based incentives to certain members of its senior management: stock option plans for associates of

its non-U.S. operating companies; stock option, warrant and restricted stock unit plans for associates of its U.S. based

companies.

Under a warrant plan the exercise by the associate of a warrant results in the creation of a new share, while stock option or

restricted stock unit plans are based on existing shares. Due to the sizeable administrative requirements that Belgian law

imposes on capital increases, a certain amount of time passes between the moment warrants have been exercised and the

capital increase is formally performed. In cases when the capital increase occurs after year-end for warrants exercised

before year-end, which usually concern a limited number of warrants, Delhaize Group accounts for the actual exercise of the

warrants at the date of the following capital increase. Consequently, no movement occurs in equity due to warrants

exercised pending a subsequent capital increase, until such a capital increase takes place. If considered dilutive, such

exercised warrants pending a subsequent capital increase are included in the diluted earnings per share calculation.

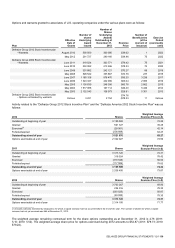

Restricted stock unit awards represent the right to receive the number of ADRs set forth in the award at the vesting date at

no cost to plan participants.

The remuneration policy of Delhaize Group can be found as Exhibit E to the Delhaize Group’s Corporate Governance Charter

available on the Company’s website (www.delhaizegroup.com).

As explained in Note 2.3, the share-based compensation plans operated by Delhaize Group are accounted for as equity-settled

share-based payment transactions, do not contain cash settlement alternatives and the Group has no past practice of cash

settlement. The cost of such transactions with employees is measured by reference to the fair value of the equity instruments at

grant date and is expensed over the applicable vesting period. The Group’s share-based compensation plans are subject to

service vesting conditions and do not contain any performance conditions.

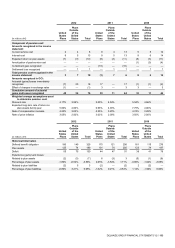

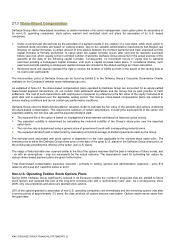

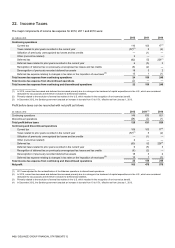

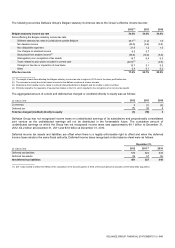

Delhaize Group uses the Black-Scholes-Merton valuation model to estimate the fair value of the warrants and options underlying

the share-based compensation. This requires the selection of certain assumptions, including the expected life of the option, the

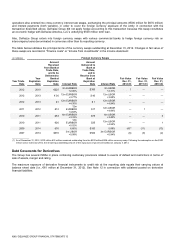

expected volatility, the risk-free rate and the expected dividend yield:

The expected life of the option is based on management’s best estimate and based on historical option activity.

The expected volatility is determined by calculating the historical volatility of the Group’s share price over the expected

option term.

The risk-free rate is determined using a generic price of government bonds with corresponding maturity terms.

The expected dividend yield is determined by calculating a historical average of dividend payments made by the Group.

The exercise price associated with stock options is dependent on the rules applicable to the relevant stock option plan. The

exercise price is either the Delhaize Group share price on the date of the grant (U.S. plans) or the Delhaize Group share price on

the working day preceding the offering of the option (non-U.S. plans).

The usage of historical data over a period similar to the life of the options assumes that the past is indicative of future trends, and

- as with all assumptions - may not necessarily be the actual outcome. The assumptions used for estimating fair values for

various share-based payment plans are given further below.

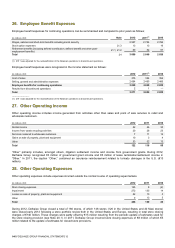

Total share-based compensation expenses recorded - primarily in selling, general and administrative expenses - were €13

million in 2012 and 2011 and €16 million in 2010.

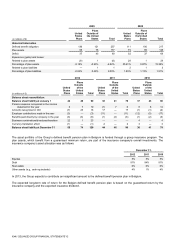

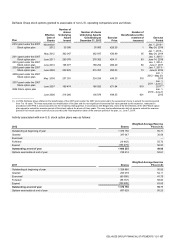

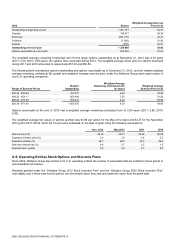

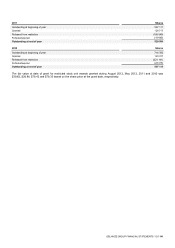

Non-U.S. Operating Entities Stock Options Plans

During 2009, Delhaize Group significantly reduced in its European entities the number of associates that are entitled to future

stock options and replaced this part of the long-term incentive plan with a “performance cash” plan. As a consequence, since

2009, only vice presidents and above are granted stock options.

25% of the options granted to associates of non-U.S. operating companies vest immediately and the remaining options vest after

a service period of approximately 3½ years, the date at which all options become exercisable. Options expire seven years from

the grant date.