Food Lion 2012 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2012 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DELHAIZE GROUP FINANCIAL STATEMENTS ’12 // 101

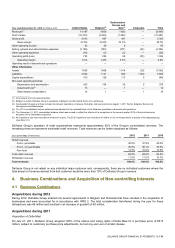

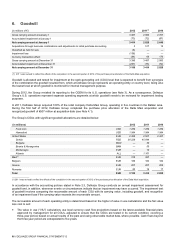

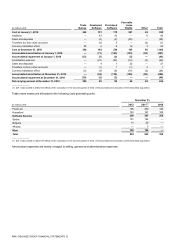

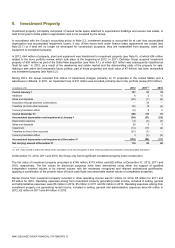

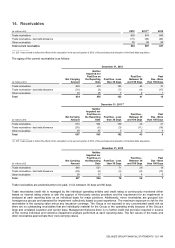

8. Property, Plant and Equipment

(in millions of €)

Land and

Buildings

Leasehold

Improvements

Furniture,

Fixtures,

Equipment

and

Vehicles

Construction

in Progress

and Advance

Payments

Property

under

Finance

Leases

Total

Property,

Plant and

Equipment

Cost at January 1, 2012

2 539

1 902

3 624

87

969

9 121

Additions

96

101

246

147

14

604

Sales and disposals

(21)

(110)

(228)

(4)

(26)

(389)

Acquisitions through business combinations

3

—

1

—

—

4

Transfers (to) from other accounts

29

56

41

(187)

(86)

(147)

Currency translation effect

(49)

(28)

(56)

—

(15)

(148)

Divestitures / Classified as held for sale

(1)

(1)

(12)

—

—

(14)

Balance at December 31, 2012

2 596

1 920

3 616

43

856

9 031

Accumulated depreciation at January 1, 2012

(735)

(1 126)

(2 117)

—

(422)

(4 400)

Accumulated impairment at January 1, 2012

(19)

(35)

(62)

—

(55)

(171)

Depreciation expense

(93)

(132)

(294)

—

(49)

(568)

Impairment loss

(15)

(23)

(36)

(1)

(12)

(87)

Sales and disposals

14

109

210

—

25

358

Transfers to (from) other accounts

10

1

4

—

78

93

Currency translation effect

11

17

34

—

8

70

Divestitures / Classified as held for sale

—

—

5

—

—

5

Accumulated depreciation at December 31, 2012

(801)

(1 160)

(2 203)

—

(407)

(4 571)

Accumulated impairment at December 31, 2012

(26)

(29)

(53)

(1)

(20)

(129)

Net carrying amount at December 31, 2012

1 769

731

1 360

42

429

4 331

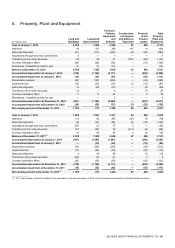

Cost at January 1, 2011

1 930

1 861

3 217

94

930

8 032

Additions

112

92

265

204

35

708

Sales and disposals

(8)

(22)

(96)

(5)

(18)

(149)

Acquisitions through business combinations

297

21

77

5

—

400

Transfers (to) from other accounts

167

(90)

76

(213)

(6)

(66)

Currency translation effect

41

40

85

2

28

196

Balance at December 31, 2011(1)

2 539

1 902

3 624

87

969

9 121

Accumulated depreciation at January 1, 2011

(587)

(1 055)

(1 881)

—

(380)

(3 903)

Accumulated impairment at January 1, 2011

—

(12)

(23)

—

(19)

(54)

Depreciation expense

(74)

(126)

(264)

—

(49)

(513)

Impairment loss

(17)

(24)

(39)

—

(35)

(115)

Sales and disposals

4

20

89

—

19

132

Transfers to (from) other accounts

(60)

65

(3)

—

3

5

Currency translation effect

(20)

(29)

(58)

—

(16)

(123)

Accumulated depreciation at December 31, 2011

(735)

(1 126)

(2 117)

—

(422)

(4 400)

Accumulated impairment at December 31, 2011

(19)

(35)

(62)

—

(55)

(171)

Net carrying amount at December 31, 2011(1)

1 785

741

1 445

87

492

4 550

_______________

(1) 2011 was revised to reflect the effects of the completion in the second quarter of 2012 of the purchase price allocation of the Delta Maxi acquisition.