Cincinnati Bell 2012 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216

|

|

Form 10-K Part II Cincinnati Bell Inc.

distribution of all annual phantom stock awards in cash. Therefore, the number of actual shares of common

stock to be issued pursuant to the plan as of December 31, 2012 is approximately 14,000. This plan also

provides that no awards are payable until such non-employee director completes at least five years of active

service as a non-employee director, except if he or she dies while serving as a member of the Board of

Directors.

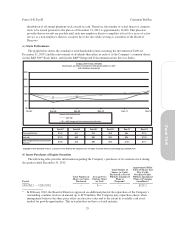

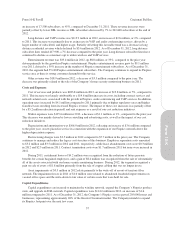

(e) Stock Performance

The graph below shows the cumulative total shareholder return assuming the investment of $100 on

December 31, 2007 (and the reinvestment of dividends thereafter) in each of (i) the Company’s common shares,

(ii) the S&P 500®Stock Index, and (iii) the S&P®Integrated Telecommunications Services Index.

Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12

Cincinnati Bell Inc. $41 $73 $59 $64 $115$100

$63 $80 $92 $94 $109$100

$75 $80 $95 $102 $117$100

S&P 500

S&P Integrated Telecommunication

Services

Copyright © 2013 Standard & Poor's, a division of The McGraw-Hill Companies Inc. All rights reserved. (www.researchdatagroup.com/S&P.htm)

CUMULATIVE TOTAL RETURN

Based upon an initial investment of $100 on December 31, 2007

with dividends reinvested

$0

$50

$100

$150

$250

$200

Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12

Cincinnati Bell Inc.

S&P 500

S&P Integrated Telecommunication Services

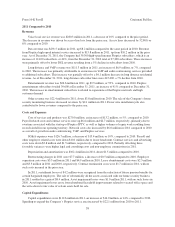

(f) Issuer Purchases of Equity Securities

The following table provides information regarding the Company’s purchases of its common stock during

the quarter ended December 31, 2012:

Period

Total Number of

Shares (or Units)

Purchased

Average Price

Paid per Share

(or Unit)

Total Number of

Shares (or Units)

Purchased as Part of

Publicly Announced

Plans or

Programs*

Approximate Dollar

Value of Shares that

May Yet Be

Purchased Under

Publicly Announced

Plans or Programs

(in millions)*

10/1/2012 — 12/31/2012 ............. — $— — $129.2

* In February 2010, the Board of Directors approved an additional plan for the repurchase of the Company’s

outstanding common stock in an amount up to $150 million. The Company may repurchase shares when

management believes the share price offers an attractive value and to the extent its available cash is not

needed for growth opportunities. This new plan does not have a stated maturity.

29

Form 10-K