Cincinnati Bell 2012 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216

|

|

Form 10-K Part II Cincinnati Bell Inc.

postpaid smartphone subscribers at December 31, 2010, a 10% increase from 2010. The increase in smartphone

subscribers increased data usage, and the Company earned $14.54 of data ARPU in 2011 compared to $11.69 in

2010.

Prepaid service revenue was $53.2 million in 2011, a decrease of $1.4 million, or 3%, compared to 2010.

Prepaid subscribers were 148,000 at December 31, 2011, down 6% from a year earlier, due to aggressive

competitor promotions on prepaid service.

Equipment and other revenue in 2011 was $25.2 million, up $5.2 million compared to 2010 primarily due to

higher revenue per smartphone handset sales to consumers and increased sales to a wholesale distributor.

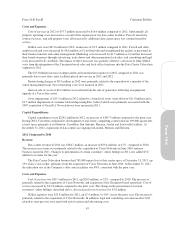

Costs and Expenses

Cost of services and products was $134.2 million, a decrease of $3.2 million, or 2%, compared to 2010. The

decrease was primarily attributable to lower handset subsidies and contract services compared to 2010, which

was partially offset by higher cost of goods sold due to the increase in equipment revenue and higher network

operation costs resulting from increased smartphone penetration and data usage.

SG&A expenses were $55.2 million in 2011, a decrease of $5.9 million, or 10%, compared to 2010,

primarily due to a $2.8 million decrease in third-party service provider and payroll costs and a $2.6 million

decrease in advertising and promotional expenses due to cost reduction initiatives.

Depreciation and amortization was $33.5 million for 2011, essentially flat compared to 2010. In 2011,

Wireless began amortizing its trademark license which added $1.5 million of amortization expense. The increase

in amortization was offset by a decrease in depreciation on tangible assets.

In 2011, Wireless recognized a goodwill impairment loss of $50.3 million and asset impairment losses of

$1.1 million. The goodwill impairment loss arose from declines in revenues and wireless subscribers. Asset

impairments were recognized for canceled capital projects. In 2010, Wireless incurred a $1.0 million

restructuring charge primarily for employee separation costs.

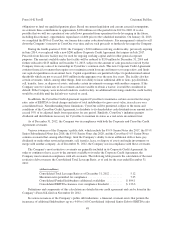

Capital Expenditures

Capital expenditures were $17.6 million in 2011, up $5.9 million, or 50%, compared to 2010. During 2011,

Wireless deployed software upgrades and incurred additional fiber costs to begin its network upgrade to 4G using

HSPA+ technology.

41

Form 10-K