Food Lion 2012 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2012 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

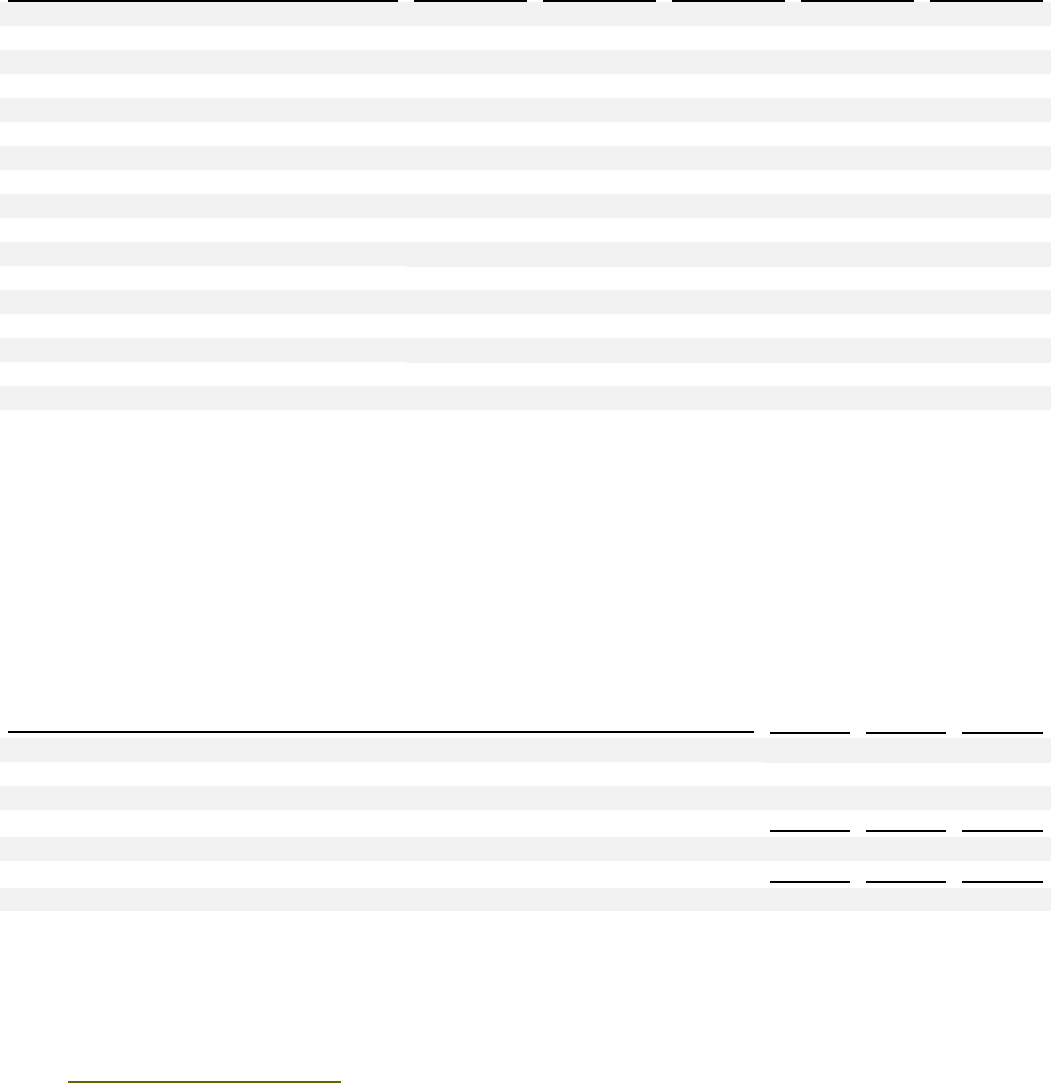

DELHAIZE GROUP FINANCIAL STATEMENTS ’12 // 91

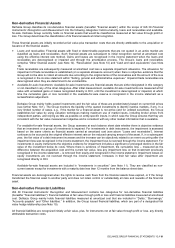

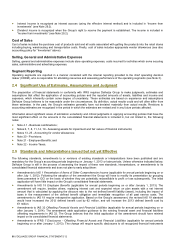

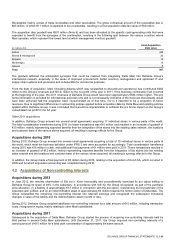

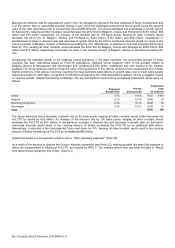

Year ended December 31, 2010 (in millions of €)

United States

Belgium(2)

Southeastern

Europe and

Asia(3)

Corporate

Total

Revenues(1)

14 187

4 800

1 863

—

20 850

Cost of sales

(10 272)

(3 803)

(1 422)

—

(15 497)

Gross profit

3 915

997

441

—

5 353

Gross margin

27.6%

20.8%

23.7%

—

25.7%

Other operating income

43

36

6

—

85

Selling, general and administrative expenses

(3 189)

(795)

(377)

(33)

(4 394)

Other operating expenses

(16)

(2)

(2)

—

(20)

Operating profit (loss)

753

236

68

(33)

1 024

Operating margin

5.3%

4.9%

3.7%

—

4.9%

Operating result of discontinued operations

—

—

—

—

—

Other information

Assets

7 850

1 806

1 014

232

10 902

Liabilities

2 592

1 141

508

1 592

5 833

Capital expenditures

410

128

113

9

660

Non-cash operating activities:

Depreciation and amortization

423

104

39

9

575

Impairment loss(6)

13

—

1

—

14

Share-based compensation

14

1

—

1

16

_______________

(1) All revenues are from external parties.

(2) Belgium includes Delhaize Group’s operations in Belgium and the Grand Duchy of Luxembourg.

(3) Southeastern Europe and Asia includes the Group’s operations in Greece, Romania, Indonesia and since August 1, 2011 Serbia, Bulgaria, Bosnia and

Herzegovina and Montenegro.

(4) The 2011 consolidated income statement was adjusted for the reclassification of the Albanian operations to discontinued operations.

(5) The December 31, 2011 consolidated balance sheet was revised to reflect the effects of the completion in the second quarter 2012 of the purchase price

allocation of the Delta Maxi acquisition.

(6) No impairment loss was recorded or reversed in equity. The 2012 impairment loss includes €16 million on the re-measurement of assets of the disposal group

(see Note 5.3.)

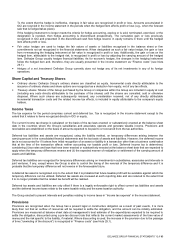

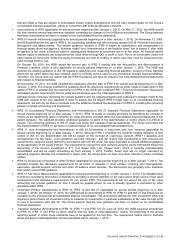

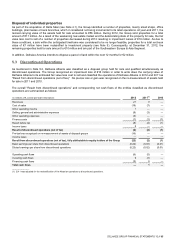

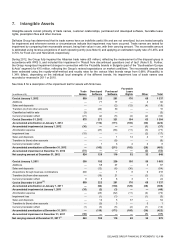

Delhaize Group’s operation of retail supermarkets represents approximately 90% of the Group’s consolidated revenues. The

remaining revenue represents wholesale retail revenues. Total revenues can be further analyzed as follows:

(as a percentage of revenues)

2012

2011

2010

Retail revenues

- Food - perishable

40.0%

37.9%

40.0%

- Food - non-perishable

35.6%

36.1%

35.5%

- Non-food

13.4%

15.0%

13.8%

Total retail revenues

89.0%

89.0%

89.3%

Wholesale revenues

11.0%

11.0%

10.7%

Total revenues

100.0%

100.0%

100.0%

Delhaize Group is not reliant on any individual major customer and, consequently, there are no individual customers where the

total amount of revenue derived from that customer would be more than 10% of Delhaize Group’s revenue.

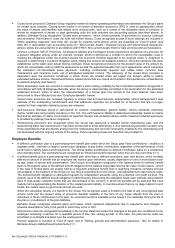

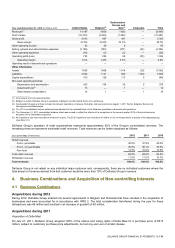

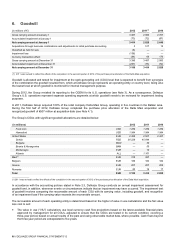

4. Business Combinations and Acquisition of Non-controlling Interests

4.1 Business Combinations

Acquisitions during 2012

During 2012, Delhaize Group entered into several agreements in Belgium and Romania that have resulted in the acquisition of

businesses and were accounted for in accordance with IFRS 3. The total consideration transferred during the year for these

transactions was €5 million and resulted in an increase of goodwill of €3 million.

Acquisitions during 2011

Acquisition of Delta Maxi

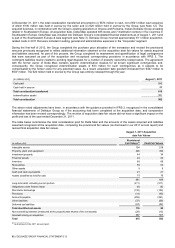

On July 27, 2011, Delhaize Group acquired 100% of the shares and voting rights of Delta Maxi for a purchase price of €615

million, subject to customary purchase price adjustments, but not any earn-out or similar clauses.