Cincinnati Bell 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

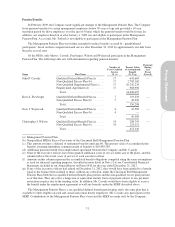

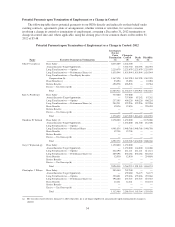

Pension Benefits

In February 2009, the Company made significant changes to the Management Pension Plan. The Company

froze pension benefits for certain management employees below 50 years of age and provided a 10-year

transition period for those employees over the age of 50 after which the pension benefit would be frozen. In

addition, any employee hired on or after January 1, 2009 was not eligible to participate in the Management

Pension Plan. As a result, Mr. Torbeck is not eligible to participate in the Management Pension Plan.

The Management Pension Plan was further amended to reduce benefits accrued by “grandfathered

participants” based on their compensation and service after December 31, 2012 by approximately one-half from

the prior accrual rates.

Of the NEOs, only Messrs. Cassidy, Freyberger, Wilson and Wojtaszek participate in the Management

Pension Plan. The following table sets forth information regarding pension benefits:

Name Plan Name

Number of

Years Credited

Service

(#) (e)

Present Value

of Accumulated

Benefit

($) (f)(g)

Payments

During

Last

Fiscal

Year ($)

John F. Cassidy Qualified Defined Benefit Plan (a) ..... 17 641,663 —

Non-Qualified Excess Plan (b) ........ 17 2,783,162

Non-Qualified Supplemental Plan (c) . . . 17 10,242,276

Employment Agreement (d) .......... 17 968,996

Total ........................... 14,636,097

Kurt A. Freyberger Qualified Defined Benefit Plan (a) ..... 7 119,258 —

Non-Qualified Excess Plan (b) ........ 7 30,950

Total ........................... 150,208

Gary J. Wojtaszek Qualified Defined Benefit Plan (a) ..... 4 45,509 —

Non-Qualified Excess Plan (b) ........ 4 —

Total ........................... 45,509

Christopher J. Wilson Qualified Defined Benefit Plan (a) ..... 14 288,759 —

Non-Qualified Excess Plan (b) ........ 14 124,351

Total ........................... 413,110

(a) Management Pension Plan.

(b) Nonqualified ERISA Excess Provisions of the Cincinnati Bell Management Pension Plan.

(c) This amount assumes a deferral of retirement benefits until age 60. The present value of accumulated plan

benefits assuming immediate commencement of benefits is $10,890,550.

(d) Additional pension benefit from employment agreement between the Company and Mr. Cassidy.

(e) None of the executive officers have been granted additional years of service under any of the plans, and this

column reflects the actual years of service of each executive officer.

(f) Amounts in this column represent the accumulated benefit obligations computed using the same assumptions

as used for financial reporting purposes, described in more detail in Note 11 to our Consolidated Financial

Statements included in our Annual Report on Form 10-K for the year ended December 31, 2012.

(g) If any of the executive officers had retired on December 31, 2012, they would have been entitled to a benefit

equal to the balance then credited to them, without any reduction, under the Cincinnati Bell Management

Pension Plan (both the tax-qualified defined benefit plan portion and the non-qualified excess plan portion)

as of that date. They may elect a lump-sum or equivalent annuity form of payment subject to any payment

restrictions in place due to the funding status. In addition, Mr. Cassidy would have been eligible to receive

the benefit under his employment agreement as well any benefits under the SERP described above.

The Management Pension Plan is a tax-qualified defined benefit pension plan and is the same plan that is

available to other eligible salaried and certain non-union hourly employees. Mr. Cassidy also participates in the

SERP. Contributions to the Management Pension Plan’s trust and the SERP are made only by the Company.

51

Proxy Statement