Cincinnati Bell 2012 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K Part II Cincinnati Bell Inc.

certain of its subsidiaries. Each such guarantee is a senior unsecured obligation of the applicable guarantor,

ranking equally with all existing and future unsecured senior debt of such guarantor and effectively subordinated

to all existing and future secured indebtedness of such guarantor to the extent of the value of the assets securing

that indebtedness. The CyrusOne 6

3

⁄

8

% Senior Notes are structurally subordinated to all liabilities (including

trade payables) of each subsidiary of the Issuers that does not guarantee the Notes.

The CyrusOne 6

3

⁄

8

% Senior Notes bear interest at a rate of 6

3

⁄

8

% per annum, payable semi-annually on

May 15 and November 15 of each year, beginning on May 15, 2013, to persons who are registered holders of the

CyrusOne 6

3

⁄

8

% Senior Notes on the immediately preceding May 1 and November 1, respectively.

The indenture governing the CyrusOne 6

3

⁄

8

% Senior Notes limits the ability of CyrusOne LP and its

restricted subsidiaries to incur indebtedness, encumber their assets, enter into sale and leaseback transactions,

make restricted payments, create dividend restrictions and other payment restrictions that affect CyrusOne LP’s

restricted subsidiaries, permit restricted subsidiaries to guarantee certain indebtedness, enter into transactions

with affiliates, sell assets, and engage in certain business activities, in each case subject to certain qualifications

set forth in the indenture.

The CyrusOne 6

3

⁄

8

% Senior Notes will mature on November 15, 2022. However, prior to November 15,

2017, the issuers may, at their option, redeem some or all of the CyrusOne 6

3

⁄

8

% Senior Notes at a redemption

price equal to 100% of the principal amount of the CyrusOne 6

3

⁄

8

% Senior Notes, together with accrued and

unpaid interest, if any, plus a “make-whole” premium. On or after November 15, 2017, the Issuers may, at their

option, redeem some or all of the 6

3

⁄

8

% Senior Notes at any time at declining redemption prices equal to

(i) 103.188% beginning on November 15, 2017, (ii) 102.125% beginning on November 15, 2018, (iii) 101.063%

beginning on November 15, 2019 and (iv) 100.000% beginning on November 15, 2020 and thereafter, plus, in

each case, accrued and unpaid interest, if any, to the applicable redemption date. In addition, before

November 15, 2015, and subject to certain conditions, the issuers may, at their option, redeem up to 35% of the

aggregate principal amount of the CyrusOne 6

3

⁄

8

% Senior Notes with the net proceeds of certain equity offerings

at 106.375% of the principal amount thereof, plus accrued and unpaid interest, if any, to the date of redemption;

provided that (i) at least 65% of the aggregate principal amount of the CyrusOne 6

3

⁄

8

% Senior Notes remains

outstanding and (ii) the redemption occurs within 90 days of the closing of any such equity offering.

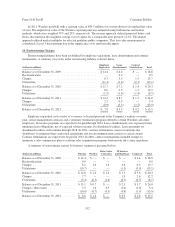

Cincinnati Bell Telephone Notes

CBT issued $80.0 million in unsecured notes that were guaranteed on a subordinated basis by Cincinnati

Bell Inc. but not the subsidiaries of Cincinnati Bell Inc. These notes had various final maturity dates occurring in

2023, and were callable prior to maturity. The fixed interest rates on these notes ranged from 7.18% to 7.27%. In

the fourth quarter of 2012, the Company fully redeemed the outstanding balance of $73.0 million under the CBT

Notes.

CBT issued $150.0 million in aggregate principal of 6.30% unsecured senior notes due 2028, which is

guaranteed on a subordinated basis by Cincinnati Bell Inc. but not the subsidiaries of Cincinnati Bell Inc. The

maturity date of these notes is in 2028 and they may not be called prior to maturity. The indentures governing

these notes provide for customary events of default, including for failure to make any payment when due and for

a default of any other existing debt instrument of Cincinnati Bell Inc. or CBT that exceeds $20.0 million. At both

December 31, 2012 and 2011, the amount outstanding under these senior notes was $134.5 million.

Capital Lease Obligations

Capital lease obligations represent our obligation for certain leased assets, including wireless towers, data

center facilities and various equipment. These leases generally contain renewal options. As of December 31,

2012, CyrusOne held a purchase option on one leased data center facility.

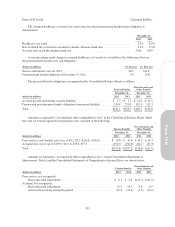

Other Financing Arrangements

CyrusOne leases certain buildings used in its data center operations. Structural improvements were made to

these leased facilities in excess of normal tenant improvements and, as such, we are deemed the accounting

95

Form 10-K