Food Lion 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual

report

WWW.DELHAIZEGROUP.COM

2012

TOGETHER THE BEST FOR LIFE

Table of contents

-

Page 1

2012 report Annual W W W . D E L H A I Z E G R O U P . C O M TOGETHER THE BEST FOR LIFE -

Page 2

... Delhaize Group has leading positions in food retailing in key markets. Our operating companies have acquired these leading positions through distinct go-to-market strategies. The Group is committed to offer its customers a locally differentiated shopping experience, to deliver superior value... -

Page 3

... Principles STRATEGY 12 14 18 23 Our strategy at work Growth Efï¬ciency Sustainability REVIEW (1) 26 29 32 35 Financial Review United States Belgium Southeastern Europe & Asia These chapters contain the information required by the Belgian Companies Code to be included in the Management Report on... -

Page 4

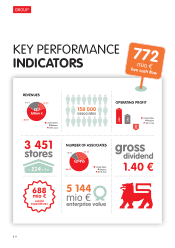

GROUP KEy PERFORMANCE INDICATORS REVENUES 21.6% 14.0% free cas 7 7 2 m io â,¬ h ï¬,ow OPERATING PROFIT 22.7 billion â,¬ 64.4% United States Belgium SEE & Asia 158 000 associates United States Belgium SEE & Asia 343 202 -113 3 451 stores + 224 new NUMBER OF ASSOCIATES 10.4% 23.3% gross ... -

Page 5

...)(2) Group share in net proï¬t (diluted)(2) Free cash ï¬,ow(1)(2) Net dividend Shareholders' equity(3) Share price (year-end) RATIOS (%) Operating margin Net margin Net debt to equity(1) CURRENCY INFORMATION Average â,¬ per $ rate â,¬ per $ rate at year-end OTHER INFORMATION Number of sales outlets... -

Page 6

...: excellent service, a high quality assortment and affordable prices. After becoming a member of the Board in 2011, the Group's spirit really reminded me of my father's store and the way he treated his customers as his most important asset. How would you describe 2012 from an operational point of... -

Page 7

...this level. A third element is that as a company, you need to be able to attract talent. At Delhaize Group we have developed strong programs to achieve this goal. In addition to those, our very real and lively values are a strong point of attraction for young talent. DELHAIZE GROUP ANNUAL REPORT '12... -

Page 8

... unnoticed. MJ: Food Lion had to step up its efforts to be more in line with what customers need on service levels and prices. I was in the U.S. several times last year and I was impressed by our operations. The repositioning work we are doing is a reflection of the new reality in food retail, so... -

Page 9

... our customers and our shareholders. While Delhaize Group seems to have difï¬culties in its mature markets, with the portfolio in Southeastern Europe it clearly has a winning hand. POB: The performance of our newer operations and formats, like South- + 224 new stores DELHAIZE GROUP ANNUAL REPORT... -

Page 10

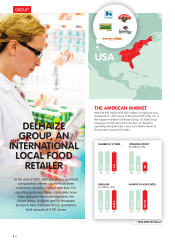

... in revenues and a network of 1 553 stores at the end of 2012, the U.S. is the largest market for Delhaize Group. Of total Group revenues, 64.4% came from the ï¬ve U.S. banners operating along the East coast, from Maine down to Florida and covering 18 states. NUMBER OF STORES OPERATING PROFIT (in... -

Page 11

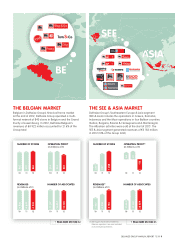

... and Montenegro). The Albanian activities were sold at the start of 2013. The SEE & Asia segment generated revenues of â,¬3 183 million in 2012 (14% of the Group total). NUMBER OF STORES OPERATING PROFIT (in millions of â,¬) NUMBER OF STORES OPERATING PROFIT(1) (in millions of â,¬) 68 81 11... -

Page 12

...in a sustainable way. Together, we offer assortments, products and services that are nutritious, healthy and safe, everyday, at prices all customers can afford. We are connected with our colleagues across the Group. We learn, we grow talent and we innovate. We support, we respect and we inspire each... -

Page 13

... strong market densities Continuous productivity improvement drives our value proposition We are a leader in sustainability Our team is built with excellent people to deliver excellent results Simpler is better f ples o princi rategy our st 8 3 4 5 6 7 8 DELHAIZE GROUP ANNUAL REPORT '12... -

Page 14

... ï,« Food Lion Launches New Brand Strategy in 269 North Carolina and South Carolina Stores $ 5th Report zero Sustainability â,¬ AUGUST ï,« Launch of Strategic Cost Plan SEPTEMBER ï,« Alfa Beta rewarded by Greek customers ï,« Recruitment of Marcus Spurrell as Delhaize Group's ï¬rst Senior Vice... -

Page 15

DELHAIZE GROUP ANNUAL REPORT '12 // 13 -

Page 16

STRATEGy H T W O GR e growth ble revenu ta ï¬ ro p g n f the Accelerati ey pillars o k e re th e this is one of th omprising C . y g te a tr roup s tiation, Delhaize G all differen w ru fo re lar a rowth and growth pil network g o li fo rt o p braced organic re fully em a ts n e m le the se e ies... -

Page 17

... most of our banners, the Taste of Inspirations gourmet brand, and some category-speciï¬c brands that target speciï¬c assortments, such as Care (health & beauty), Bio (organic), Kids (children), and Baby (infants). Every year DG operating companies develop new products to better meet the needs and... -

Page 18

... banner uses the Hannaford.com website to support customers who want to plan both their shopping and cooking experiences, offering detailed information on products (from pricing to ingredients) and a comprehensive list-making app. Technology It has been discussed before and remains the case today... -

Page 19

... 100th store in 2011, Mega Image came close to celebrating the 200th store mark in 2012. In Indonesia, Super Indo celebrated the opening of its 100th store. In addition to expanding in the Group's newer markets, Delhaize Group also pushed the further expansion of new formats like Bottom Dollar Food... -

Page 20

... con e Group esta th , n la P e m a 500 the New G gs target of â,¬ n vi sa st co ss of 2012. an annual gro d by the end ve ie ch a e b et, million to ieved this targ ch a rve o p u cross the Delhaize Gro e time and a m sa e th t a creating n costs and ew mindset o n a y n a p m all, every co g years... -

Page 21

... in order to leverage knowhow and economies of scale. Already, since early 2009 all European operations have been beneï¬ting from the membership to the buying alliance, AMS, giving them access to the best possible quality products at the best possible prices. DELHAIZE GROUP ANNUAL REPORT '12... -

Page 22

... costs. While warehouse management systems work well at distribution centers, small inventories at store level require a very different ordering system. At all operational companies across Delhaize Group, systems have been installed to optimize the store inventory levels. For example, In 2012 Food... -

Page 23

... mean store associates spend less time stocking the product and more time improving the customer experience. This is especially the case at the discount format, Bottom Dollar Food. There, most of the store inventory of many products can be found on "sky shelves" located above the top selling shelf... -

Page 24

... both the current health of the company and securing the performance going forward. The initial target at the beginning of the year was set at generating â,¬500 million of free cash ï¬,ow by the end of 2012. At the end of the year, Delhaize Group largely overachieved this target and even set aside... -

Page 25

...ro G its e to 12 Delhaiz products strategy its own. In 20 ucing a new d re o e tr w in it y if b s r a a t 0 in eb plane ability by 202 ven raised th e in a d n st a su in in a r m e in this do d as a lead be recognize to n o iti ets. b m a and all of its mark DELHAIZE GROUP ANNUAL REPORT '12 // 23 -

Page 26

... to pick up pre-assembled packages of select dry foods, fresh foods that reached their sell-by dates, and fro- Store manager of the year In 2012 Delhaize Group organized for the ï¬rst time the Store Manager of the Year (SMYA) Award across the entire Group. DG launched the SMYA program as a way to... -

Page 27

...that can't be sold is donated to feed people in local communities, and (3) adding food waste recycling programs where they didn't exist already. The pilot was successful, leading to much lower waste and higher recycling, bringing waste cost at Hannaford down by 15% from 2011 to 2012. 2020 While the... -

Page 28

...the Group. The lower margin of our Maxi business also contributed to the decreased gross margin. Other operating income was â,¬122 million, an increase of â,¬4 million compared to last year. Selling, general and administrative expenses were 21.4% of revenues and were flat at identical exchange rates... -

Page 29

... plans. The Group owned 1 044 135 treasury shares as of December 31, 2012. At the end of 2012, Delhaize Group's net debt decreased by â,¬587 million to â,¬2.1 billion mainly as a result of strong free cash flow generation partially offset by the payment of dividends. BASIC NET PROFIT (group share... -

Page 30

... of senior management and of support services associates in the U.S. In January 2013, the Greek parliament prospectively enacted an increase in the Greek corporate tax rate from 20 to 26%. The impact on Alfa Beta will be immaterial. In February 2013, Delhaize Group launched a tender offer to acquire... -

Page 31

...Delhaize America generated â,¬14.6 billion ($18.8 billion) in revenues in 2012 and â,¬850 million in EBITDA. Through multiple formats and banners, Delhaize America operates stores on the East Coast of the United States; from Maine to Florida. 64% of total group revenue DELHAIZE GROUP ANNUAL REPORT... -

Page 32

... 33 New Jersey 11 New York 49 North Carolina 507 Ohio 3 Pennsylvania 50 South Carolina 130 Tennessee 32 Vermont 17 Virginia 312 West Virginia 18 Total 1 553 Number of states 18 36% / Other segments US / 64% Hannaford Bottom Dollar Food Food Lion Harvey's Sweetbay stores 1 553 104 613 associates... -

Page 33

...Food Lion Founded in 1957, Food Lion prides itself on offering customers convenient stores providing a good assortment of quality products at low prices. At the end of 2012, Food Lion operated 1 138 stores located in 10 states in the Southeastern United States. In 2011 the company launched the brand... -

Page 34

... is Delhaize Group's historical domestic market. Delhaize Belgium operates a wide variety of company-operated and afï¬liated store formats including supermarkets, convenience and proximity stores, specialty stores and the recently added discount supermarkets Red Market. At the end of 2012, Delhaize... -

Page 35

.... The 136 stores sell pet food, care products, care services and accessories for pets. In 2012, Tom & Co launched Tom & Care, "health insurance" for animals. It is sold exclusively at Tom & Co and is unique in its kind. Supermarkets - Delhaize With 146 company-operated stores, Delhaize "Le Lion" is... -

Page 36

..., and a home delivery service, Caddy Home. •฀฀ Delhaize฀Direct: Customers do their shopping on-line on a dedicated store website and collect their groceries at one of the 118 stores that have a dedicated collection point. The ambition is to further increase this number in 2013 and continue... -

Page 37

... of revenues decreased by 15 basis points to 20.3% as a result of higher taxes in Greece due to austerity measures and higher staff costs and rents due to new store openings. Total capital expenditures amounted to â,¬157 million, compared to â,¬185 million in 2011. DELHAIZE GROUP ANNUAL REPORT '12... -

Page 38

... expansion program in 2011, Mega Image shifted into an even higher gear in 2012 by opening 89 new stores, nearly doubling its store network and ending the year with 193 stores. An important lever for this growth was the development and deployment of the Shop & Go format in 2010, enabling Mega Image... -

Page 39

36 859 o rowth revenue g om coming fr ent gm SEE&A se % 5 4 ro f G up associates KEY FIGURES (as of December 31, 2012) Albania Bosnia and Herzegovina Bulgaria 23 m2 170 - 6 000 16 000 19 400 ... 12 2 370 8 200 132 600 5 900 61 260 2 000 103 1 000 8 700 DELHAIZE GROUP ANNUAL REPORT '12 // 37 -

Page 40

... of Food Marketing Institute Board member and former Chairman of CIES Board member of the Consumer Goods Forum Board member of Guberna Vice-Chairman Executive Committee Federation of Belgian Companies Master in Business Administration Elected 1995 4. JACQUES DE VAUCLEROY (1961) Member of Management... -

Page 41

... of the Executive Committee: Mr. Pierre Dumont Honorary Director Mr. Roger Boin passed away at the end of 2012. The Board of Directors of Delhaize Group and its management wish to show their respect and pay tribute for his part in helping to build the company. DELHAIZE GROUP ANNUAL REPORT '12 // 39 -

Page 42

... Belgian Companies Code. The Board of Directors Mission of the Board of Directors The Board of Directors of Delhaize Group is responsible for the strategy and the management of the Company in its best corporate interests. This responsibility includes the maximization of shareholder value, including... -

Page 43

...'s Report on the annual accounts and the consolidated ï¬nancial statements, and the annual report •฀฀ Approval of revenues and earnings press releases •฀฀ Approval of the publication of the Corporate Responsibility Report 2011 •฀฀ Review and decision on possible acquisitions and... -

Page 44

... Companies Code, the Belgian Code on Corporate Governance and the New York Stock Exchange (NYSE) rules. Based on the information provided by all directors regarding their relationships with Delhaize Group, the Board of Directors determined that all directors, with the exception of Chief Executive... -

Page 45

... revenues and earnings press releases •฀฀ Review of the effect of regulatory and accounting initiatives and any off-balance sheet structures on the ï¬nancial statements •฀฀ Review of changes, as applicable, in accounting principles and valuation rules •฀฀ Review of the Internal... -

Page 46

... unit price of â,¬1 and at a maximum unit price not higher than 20% above the highest closing stock market price of the Company's shares on Euronext Brussels during the twenty trading days preceding such acquisition. Such authorization has been granted for a period of ï¬ve years as from the date... -

Page 47

... 0.71% of the total number of outstanding shares of the Company as of that date. On December 31, 2012, the Company's Executive Management owned as a group 1,187,576 stock options, warrants and restricted stock units representing an equal number of existing or new ordinary shares or ADSs of the... -

Page 48

..., 2012 will be included in the Company's Annual Report on Form 20-F for such year, which is required to be ï¬led with the U.S. Securities and Exchange Commission by April 30, 2013. The Group's 2011 annual report ï¬led on Form 20-F includes management's conclusion that the Group's internal control... -

Page 49

... and making decisions. Many departments within the Company support risk management activities including: Legal, Compliance, Internal Audit, Quality Assurance and Food Safety, Insurance, Claims Management, Loss Prevention/Security, Health/Safety, Information Security, Accounting and Finance and Risk... -

Page 50

... number of options and warrants outstanding under those plans as of December 31, 2012 can be found under Note 21.3 to the Financial Statements. Management associates of U.S. operating companies received restricted stock units under the Delhaize America, LLC 2002 and 2012 Restriced Stock Unit Plans... -

Page 51

... Meeting of Shareholders held on May 26, 2011 approved a change in control clause set out in the â,¬600 million ï¬ve-year revolving credit facility dated April 15, 2011 entered into among inter alios the Company, Delhaize America, LLC, Delhaize Grifï¬n SA, Delhaize The Lion Coordination Center SA... -

Page 52

... results of the annual performance review for each executive into account. The Company's Executive Vice President for Human Resources assists the Chief Executive Ofï¬cer in this process. Role of Outside Compensation Consultant During 2012, and as in previous years, the Company hired an independent... -

Page 53

...ect base salary, annual bonus and performance cash components granted in 2012. FIXED VS VARIABLE COMPENSATION FOR THE CEO 3.28 2.73 0.95 0.97 2.54 ï¬xed: 36.3% 0.97 10 variable: 63.7% CEO 11 12 0.97 13 Other Members of Executive Management DELHAIZE GROUP ANNUAL REPORT '12 // 51 3.10 -

Page 54

... May 21, 2010. 2012 includes the pro-rata share of compensation for Pierre Bouchut and Roland Smith who joined the company in 2012. 10 11 12 13 LTI - Performance Cash grants Annual Bonus ("PFO") for 2011. However, taking into account the economic environment, Executive Management has voluntary... -

Page 55

...With respect to annual bonuses paid in 2013 based on performance in 2012, the annual bonus for the members of management having the level of Director, Vice President, Senior Vice President, Executive Vice President and CEO is funded based on the following elements: •฀฀ Company Performance - 50... -

Page 56

... Depositary Shares traded on the New York Stock Exchange. Following U.S. market practice, the options granted in June 2012 under the Delhaize Group 2012 U.S. Stock Incentive Plan for executives of the Group's U.S. operating companies vest in equal annual installments of one third over a three-year... -

Page 57

... units granted to the CEO and the different members of the Executive Management team during the period 2010-2012. NuMBER of REsTRiCTED sToCk uNiTs AWARDED 2010 2011 2012 Resulting Payout The restricted stock unit awards granted in 2012 under the Delhaize America 2012 Restricted Stock Unit Plan... -

Page 58

... page. summary of Total Compensation Paid The following table summarizes the components described in the paragraphs above and that represent a cash payment during the year. CEo (in millions of â,¬)(1) other Members of Executive Management(2) 2010 0.95 0.68 0.74 0.06 0.56 2.99 2011 0.97 0.66 0.38... -

Page 59

... The Company's Executive Management, in accordance with employment-related agreements and applicable law, is compensated in line with the Company's Remuneration Policy and is assigned duties and responsibilities in line with current market practice for its position and DELHAIZE GROUP ANNUAL REPORT... -

Page 60

...in the Financial Statements). Our growth strategy may place a signiï¬cant strain on our management, operational, ï¬nancial and other resources. The lack of suitable acquisition targets at acceptable prices may limit the Group's growth. Risk Related to Competitive Activity The food retail industry... -

Page 61

... stores do not successDELHAIZE GROUP ANNUAL REPORT '12 // 59 Risk related to the Achievement of Cost savings, which may Reduce, Delay or otherwise hinder our Ability to implement our New Game Plan Effective February 1, 2010, the support functions for Food Lion, Bloom, Harveys, Bottom Dollar Food... -

Page 62

...our image and reputation could be harmed, which could adversely affect our business and operating results. financial Risks Delhaize Group has identiï¬ed the exposure associated with the ability to continuously fund its operations, adverse interest rate and currency movements, the credit quality of... -

Page 63

... Policies" in the Financial Statements with respect to translation of foreign currencies). If the average U.S. dollar exchange rate had been 1 cent higher/lower and all other variables were held constant, the Group's net proï¬t would have increased/ decreased by â,¬2 million in 2012 and 2011 (2010... -

Page 64

... instruments Delhaize Group requires a minimum credit quality for its ï¬nancial investments (see Notes 11 "Investments in Securities" and 14 "Receivables" in the Financial Statements for further details). The Group's policy is to require short-term investments to have a short-term credit rating of... -

Page 65

... of ï¬nancial capacity in the insurance markets. The main risks covered by Delhaize Group's insurance programs are property, liability and health-care. The U.S. operations of Delhaize Group use self-insured retention programs for workers' compensation, general liability, automotive accident... -

Page 66

... former Code was implemented in 2010, anti-fraud and other appropriate training has been implemented within the Group, and the internal 64 // audit function has been reinforced during the recent years. Product liability Risk The packaging, marketing, distribution and sale of food products entail... -

Page 67

... exposures. Unexpected outcomes as a result of these audits could adversely affect Delhaize Group's ï¬nancial statements. For more information on tax audits in jurisdictions where we conduct business, see Note 34 "Contingencies" to the Financial Statements. DELHAIZE GROUP ANNUAL REPORT '12 // 65 -

Page 68

fiNANCiAl STATEMENTS 66 // -

Page 69

... Consolidated statement of Comprehensive income Consolidated statement of Changes in Equity Consolidated statement of Cash flows Notes to the financial statements 75 1. General Information 75 2. Signiï¬cant Accounting Policies 89 3. Segment Information 91 4. Business Combinations and Acquisition of... -

Page 70

...13 14 11 12 19 1 401 634 21 93 - - 79 41 932 3 201 18 3 219 11 936 15 5.2 _____ (1) 2011 was revised to reflect the effects of the completion in the second quarter of 2012 of the purchase price allocation of the Delta Maxi acquisition (see Note 4.1). 68 // DELHAIZE GROUP FINANCIAL STATEMENTS'12 -

Page 71

... - current portion Obligations under finance leases Derivative instruments Provisions Income taxes payable Accounts payable Accrued expenses Other current liabilities Liabilities associated with assets held for sale Total current liabilities Total liabilities Total liabilities and equity 18.1 18... -

Page 72

... Revenues Cost of sales Gross profit Gross margin Other operating income Selling, general and administrative expenses Other operating expenses Operating profit Operating margin Finance costs Income from investments Profit before taxes and discontinued operations Income tax expense Net profit from... -

Page 73

Consolidated Statement of Comprehensive Income (in millions of â,¬) Note 2012 103 - - - 2011(1) 475 - - - 2010 575 - 1 - 1 23 (15) (3) 5 3 (1) - 2 1 (1) Net profit Deferred gain (loss) on discontinued cash flow hedge Reclassification adjustment to net profit Tax (expense) benefit Deferred gain ... -

Page 74

... stock options Excess tax benefit (deficiency) on employee stock options and restricted shares Tax payment for restricted shares vested Share-based compensation expense Dividend declared Purchase of non-controlling interests Balances at December 31, 2010 Other comprehensive income Net profit Total... -

Page 75

... income Net profit Total comprehensive income for the period Capital increases Treasury shares sold upon exercise of employee stock options Tax payment for restricted shares vested Share-based compensation expense Dividend declared Purchase of non-controlling interests Balances at December 31, 2012... -

Page 76

... (Group share in net profit) Net profit attributable to non-controlling interests Adjustments for: Depreciation and amortization Impairment Allowance for losses on accounts receivable Share-based compensation Income taxes Finance costs Income from investments Other non-cash items 28 21.3 22 Changes... -

Page 77

... shares listed on NYSE Euronext Brussels and on the New York Stock Exchange ("NYSE"), under the symbols "DELB" and "DEG ," respectively. The consolidated financial statements for the year ended December 31, 2012 as presented in this annual report were prepared under the responsibility of the Board... -

Page 78

..., either at fair value or at the proportionate share of the acquiree's identifiable net assets. Acquisition costs incurred are expensed and included in "Selling, general and administrative expenses." When Delhaize Group acquires a business, it assesses the financial assets and liabilities assumed... -

Page 79

... on the acquisition of a foreign entity are treated as assets and liabilities of the foreign entity and translated at the closing exchange rate; and (c) the income statements are translated at the average daily exchange rate (i.e., the yearly average of exchange rates on each working day). The... -

Page 80

...asset may be impaired. The Group believes that acquired and used trade names have indefinite lives because they contribute directly to the Group's cash flows as a result of recognition by the customer of each banner's characteristics i n the marketplace. 78 // DELHAIZE GROUP FINANCIAL STATEMENTS'12 -

Page 81

... income statement. Residual values, useful lives and methods of depreciation are reviewed at each financial year-end and adjusted prospectively, if appropriate. Investment Property Investment property is defined as property (land or building - or part of a building - or both) held by Delhaize Group... -

Page 82

...to bring each product to its present location and condition. Inventories are regularly reviewed and written down on a case-by-case basis if the anticipated net realizable value (anticipated selling price in the course of ordinary business less the estimated costs necessary to make the sale) declines... -

Page 83

... any. In a very limited number of cases, e.g., if the market for a financial asset is not active (and for unlisted securities), the Group establishes fair value by using valuation techniques making maximum use of market inputs, including broker prices from independent parties, and relying as little... -

Page 84

...the case of currency risk) or from highly probable forecast transactions. In such a cash flow hedge relationship, the changes in the fair value of the derivative hedging instrument are recognized directly in OCI to the extent that the hedge is effective. 82 // DELHAIZE GROUP FINANCIAL STATEMENTS'12 -

Page 85

... market assessments of the time value of money and the risk specific to the liability, if material. Where discounting is used, the increase in the provision due to the passage of time ("unwinding of the discount") is recognized in "Finance costs" (see Note 29.1). DELHAIZE GROUP FINANCIAL STATEMENTS... -

Page 86

...lease payments, including contractually required real estate taxes, common area maintenance and insurance costs, net of anticipated subtenant income. The adequacy of the closed store provision is dependent upon the economic conditions in which stores are located which will impact the Group's ability... -

Page 87

... rights used. For certain products or services, such as the sale of lottery tickets, third-party prepaid phone cards, etc., Delhaize Group acts as an agent and consequently records the amount of commission income in its net sales. Rental income from investment property is recognized in profit or... -

Page 88

...statements. Amendments to IAS 19 Employee Benefits (applicable for annual periods beginning on or after January 1, 2013): The amendment will require, besides others, replacing interest cost and expected return on plan assets with a net interest amount that is calculated by applying the discount rate... -

Page 89

... of the annual reporting period" in which these standards have to be applied for the first time. The requirement means that for Delhaize Group the date of initial application of these standards will be January 1, 2013. ï,· ï,· ï,· ï,· ï,· ï,· DELHAIZE GROUP FINANCIAL STATEMENTS '12 // 87 -

Page 90

2.6 Financial Risk Management, Objectives and Policies The Group's activities expose it to a variety of financial risks: market risk (including currency risk, fair value interest rate risk, cash flow interest rate risk and price risk), credit risk and liquidity risk. Delhaize Group's princip al ... -

Page 91

... for Food Lion and Hannaford. Overall, this results in a geographical segmentation of the Group's business, based on the location of customers and stores, which matches the way Delhaize Group manages its operations. The Executive Committee internally reviews the performance of Delhaize Group... -

Page 92

... 13 Revenues Cost of sales Gross profit Gross margin Other operating income Selling, general and administrative expenses Other operating expenses Operating profit (loss) Operating margin Operating result of discontinued operations Other information Assets Liabilities Capital expenditures Non-cash... -

Page 93

...14 16 Revenues Cost of sales Gross profit Gross margin Other operating income Selling, general and administrative expenses Other operating expenses Operating profit (loss) Operating margin Operating result of discontinued operations Other information Assets Liabilities Capital expenditures Non-cash... -

Page 94

...in escrow by the Group (see Note 12). The acquired business, in combination with the Group's existing operations in Greece and Romania , makes Delhaize Group a leading retailer in Southeastern Europe. At acquisition date, Delta Maxi operated 485 stores and 7 distribution centers in five countries in... -

Page 95

... â,¬10 million, mainly representing expected benefits from the integration of the stores into the existing sales network, the locations and customer base of the various stores acquired, all resulting in synergy effects for the Group. Acquisitions during 2010 During 2010, Delhaize Group entered into... -

Page 96

...-current liabilities Accounts payable and accrued expenses Assets classified as held for sale, net of associated liabilities The Group recognized an impairment loss of â,¬16 million (see also Note 5.3) to write down the carrying value of Delhaize Albania to its fair value less costs to sell, which... -

Page 97

...to â,¬56 million. During 2012, the Group sold properties for a total amount of â,¬17 million. As a result of the weakening real estate market and the deteriorating state of the property for sale, the fair value less cost to sell of a number of properties decreased during 2012 resulting in impairment... -

Page 98

... 2012, Delhaize Group completed the purchase price allocation of the Delta Maxi acquisition and recognized goodwill of â,¬507 million at acquisition date (see Note 4.1). The Group's CGUs with significant goodwill allocations are detailed below: (in millions) Food Lion Hannaford United States Serbia... -

Page 99

... value of the cash generating units to exceed their recoverable amounts. The Group estimated that a decrease in growth rate by 50 basis points, keeping all other assumptions constant, would decrease the 2012 VIU for both Food Lion and Hannaford by $396 million. An increase of the discount rate... -

Page 100

...is of the opinion that no reasonable possible change in any of the key assumptions mentioned above would cause the carrying value of the cash generating units to exceed their recoverable amounts. The Group estimated that a decrease in growth rate by 50 basis points, keeping all other constant, would... -

Page 101

... value in use, with their carrying amount. The recoverable amount is estimated using revenue projections of each operating entity (see Note 6) and applying an estimated royalty rate of 0.45% and 0.70% for Food Lion and Hannaford, respectively. During 2012, the Group fully impaired the Albanian trade... -

Page 102

...Maxi acquisition. Trade name assets are allocated to the following cash generating units: December 31, (in millions of â,¬) 2012 196 163 359 151 14 - 165 524 2011(1) 200 167 367 164 29 3 196 563 2010 193 162 355 - - - - 355 Food Lion Hannaford Delhaize America Serbia Bulgaria Albania Maxi Total... -

Page 103

...impairment at December 31, 2012 Net carrying amount at December 31, 2012 Cost at January 1, 2011 Additions Sales and disposals Acquisitions through business combinations Transfers (to) from other accounts Currency translation effect Balance at December 31, 2011(1) Accumulated depreciation at January... -

Page 104

... approach or independent third-party appraisals, based on the location and condition of the stores. Closed stores are reviewed for impairment on a fair value less cost to sell basis, based on actual results of the past and using observable market data, where possible. Management believes that the... -

Page 105

...'s policy, closed stores held under finance lease agreements are reclassified to investment property. In 2011 the Group also transferred â,¬16 million of assets acquired from Delta Maxi to "Assets classified as held for sale." Property under finance leases consists mainly of buildings. The number of... -

Page 106

... the weakening real estate market and the deteriorating state of the property for sale, making a sale within the foreseeable future unlikely, part of these properties (net book value of â,¬7 million) has been reclassified into investment property (see Note 5.2). During 2012, the Group recorded â,¬14... -

Page 107

... Current Receivables Investments in securities Other financial assets Derivative instruments Cash and cash equivalents Total financial assets December 31, 2011 Financial assets measured at amortized cost Financial assets measured at fair value Derivatives through profit or loss - - 57 - - - 1 - 58... -

Page 108

... broker, industry group, pricing service, or regulatory agency, and those prices represent actual and regularly occurring market transactions on an arm's length basis. Level 2: The fair value of financial instruments that are not traded in an active market is determined by using valuation techniques... -

Page 109

...through profit or loss Derivatives - through equity Total financial assets measured at fair value During 2010, â,¬1 million of securities were transferred from Level 2 to Level 1. No transfers between the different fair value hierarchy levels took place in 2012 and 2011. 10.2 Financial Liabilities... -

Page 110

... under finance leases Derivative instruments Accounts payable(1) Total financial liabilities _____ (1) 2011 was revised to reflect the effects of the completion in the second quarter of 2012 of the purchase price allocation of the Delta Maxi acquisition. December 31, 2010 Financial liabilities... -

Page 111

... or loss Derivatives - through equity Current Derivatives - through profit or loss Derivatives - through equity Total financial liabilities measured at fair value During 2012, 2011 and 2010, no transfers between the different fair value hierarchy levels took place. See Note 10.1 with respect to the... -

Page 112

... 31, 2012) in order to satisfy future pension benefit payments for a limited number of employees, which however do not meet the definition of plan assets as per IAS 19. The maximum exposure to credit risk at the reporting date is the carrying value of the investments. At December 31, 2012, the Group... -

Page 113

...60 days. Trade receivables credit risk is managed by the individual operating entities and credit rating is continuously monitored either based on internal rating criteria or with the support of third party service providers and the requirement for an impairment is analyzed at each reporting date on... -

Page 114

... Finance lease obligations incurred for store properties and equipment Finance lease obligations terminated for store properties and equipment As a result of the store closings (announced in the beginning of 2012 as a consequence of the portfolio review), Delhaize America terminated several finance... -

Page 115

... hedge certain stock option plan exposures. During 2012, Delhaize Group SA did not acquire Delhaize Group shares and did not transfer shares to satisfy the exercise of stock options granted to associates of non-U.S. operating companies (see Note 21.3). DELHAIZE GROUP FINANCIAL STATEMENTS '12 // 113 -

Page 116

... Stock Incentive Plan and the Delhaize America 2002 Restricted Stock Unit Plan. Since the authorization of the Board of August 3, 2011, Delhaize Group SA acquired 285 000 Delhaize Group shares for an aggregate amount of â,¬13 million. As a consequence, at the end of 2012, the management of Delhaize... -

Page 117

... Group's objectives for managing capital are to safeguard the Group's ability to continue as a going concern and to maximize shareholder value, while maintaining investment grade credit rating, keeping sufficient flexibility to execute strategic projects and reduce the cost of capital. In order... -

Page 118

...of warrants issued under the Delhaize Group 2002 and 2012 Stock Incentive Plans, the Group may have to issue new ordinary shares, to which payment in 2013 of the 2012 dividend is entitled, between the date of adoption of the annual accounts by the Board of Directors and the date of their approval by... -

Page 119

...inter-bank offering rate at the borrowing date plus a pre-set margin. Delhaize Group also has a treasury notes program available. The carrying values of long-term debt (excluding finance leases, see Note 18.3), net of discounts and premiums, deferred transaction costs and hedge accounting fair value... -

Page 120

..., at an annual coupon of 3.125%, issued at 99.709% of their principal amount. Delhaize Group entered into matching interest rate swaps to hedge â,¬100 million of the Group's exposure to changes in the fair value of the 3.125% bonds due to variability in market interest rates (see Note 1 9). The net... -

Page 121

...principals of Delhaize Group's non-derivative financial liabilities, excluding any hedging effects and not taking premiums and discounts into account: (in millions of $) 2013 2014 2015 2016 2017 Thereafter Fair Value Fixed rates Notes due 2014, redeemed in 2013 Average interest rate Interest... -

Page 122

... earliest period in which Delhaize Group can be required to pay. Delhaize Group is managing its liquidity risk based on contractual maturities. The fair value of the Group's long-term debt (excluding finance leases, see Note 18.3) is based on the current market quotes for publicly traded debt in an... -

Page 123

... the credit facilities that were in place at the various reporting dates, Delhaize America, LLC had $1 million (â,¬1 million) average daily borrowings during 2012 at an average rate of 1.69%, no average daily borrowings during 2011 and $2 million (â,¬2 million) during 2010. In addition to the New... -

Page 124

... Finance and Operating Lease Income As noted above, occasionally, Delhaize Group acts as a lessor for certain owned or leased property, mainly in connection with closed stores that have been sub-leased to other parties, retail units in Delhaize Group shopping centers or within a Delhaize Group store... -

Page 125

... securities and sale and maturity of debt securities and can be summarized as follows: (in millions of â,¬) 2012 1 408 (637) 1 772 Net cash provided by operating activities Net cash used in investing activities Net investment in debt securities Free cash flow DELHAIZE GROUP FINANCIAL STATEMENTS... -

Page 126

...hedged item"), exposing the Group to changes in the fair value due to changes in market interest rates ("hedged risk"). In order to hedge that risk, Delhaize Group entered into matching interest rate swaps and swapped 100% of the proceeds of the bond to 124 // DELHAIZE GROUP FINANCIAL STATEMENTS'12 -

Page 127

... exposing Delhaize Group to currency risk on dollar cash flows ("hedged risk"). In order to hedge that risk, Delhaize Group swapped 100% of the proceeds to a euro fixed rate liability with a 5-year term ("hedging instrument"). The maturity dates, the dollar interest rate, the interest payment dates... -

Page 128

...of derivative financial instruments to credit risk at the reporting date equals their carrying values at balance sheet date (i.e., â,¬61 million at December 31, 2012). See Note 12 in connection with collateral posted on derivative financial liabilities. 126 // DELHAIZE GROUP FINANCIAL STATEMENTS'12 -

Page 129

...decision to close 146 stores (126 stores in the United States and 20 underperforming Maxi stores) (see Note 28). During the year, additional stores were closed as part of the ordinary course of business, resulting in 180 stores being closed during 2012. DELHAIZE GROUP FINANCIAL STATEMENTS'12 // 127 -

Page 130

... 31, 2010 Store closings added Stores sold/lease terminated Balance at December 31, 2011 Store closings added Stores sold/lease terminated Balance at December 31, 2012 146 7 (49) 104 18 (20) 102 163 (86) 179 Expenses relating to closed store provisions were recorded in the income statement as... -

Page 131

.... In addition, the Group has also other post-retirement defined benefit arrangements, being principally health care arrangements in the U.S. The actuarial valuations performed on the defined benefit plans involve making a number of assumptions about, e.g., discount rate, expected rate of return on... -

Page 132

... million in 2012, â,¬9 million in 2011 and â,¬6 million in 2010, respectively. In the U.S., Delhaize Group sponsors profit-sharing retirement plans covering all employees at Food Lion, Sweetbay, Hannaford and Harveys with one or more years of service. Profit-sharing contributions substantially vest... -

Page 133

... number of executives of Food Lion and Hannaford. Benefits generally are based on average earnings, years of service and age at retirement. In 2011, Delhaize America decided to discontinue the SERP for Hannaford executives. ï,· ï,· ï,· Alfa Beta has an unfunded defined benefit post-employment plan... -

Page 134

...Fair value of plan assets Net deficit/(surplus) for funded plans Deficit for funded plans Surplus for funded plans Present value of unfunded obligations Unrecognized past service cost Net liability Weighted average assumptions used to determine benefit obligations: Discount rate Rate of compensation... -

Page 135

2012 Plans Outside of the United States 2011 Plans Outside of the United States 2010 Plans Outside of the United States (in millions of â,¬) United States Plans Total United States Plans Total United States Plans Total Component of pension cost: Amounts recognized in the income statement: ... -

Page 136

... an insignificant amount to the defined benefit pension plan in Belgium. The expected long-term rate of return for the Belgian defined benefit pension plan is based on the guaranteed return by the insurance company and the expected insurance dividend. 134 // DELHAIZE GROUP FINANCIAL STATEMENTS'12 -

Page 137

...â,¬) 2012 1 9 10 2011 2 4 6 2010 2 12 14 Cost of sales Selling, general and administrative expenses Total defined benefit expense recognized in profit or loss 21.2 Other Post-Employment Benefits Hannaford and Sweetbay provide certain health care and life insurance benefits for retired employees... -

Page 138

21.3 Share-Based Compensation Delhaize Group offers share-based incentives to certain members of its senior management: stock option plans for associates of its non-U.S. operating companies; stock option, warrant and restricted stock unit plans for associates of its U.S. based companies. ï,· ï,· ... -

Page 139

... Activity associated with non-U.S. stock option plans was as follows: Weighted Average Exercise Price (in â,¬) 55.71 30.58 - 55.73 50.97 49.95 54.61 2012 Outstanding at beginning of year Granted Exercised Forfeited Expired Outstanding at end of year Options exercisable at end of year Shares 1 379... -

Page 140

...vice presidents and above. Warrants granted under the "Delhaize Group 2012 Stock Incentive Plan" and the "Delhaize Group 2002 Stock Incentive Plan" vest ratably over a three-year service period, are exercisable when they vest and expire ten years from the grant date. 138 // DELHAIZE GROUP FINANCIAL... -

Page 141

... 108 973 2 154 Plan Delhaize Group 2012 Stock Incentive plan - Warrants Delhaize Group 2002 Stock Incentive plan - Warrants Effective Date of Grants August 2012 May 2012 June 2011 June 2010 June 2009 May 2008 June 2007 June 2006 May 2005 May 2004 May 2003 Number of shares Underlying Award Issued... -

Page 142

... 2012 Share price (in $) Expected dividend yield (%) Expected volatility (%) Risk-free interest rate (%) Expected term (years) 39.62 3.6 27.1 0.5 4.2 May 2012 38.86 3.5 27.9 0.6 4.2 2011 78.42 2.9 26.0 1.2 4.0 2010 78.33 2.5 25.2 1.6 4.0 U.S. Operating Entities Restricted Stock Unit Awards Plan... -

Page 143

...Shares 716 350 123 917 (221 141) (22 015) 597 111 The fair value at date of grant for restricted stock unit awards granted during August 2012, May 2012, 2011 and 2010 was $39.62, $38.86, $78.42 and $78.33 based on the share price at the grant date, respectively. DELHAIZE GROUP FINANCIAL STATEMENTS... -

Page 144

... related to the resolution of several tax matters in the U.S. which resulted in the recognition of an income tax benefit. In December 2012, the Serbian government enacted an increase in tax rate from 10 to 15%, effective as from January 1, 2013. 142 // DELHAIZE GROUP FINANCIAL STATEMENTS'12 -

Page 145

... 527 2010 543 95 448 Deferred tax liabilities Deferred tax assets Net deferred tax liabilities _____ (1) 2011 was revised to reflect the effects of the completion in the second quarter of 2012 of the purchase price allocation of the Delta Maxi acquisition. DELHAIZE GROUP FINANCIAL STATEMENTS'12... -

Page 146

..., 2012, Delhaize Group did not recognize deferred tax assets of â,¬112 million, of which: â,¬42 million related to U.S. tax loss carry-forwards of â,¬901 million (mainly at a 4.0% U.S. State effective tax rate) and U.S. tax credits, which if unused would expire at various dates between 2013 and... -

Page 147

... and identifiable cost incurred by the Group to sell the vendor's product in wh ich case they are recorded as a reduction in "Selling, general and administrative expenses" (â,¬14 million, â,¬18 million and â,¬9 million in 2012, 2011 and 2010, respectively). DELHAIZE GROUP FINANCIAL STATEMENTS '12... -

Page 148

... supermarkets. (in millions of â,¬) 2012 125 272 22 9 428 2011 8 135 13 13 169 2010 (2) 14 3 5 20 Store closing expenses Impairment Losses on sale of property, plant and equipment Other Total During 2012, Delhaize Group closed a total of 180 stores, of which 146 stores (126 in the United States... -

Page 149

... of the weakening real estate market and the deteriorating state of the property for sale. During the fourth quarter of 2011, the Group performed a review of its store portfolio and concluded to impair 126 stores and one distribution center in the U.S. (â,¬115 million) and several of its investment... -

Page 150

...(17) Cost of sales Selling, general and administrative expenses Finance costs Income from investments Total 29.1 29.2 31. Earnings Per Share ("EPS") Basic earnings per share is calculated by dividing the profit attributable to equity holders of the Group by the weighted average number of ordinary... -

Page 151

... Several of the Group's subsidiaries provide post -employment benefit plans for the benefit of employees of the Group. Payments made to these plans and receivables from and payables to these plans are disclosed in Note 21. The Company's Remuneration Policy for Directors and the Executive Management... -

Page 152

... compensation Employer social security contributions Total compensation expense recognized in the income statement _____ (1) Short-term benefits include the annual bonus payable during the subsequent year for performance achieved during the respective years. (2) The members of Executive Management... -

Page 153

...8 Food Lion and 3 Bottom Dollar Food), 6 stores in Southeastern Europe and 1 store in Belgium. As a result, the group recorded an impairment charge of â,¬49 million in the fourth quarter of 2012. During the first part of 2013, the Group expects earnings to be DELHAIZE GROUP FINANCIAL STATEMENTS '12... -

Page 154

...the severance of support services senior management and associates in the U.S. In January 2013, the Greek parliament enacted the increase in the Greek corporate tax rate from 20 to 26%. The impact on Alfa Beta will be immaterial. In February 2013, Delhaize Group launched a tender offer to acquire 16... -

Page 155

... 100.0 0.0 0.0 100.0 - - 100.0 85.0 88.0 - Newly created or acquired company during 2012. In liquidation. Sold in February 2013 (classified as held for sale in 2012). Merged into a group company during 2012. Sold in February 2012. Liquidated in 2012. DELHAIZE GROUP FINANCIAL STATEMENTS '12 // 153 -

Page 156

... of Super Indo included in the Group's result was â,¬141 million, â,¬119 million and â,¬110 million for 2012, 2011 and 2010, respectively. Net income of Super Indo included in the Group's results was approximately â,¬4 million in 2012, 2011 and 2010. 154 // DELHAIZE GROUP FINANCIAL STATEMENTS'12 -

Page 157

... margin Selling, general and administrative expenses as a percentage of revenues Operating profit Operating margin Net profit from continuing operations Group share in net profit Group share in net profit per share: Basic Diluted 2010 4.71 4.68 1.25 1.24 1.16 1.15 1.32 1.31 0.98 0.98 Full Year... -

Page 158

...132 Di stores sold in 2007. Number of Associates (at year-end) 2012 Full-time Part-time FTE(1) Male Female Total 77 457 80 453 119 804 75 102 82 808 157 910 2011 78 945 80 911 121 648 77 175 82 681 159 856 2010 61 617 77 005 103 051 68 294 70 328 138 622 Geographical Split 2012 Total United States... -

Page 159

... 1 408 (637) 1 772 2011 1 106 (1 265) (72) (231) 2010 1 317 (665) 13 665 Net cash provided by operating activities Net cash used in investing activities Investment in (sale and maturity of) debt securities, net Free cash flow Use of Free Cash Flow (in millions of â,¬) 2012 772 3 (180) (60) (23... -

Page 160

... Asia (113) 204 - (in millions of â,¬) United States 343 63 - Belgium 202 5 - Corporate (42) - - - Total 390 272 - Operating profit (as reported) Add (substract): Fixed asset impairment charges (reversals) Restructuring expenses (reversals) Store closing expenses (Gains) losses on disposal of... -

Page 161

... of â,¬) Revenues Operating profit Net financial expenses Income tax expense Net profit from continuing operations Net profit (Group share) Free cash flow(1) FINANCIAL POSITION (in millions of â,¬) Total assets Total equity Net debt(1) Enterprise value(1),(2) PER SHARE INFORMATION (in â,¬) Group net... -

Page 162

... in the consolidation, as well as an overview of the most significant risks and uncertainties with which Delhaize Group is confronted. Brussels, March 6, 2013 Pierre-Olivier Beckers President and CEO Pierre Bouchut Executive Vice President and CFO 160 // DELHAIZE GROUP FINANCIAL STATEMENTS'12 -

Page 163

... position as of December 31, 2012, and of its results and its cash flows for the year then ended, in accordance with International Financial Reporting Standards as adopted by the European Union and with the legal and regulatory requirements applicable in Belgium. DELHAIZE GROUP FINANCIAL STATEMENTS... -

Page 164

... not in obvious contradiction with any information obtained in the context of our mandate. Diegem, March 6, 2013 The statutory auditor DELOITTE Bedrijfsrevisoren / Reviseurs d'Entreprises BV o.v.v.e. CVBA / SC s.f.d. SCRL Represented by Michel Denayer 162 // DELHAIZE GROUP FINANCIAL STATEMENTS'12 -

Page 165

...of Delhaize Group SA/NV are presented below. In accordance with the Belgian Company Code, the full annual accounts, the statutory Directors' report and the Statutory Auditor's report will be filed with the National Bank of Belgium. These documents will also be available on the Company's website, www... -

Page 166

... with its internal policy, Delhaize Group SA/NV does not hold or issue derivative instruments for speculative or trading purposes. Summary of the net earnings per share of Delhaize Group SA/NV: 2012 Net earnings per share 4.03 2011 2.94 2010 0.65 164 // DELHAIZE GROUP FINANCIAL STATEMENTS '12 -

Page 167

... Share premium Distributable reserves Other reserves Profit carried forward Provisions and deferred taxation Financial liabilities After one year Within one year Trade creditors Other liabilities After one year Within one year Accruals and deferred income Total liabilities and equity DELHAIZE GROUP... -

Page 168

...exercise of warrants issued under the Delhaize Group 2002 Stock Incentive Plan, the Company might have to issue new ordinary shares, to which coupon no. 51 entitling to the payment of the 2012 dividend is attached, between the date of adoption of the annual accounts by the Board of Directors and the... -

Page 169

... rights Number of subscription rights in issue Amount of capital to be subscribed Corresponding maximum number of shares to be issued Unissued authorized capital 50 946 15 50 961 101 921 498 4 308 989 97 612 509 1 016 452 27 683 3 519 438 1 760 3 519 438 4 945 DELHAIZE GROUP FINANCIAL STATEMENTS... -

Page 170

... Depositary Shares (ADS), each representing one ordinary share of Delhaize Group, are traded on the New York Stock Exchange under the symbol DEG. ADSs are evidenced by American Depositary Receipts (ADRs). Information on Delhaize Group's share price can be found on the websites of Delhaize Group (www... -

Page 171

... payable to owners of ordinary shares against coupon no. 51. The Delhaize Group shares will start trading ex-coupon on May 28, 2013 (opening of the market). The record date (i.e. the date at which shareholders are entitled to the dividend) is May 30, 2013 (closing of the market) and the payment date... -

Page 172

... can be downloaded from Delhaize Group's website: www.delhaizegroup.com. Delhaize Group is subject to the reporting requirements of the U.S. Securities and Exchange Commission (SEC) governing foreign companies listed in the U.S. An annual report will be ï¬led with the SEC on Form 20-F. The Form 20... -

Page 173

...newspapers L'Echo and De Tijd, as well as in the Belgian Ofï¬cial Gazette and on the Company website. iNfoRMATioN DElhAizE GRouP shARE 2012 SHARE PRICE (in â,¬) 2011 2010 2009 2008 2007 2006 2005 2004 2003 Price: year-end average (close) highest (intraday) lowest (intraday) Annual return Delhaize... -

Page 174

...the underlying common share through the bank that issued the ADS. Each Delhaize Group ADS represents one share of Delhaize Group common stock and is traded on the New York Stock Exchange. Free cash ï¬,ow Cash ï¬,ow before ï¬nancing activities, investment in debt securities and sale and maturity of... -

Page 175

... of goods and point of sale services to customers, including wholesale and afï¬liated customers, relating to the normal activity of the Company (the Weighted average number of shares outstanding Number of shares outstanding at the beginning of the period less treasury DELHAIZE GROUP ANNUAL REPORT... -

Page 176

Company Information Registered Ofï¬ce: Delhaize Group SA rue Osseghemstraat 53 1080 Brussels Belgium Tel: +32 2 412 21 11 - Fax: +32 2 412 21 94 Operations United States FOOD LION - BOTTOM DOLLAR FOOD P.O. Box 1330, 2110 Executive Drive Salisbury - NC 28145-1330 U.S.A. Tel : +1 704 633 8250 www....