Food Lion 2012 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2012 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28 //

REVIEW

At the end of 2012, Delhaize Group

had total annual minimum operat-

ing lease commitments for 2013

of €312 million, including €21 mil-

lion related to closed stores. These

leases generally have terms that

range between 1 and 45 years with

renewal options ranging from 3 to

30 years.

Events after

Balance Sheet Date

On January 3, 2013, Delhaize Group

redeemed the remaining $99 mil-

lion of the $300 million 5.875% sen-

ior notes due 2014 and the underly-

ing cross-currency swap.

On January 17, 2013, Delhaize

Group announced the decision to

close 52 stores, 45 stores in the

U.S. (34 Sweetbay, 8 Food Lion and

3 Bottom Dollar Food), 6 stores in

Southeastern Europe and 1 store

in Belgium. As a result, the group

recorded an impairment charge of

€49 million in the fourth quarter of

2012. During the fi rst part of 2013,

the Group expects earnings to be

impacted by approximately €80

million to refl ect store closing liabili-

ties including a reserve for ongoing

lease and severance obligations.

In addition, the Group will record

charges of approximately $20 mil-

lion (€15 million) in the fi rst quarter

of 2013 related to the severance of

senior management and of sup-

port services associates in the U.S.

In January 2013, the Greek parlia-

ment prospectively enacted an

increase in the Greek corporate tax

rate from 20 to 26%. The impact on

Alfa Beta will be immaterial.

In February 2013, Delhaize Group

launched a tender offer to acquire

16% non-controlling interest in

C-Market (Serbian subsidiary), held

by the Serbian Privatization Agency,

at a price of €300 per share. At

December 31, 2012 Delhaize Group

owned 75.4% of C-Market, or

150 254 shares.

In February 2013, Delhaize Group

completed the sale of its Albanian

activities and recorded a gain of

approximately €1 million.

NON-GAAP MEASURES

In its fi nancial communication, Delhaize

Group uses certain measures that have

no defi nition under IFRS or other generally

accepted accounting standards (non-

GAAP measures). Delhaize Group does not

represent these measures as alternative

measures to net profi t or other fi nancial

measures determined in accordance

with IFRS. These measures as reported by

Delhaize Group might differ from similarly

titled measures by other companies. We

believe that these measures are important

indicators for our business and are widely

used by investors, analysts and other

parties. A reconciliation of these measures

to IFRS measures can be found in the

chapter “Supplementary Information” of

the Financial Statements (www.annual-

reports.delhaizegroup.com). A defi nition of

non-GAAP measures and ratio composed

of non-GAAP measures can be found in

the glossary. The non-GAAP measures pro-

vided in this report have not been audited

by the statutory auditor.

(1) Excluding fi nance

leases; principal

payments (related

premiums and

discounts not taken into

account) after effect of

cross-currency interest

rate swaps.

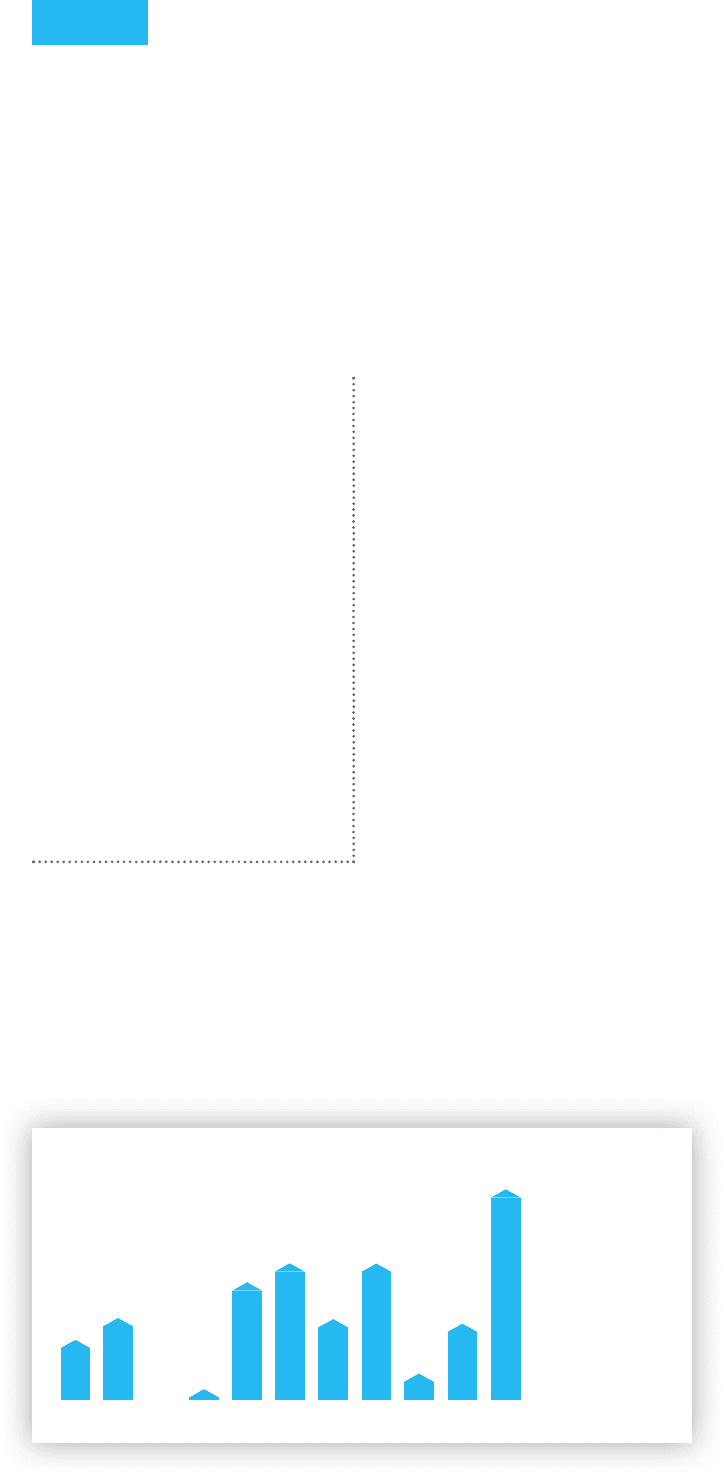

DEBT MATURITY PROFILE

(1)

(AFTER SWAPS) (in millions of €)

2013 2014 2015 2016 2017 2018 2019 2020 2027 2031 2040

164

232

341

400

400

8

225

211

627

54