Cincinnati Bell 2012 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

unsecured notes with a principal balance of $73.0 million. The Company had previously terminated an interest

rate swap related to the 7% Senior Notes. For the year ended December 31, 2012, a loss on debt extinguishment

of $13.6 million was recognized on these redemptions.

In 2010, the Company redeemed its 8

3

⁄

8

% Senior Subordinated Notes due 2014 (“8

3

⁄

8

% Subordinated

Notes”) with a principal balance of $560 million and its Tranche B Term Loan with a principal balance of $760

million. The Company also terminated an interest rate swap related to the 8

3

⁄

8

% Subordinated Notes. For the year

ended December 31, 2010 the Company recognized a debt extinguishment loss of $46.5 million.

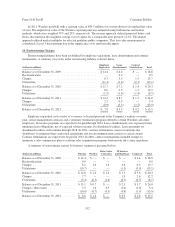

8. Commitments and Contingencies

Operating Lease Commitments

The Company leases certain circuits, facilities, and equipment used in its operations. Operating lease

expense was $19.3 million, $20.4 million, and $16.2 million in 2012, 2011, and 2010, respectively. Certain

facility leases and tower site leases provide for renewal options with fixed rent escalations beyond the initial

lease term.

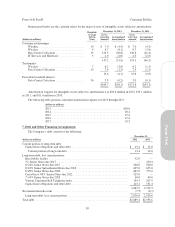

At December 31, 2012, future minimum lease payments required under operating leases having initial or

remaining noncancelable lease terms for the next five years are as follows:

(dollars in millions)

2013 ................................................................................ $16.2

2014 ................................................................................ 12.5

2015 ................................................................................ 9.0

2016 ................................................................................ 4.1

2017 ................................................................................ 1.6

Thereafter ............................................................................ 1.5

Total ................................................................................ $44.9

Data Center Customer Leases

Data center customer leases customarily contain provisions that either allow for renewal or continuation on

a month-to-month arrangement. Certain leases contain early termination rights. At lease inception, early

termination is generally not deemed reasonably assured due to the significant economic penalty incurred by the

lessee to exercise its termination right and to relocate its equipment. The future minimum lease payments

expected to be received under noncancelable operating leases, excluding month-to-month arrangements and

submetered power, for the next five years are as follows: $135.2 million in 2013, $106.5 million in 2014, $70.7

million in 2015, $49.6 million in 2016, and $34.1 million in 2017.

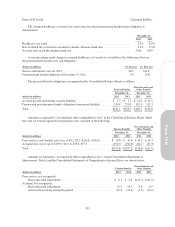

Asset Retirement Obligations

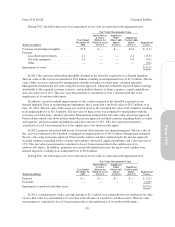

Asset retirement obligations exist for leased wireless towers and certain other assets. The following table

presents the activity for the Company’s asset retirement obligations, which are included in “Other noncurrent

liabilities” in the Consolidated Balance Sheets:

December 31,

(dollars in millions) 2012 2011

Balance, beginning of period ........................................................ $5.4 $ 5.1

Liabilities incurred ................................................................ 0.2 0.2

Revisions to estimated cash flow ..................................................... 1.1 (0.2)

Accretion expense ................................................................ 0.4 0.3

Balance, end of period ............................................................. $7.1 $ 5.4

98

Form 10-K Part II Cincinnati Bell Inc.