Food Lion 2012 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2012 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

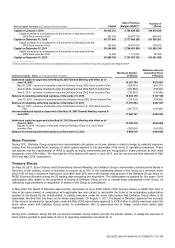

DELHAIZE GROUP FINANCIAL STATEMENTS ’12 // 119

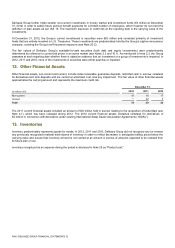

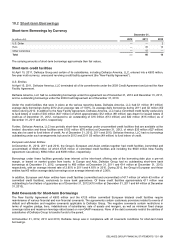

(€9 million) and $13 million (€10 million), respectively, were recorded in investment in securities on the balance sheet (see Note

11).

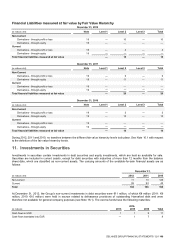

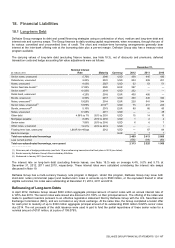

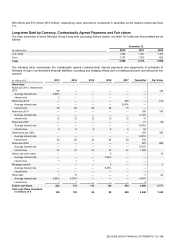

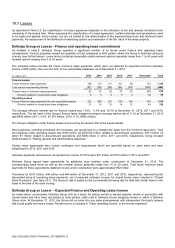

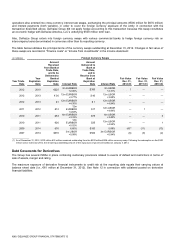

Long-term Debt by Currency, Contractually Agreed Payments and Fair values

The main currencies in which Delhaize Group’s long-term (excluding finance leases, see Note 18.3) debt are denominated are as

follows:

December 31,

(in millions of €)

2012

2011

2010

U.S. dollar

1 362

1 391

1 381

Euro

1 107

1 022

625

Total

2 469

2 413

2 006

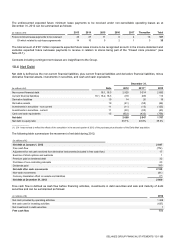

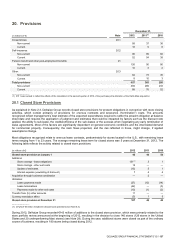

The following table summarizes the contractually agreed (undiscounted) interest payments and repayments of principals of

Delhaize Group’s non-derivative financial liabilities, excluding any hedging effects and not taking premiums and discounts into

account:

(in millions of $)

2013

2014

2015

2016

2017

Thereafter

Fair Value

Fixed rates

Notes due 2014, redeemed in

2013

99

—

—

—

—

—

105

Average interest rate

5.88%

—

—

—

—

—

Interest due

2

—

—

—

—

—

Bonds due 2017

—

—

—

—

450

—

513

Average interest rate

—

—

—

—

6.50%

—

Interest due

29

29

29

29

15

—

Notes due 2019

—

—

—

—

—

300

310

Average interest rate

—

—

—

—

—

4.13%

Interest due

12

12

12

12

12

19

Notes due 2027

—

—

—

—

—

71

82

Average interest rate

—

—

—

—

—

8.05%

Interest due

6

6

6

6

6

54

Debentures due 2031

—

—

—

—

—

270

323

Average interest rate

—

—

—

—

—

9.00%

Interest due

24

24

24

24

24

330

Notes due 2040

—

—

—

—

—

827

806

Average interest rate

—

—

—

—

—

5.70%

Interest due

47

47

47

47

47

1 084

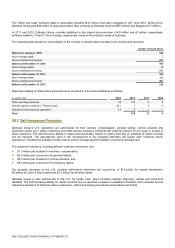

Senior and other notes

—

—

—

9

—

—

10

Average interest rate

—

—

—

7.06%

—

—

Interest due

1

1

1

—

—

—

Mortgage payable

—

—

—

2

—

—

2

Average interest rate

—

—

—

8.25%

—

—

Interest due

—

—

—

—

—

—

Other debt

1

12

—

—

—

7

20

Average interest rate

2.88%

5.36%

—

—

—

4.50%

Interest due

1

1

—

—

—

4

Total $ cash flows

222

132

119

129

554

2 966

2 171

Total cash flows translated

in millions of €

168

100

90

98

420

2 248

1 645