Food Lion 2012 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2012 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

132 // DELHAIZE GROUP FINANCIAL STATEMENTS’12

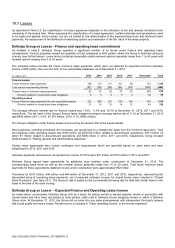

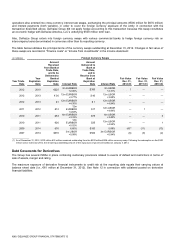

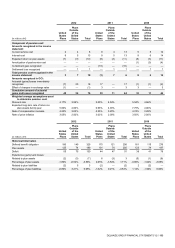

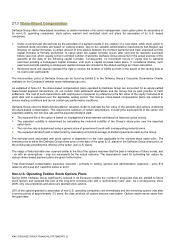

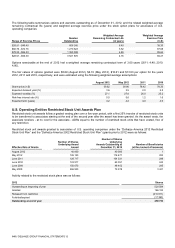

Defined Benefit Plans

(in millions of €)

2012

2011

2010

United

States

Plans

Plans

Outside

of the

United

States

Total

United

States

Plans

Plans

Outside

of the

United

States

Total

United

States

Plans

Plans

Outside

of the

United

States

Total

Change in benefit obligation:

Benefit obligation at January 1

175

121

296

161

115

276

136

121

257

Current service cost

2

4

6

9

4

13

9

5

14

Interest cost

8

5

13

8

5

13

8

6

14

Plan participants’ contributions

1

1

2

1

1

2

2

2

4

Amendments

—

—

—

—

1

1

(1)

(3)

(4)

Actuarial (gain)/loss

(5)

28

23

11

3

14

4

—

4

Benefits paid

(19)

(12)

(31)

(11)

(9)

(20)

(12)

(17)

(29)

Business combinations/divestures/ transfers

22

1

23

—

—

—

4

—

4

Plan curtailments

—

—

—

(10)

—

(10)

—

—

—

Plan settlements

—

1

1

—

1

1

—

1

1

Currency translation effect

(4)

—

(4)

6

—

6

11

—

11

Benefit obligation at December 31

180

149

329

175

121

296

161

115

276

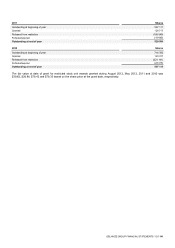

Change in plan assets:

Fair value of plan assets at January 1

131

74

205

123

74

197

99

78

177

Expected return on plan assets

7

3

10

8

3

11

8

3

11

Actuarial gain/(loss) on plan assets

2

5

7

(6)

3

(3)

5

1

6

Employer contributions

6

3

9

12

2

14

13

7

20

Plan participants’ contributions

1

1

2

1

1

2

2

2

4

Benefits paid

(19)

(12)

(31)

(11)

(9)

(20)

(12)

(17)

(29)

Currency translation effect

(3)

—

(3)

4

—

4

8

—

8

Fair value of plan assets at December 31

125

74

199

131

74

205

123

74

197

Actual return on plan assets

9

8

17

2

6

8

13

4

17

Amounts recognized in the balance sheet:

Present value of funded obligation

122

115

237

140

97

237

131

92

223

Fair value of plan assets

(125)

(74)

(199)

(131)

(74)

(205)

(123)

(74)

(197)

Net deficit/(surplus) for funded plans

(3)

41

38

9

23

32

8

18

26

Deficit for funded plans

1

41

42

9

23

32

8

18

26

Surplus for funded plans

(4)

—

(4)

—

—

—

—

—

—

Present value of unfunded obligations

58

34

92

35

24

59

30

23

53

Unrecognized past service cost

—

(1)

(1)

—

(1)

(1)

—

—

—

Net liability

55

74

129

44

46

90

38

41

79

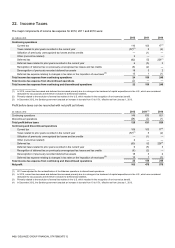

Weighted average assumptions used to

determine benefit obligations:

Discount rate

3.49%

2.27%

4.17%

3.99%

5.00%

4.54%

Rate of compensation increase

4.25%

2.66%

4.25%

3.02%

4.25%

3.20%

Rate of price inflation

3.05%

2.00%

3.05%

2.00%

3.03%

2.00%