Cincinnati Bell 2012 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K Part II Cincinnati Bell Inc.

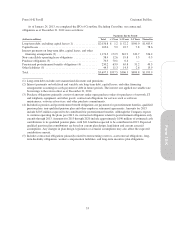

impact of CyrusOne as of December 31, 2012, we had $239.7 million of short-term liquidity, comprised of $7.4

million of cash and cash equivalents and the total unused capacity of $232.3 million from our Corporate Credit

Agreement and Receivables Facility.

Our primary uses of cash are capital expenditures and debt service. In 2012, 2011 and 2010, capital

expenditures were $367.2 million, $255.5 million, and $149.7 million, respectively. The higher capital

expenditures in 2012 resulted from increased spending on CyrusOne data centers, which totaled $228.2 million in

2012. In 2013, capital expenditures are expected to be in a range of $180 million to $190 million. In 2012, 2011

and 2010, debt repayments were $442.4 million, $11.5 million, and $1,554.5 million, respectively. In the fourth

quarter of 2012, CyrusOne LP and CyrusOne Finance Corp issued $525 million of 6 3/8% Senior Notes, the

proceeds from which were used to repay its intercompany payables, to pay debt issuance costs, and also to

support its operations. In turn, the Company used the $480 million of proceeds received from CyrusOne to make

debt repayments, to pay the debt redemption premiums and accrued interest obligations associated with such

repayments, and to also pay the debt issuance costs related to its new Corporate Credit Agreement.

Interest payments were $217.9 million, $211.8 million and $172.4 million in 2012, 2011 and 2010,

respectively. The higher interest payments in 2012 were largely the result of $4.6 million of accelerated interest

payments associated with the early redemption in the fourth quarter of 2012 of the 7% Senior Notes due 2015.

Interest on these bonds was previously due semi-annually in February and August of each year. Also contributing

to the increased interest payments was the impact of higher capital lease and other financial obligations primarily

associated with CyrusOne’s increased data center footprint. For 2013, excluding the impact of CyrusOne, our

contractual debt maturities, including capital lease obligations, are $7.1 million and associated contractual

interest payments are expected to be approximately $175 million.

To a lesser extent, cash is also used primarily to fund our pension obligations, to pay preferred stock

dividends, and also to repurchase shares of common stock as and when the stock price offers an attractive

valuation. Cash contributions to our qualified pension plans were $23.9 million, $18.1 million and $5.6 million in

2012, 2011 and 2010, respectively. Contributions to our qualified pension plans for 2013 are expected to be

$41.6 million. Dividends paid on preferred stock were $10.4 million in each of 2012, 2011 and 2010. We do not

currently pay dividends on our common shares, nor do we plan to pay dividends on such shares in 2013. In 2012,

2011 and 2010, cash used to repurchase common shares was $0.3 million, $10.4 million and $10.0 million,

respectively. As of December 31, 2012, management has authority to repurchase additional common shares with

a value of up to $129.2 million under the most recent plan approved by the Board of Directors. This plan does not

have a stated maturity date. Management may purchase additional shares in the future to the extent that cash is

available and management believes the share price offers an attractive value.

The Company’s Receivables Facility, which had $32.3 million in available borrowing capacity at

December 31, 2012, is subject to renewal annually. While we expect to continue to renew this facility, we would

be required to use cash, our Corporate Credit Agreement, or other sources to repay any outstanding balance on

the Receivables Facility if it were not renewed.

Management believes that cash on hand, cash generated from operations, and available funding from its

credit facilities will be adequate to meet the Company’s investing and financing needs for 2013.

Long-term view, including debt covenants

As of December 31, 2012, the Company had $2.7 billion of outstanding indebtedness and an accumulated

deficit of $3.2 billion. Excluding the impact of CyrusOne’s debt, the Company’s indebtedness at December 31,

2012 amounted to $2.1 billion. A significant amount of indebtedness was previously incurred from the purchase

and operation of a national broadband business, which was sold in 2003.

In addition to the uses of cash described in the Short-term view section above, the Company has to satisfy

the above-mentioned long-term debt obligations. The Company has no significant debt maturities until 2017.

Contractual debt maturities, excluding CyrusOne, are $7.1 million in 2013, $57.8 million in 2014, $5.1 million in

2015, $5.2 million in 2016, $502.6 million in 2017 and $1,562.0 million thereafter. In addition, we have ongoing

47

Form 10-K