Cincinnati Bell 2012 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Preferred Shares

The Company is authorized to issue 1,357,299 shares of voting preferred stock without par value and

1,000,000 shares of nonvoting preferred stock without par value. The Company issued 155,250 voting shares of

6

3

⁄

4

% cumulative convertible preferred stock at stated value. These shares were subsequently deposited into a

trust in which the underlying 155,250 shares are equivalent to 3,105,000 depositary shares. Shares of this

preferred stock can be converted at any time at the option of the holder into common stock of the Company at a

conversion rate of 1.44 shares of the Company common stock per depositary share of 6

3

⁄

4

% convertible preferred

stock. Annual dividends of $67.50 per share (or $3.3752 per depositary share) on the outstanding 6

3

⁄

4

%

convertible preferred stock are payable quarterly in arrears in cash, or in common stock in certain circumstances

if cash payment is not legally permitted. The liquidation preference on the 6

3

⁄

4

% preferred stock is $1,000 per

share (or $50 per depositary share). The Company paid $10.4 million in preferred stock dividends in 2012, 2011,

and 2010.

Warrants

In March 2003, the Company entered into a series of recapitalization transactions which included the

issuance of 17.5 million warrants that expire on March 26, 2013. Each warrant allows the holder to purchase one

share of Cincinnati Bell common stock at an exercise price of $3.00 each. During 2012, warrant holders elected

to exercise a total of 3.2 million warrants, primarily on a cashless basis, and received a total of 1.5 million shares

of common stock. Cash proceeds received upon exercise were $0.1 million. As of December 31, 2012, there were

14.3 million warrants still outstanding. There were no warrants exercised during 2011 or 2010.

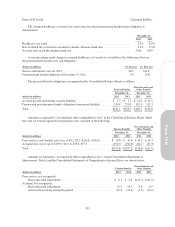

Accumulated Other Comprehensive Loss

Shareowners’ deficit includes an accumulated other comprehensive loss that is comprised of pension and

postretirement unrecognized prior service cost and unrecognized actuarial losses, and foreign currency

translation losses. At December 31, 2012 and 2011, pension and postretirement unrecognized prior service cost

and unrecognized actuarial losses, net of taxes, were $209.6 million and $208.8 million, respectively.

Accumulated foreign currency translation loss was $0.1 million at December 31, 2012 and December 31, 2011.

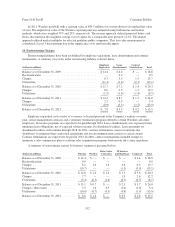

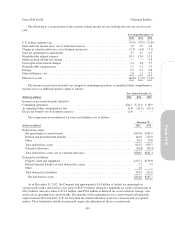

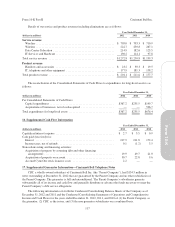

13. Income Taxes

Income tax expense consists of the following:

Year Ended December 31,

(dollars in millions) 2012 2011 2010

Current:

Federal ................................................................. $ 1.8 $ — $ 0.3

State and local ........................................................... 1.6 0.4 0.7

Total current ............................................................. 3.4 0.4 1.0

Investment tax credits ..................................................... (0.3) (0.3) (0.3)

Deferred:

Federal ................................................................. 21.8 24.3 44.0

State and local ........................................................... 2.0 3.4 1.4

Foreign ................................................................. (0.5) 0.1 —

Total deferred ............................................................ 23.3 27.8 45.4

Valuation allowance ....................................................... (1.7) (2.9) (7.2)

Total ................................................................... $24.7 $25.0 $38.9

108

Form 10-K Part II Cincinnati Bell Inc.