Cincinnati Bell 2012 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K Part II Cincinnati Bell Inc.

Stock Options and Stock Appreciation Rights

Generally, the awards of stock options and stock appreciation rights fully vest three years from grant date

and expire ten years from grant date. Beginning in 2012, some of the stock options and stock appreciation rights

vested over a three year period based on the achievement of certain performance objectives. The Company

generally issues new shares when options to purchase common shares or stock appreciation rights are exercised.

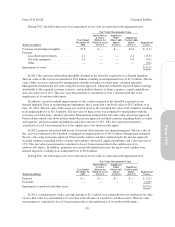

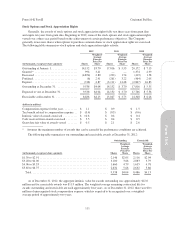

The following table summarizes stock options and stock appreciation rights activity:

2012 2011 2010

Weighted-

Average

Exercise

Price Per

Share Shares

Weighted-

Average

Exercise

Price Per

Share

Weighted-

Average

Exercise

Price Per

Share(in thousands, except per share amounts) Shares Shares

Outstanding at January 1, ................. 14,152 $3.70 17,816 $ 5.55 20,172 $ 7.15

Granted * .............................. 994 3.41 — — 1,374 2.99

Exercised .............................. (4,854) 2.80 (292) 1.74 (419) 1.58

Forfeited ............................... (6) 2.91 (261) 3.22 (464) 2.05

Expired ................................ (748) 4.87 (3,111) 14.48 (2,847) 16.83

Outstanding at December 31, .............. 9,538 $4.04 14,152 $ 3.70 17,816 $ 5.55

Expected to vest at December 31, ........... 9,538 $4.04 14,152 $ 3.70 17,766 $ 5.56

Exercisable at December 31, ............... 8,486 $4.13 13,047 $ 3.73 14,348 $ 6.26

(dollars in millions)

Compensation expense for the year .......... $ 1.1 $ 0.9 $ 1.5

Tax benefit related to compensation expense . . $ (0.4) $ (0.3) $ (0.6)

Intrinsic value of awards exercised .......... $ 10.6 $ 0.4 $ 0.4

Cash received from awards exercised ........ $ 5.5 $ 0.4 $ 0.5

Grant date fair value of awards vested ....... $ 0.5 $ 2.1 $ 2.6

* Assumes the maximum number of awards that can be earned if the performance conditions are achieved.

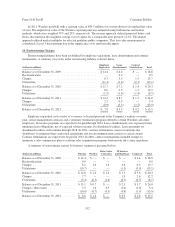

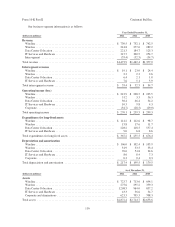

The following table summarizes our outstanding and exercisable awards at December 31, 2012:

Outstanding Exercisable

Weighted-

Average

Exercise

Price Per

Share

Weighted-

Average

Exercise

Price Per

Share(in thousands, except per share amounts) Shares Shares

$1.39 to $2.91 ................................................ 2,146 $2.05 2,116 $2.04

$3.28 to $4.00 ................................................ 3,100 3.66 2,083 3.79

$4.06 to $5.53 ................................................ 1,660 4.79 1,655 4.78

$5.65 to $6.75 ................................................ 2,632 5.66 2,632 5.66

Total ..................................................... 9,538 $4.04 8,486 $4.13

As of December 31, 2012, the aggregate intrinsic value for awards outstanding was approximately $12.0

million and for exercisable awards was $11.9 million. The weighted-average remaining contractual life for

awards outstanding and exercisable are each approximately four years. As of December 31, 2012, there was $0.1

million of unrecognized stock compensation expense, which is expected to be recognized over a weighted-

average period of approximately two years.

111

Form 10-K