Cincinnati Bell 2012 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K Part II Cincinnati Bell Inc.

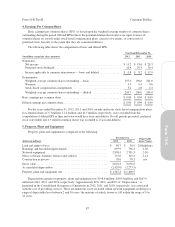

Summarized below are the carrying values for the major classes of intangible assets subject to amortization:

(dollars in millions)

Weighted-

Average

Life in

Years

December 31, 2012 December 31, 2011

Gross

Carrying

Amount

Accumulated

Amortization

Gross

Carrying

Amount

Accumulated

Amortization

Customer relationships

Wireline ................................ 10 $ 7.0 $ (4.9) $ 7.0 (4.2)

Wireless ................................ 9 8.7 (8.1) 8.7 (7.6)

Data Center Colocation .................... 15 129.5 (36.8) 136.6 (26.4)

IT Services and Hardware .................. 5 2.0 (2.0) 2.0 (2.0)

147.2 (51.8) 154.3 (40.2)

Trademarks

Wireless ................................ 7 6.2 (2.8) 6.2 (1.5)

Data Center Colocation .................... 15 7.4 (1.3) 7.4 (1.3)

13.6 (4.1) 13.6 (2.8)

Favorable leasehold interest

Data Center Colocation .................... 56 3.9 (0.2) 3.9 (0.1)

$164.7 $(56.1) $171.8 $(43.1)

Amortization expense for intangible assets subject to amortization was $18.6 million in 2012, $19.1 million

in 2011, and $11.6 million in 2010.

The following table presents estimated amortization expense for 2013 through 2017:

(dollars in millions)

2013 ............................................... $18.8

2014 ............................................... 18.4

2015 ............................................... 15.6

2016 ............................................... 12.4

2017 ............................................... 10.2

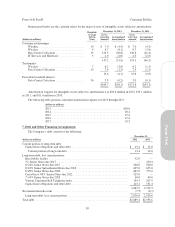

7. Debt and Other Financing Arrangements

The Company’s debt consists of the following:

December 31,

(dollars in millions) 2012 2011

Current portion of long-term debt:

Capital lease obligations and other debt ....................................... $ 13.4 $ 13.0

Current portion of long-term debt .......................................... 13.4 13.0

Long-term debt, less current portion:

Receivables facility ....................................................... 52.0 —

7% Senior Notes due 2015 ................................................. — 250.4

8 1/4% Senior Notes due 2017 .............................................. 500.0 500.0

8 3/4% Senior Subordinated Notes due 2018 ................................... 625.0 625.0

8 3/8% Senior Notes due 2020 .............................................. 683.9 775.0

CyrusOne 6 3/8% Senior Notes due 2022 ...................................... 525.0 —

7 1/4% Senior Notes due 2023 .............................................. 40.0 40.0

Various Cincinnati Bell Telephone notes ...................................... 134.5 207.5

Capital lease obligations and other debt ....................................... 123.1 131.4

2,683.5 2,529.3

Net unamortized discount .................................................... (7.5) (8.7)

Long-term debt, less current portion .......................................... 2,676.0 2,520.6

Total debt ................................................................. $2,689.4 $2,533.6

89

Form 10-K