Cincinnati Bell 2012 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

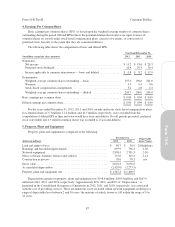

During the year ended December 31, 2012, an asset impairment loss of $11.8 million was recognized in the

Data Center Colocation segment on certain leasehold improvements at data centers acquired in the GramTel

acquisition. Also during 2012, asset impairment losses of $0.4 million and $0.5 million were recognized in the

Wireless and Wireline segments, respectively. The Wireless impairment loss was associated with abandoned

assets that have no resale market, and the Wireline impairment loss was associated with an out-of-territory fiber

network. During 2011, asset impairment losses of $1.1 million and $1.0 million were recognized in the Wireless

and Wireline segments, respectively, on abandoned assets that had no resale market. No asset impairment losses

were recognized in 2010.

As of December 31, 2012 and 2011, buildings and leasehold improvements, network equipment, and office

software, furniture, fixtures and vehicles include $244.1 million and $222.7 million, respectively, of assets

accounted for as capital leases or financing arrangements. Amortization of capital lease assets is included in

“Depreciation and amortization” in the Consolidated Statements of Operations.

6. Goodwill and Intangible Assets

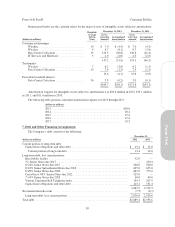

Goodwill

At December 31, 2012 and 2011, the gross value of goodwill was $340.9 million. Accumulated impairment

losses were $50.3 million at December 31, 2012 and 2011.

The changes in the carrying amount of goodwill, net of accumulated impairment losses, for the years ended

December 31, 2012 and 2011 are as follows:

(dollars in millions) Wireless Wireline

Data Center

Colocation

IT

Services and

Hardware Total

Balance as of December 31, 2010 ................... $50.3 $12.6 $276.3 $2.5 $341.7

Impairment ..................................... (50.3) — — — (50.3)

Disposition of home security business assets ........... — (0.8) — — (0.8)

Balance as of December 31, 2011 ................... — 11.8 276.3 2.5 290.6

Impairment ..................................... — — — — —

Balance as of December 31, 2012 ................... $ — $11.8 $276.3 $2.5 $290.6

In 2011, we recognized a goodwill impairment loss in the Wireless business segment. The impairment loss

arose from declines in revenues and wireless subscribers. See Note 9 for further information on how fair value of

the reporting unit was estimated.

In 2011, we sold substantially all the assets of our home security monitoring business for a gain of $8.4

million. Goodwill of $0.8 million was associated with the assets sold and included within “Gain on sale or

disposal of assets” in the Consolidated Statements of Operations. This business was historically included within

the Wireline segment.

Intangible Assets Not Subject to Amortization

As of December 31, 2012 and 2011, intangible assets not subject to amortization consist solely of FCC

wireless spectrum licenses with a carrying value of $88.2 million. These licenses are subject to renewal every 10

years for a nominal fee. The next renewal date is in 2015.

Intangible Assets Subject to Amortization

Intangible assets subject to amortization consist of customer relationships, trademarks and a favorable

leasehold interest. For the year ended December 31, 2012, an impairment loss of $1.5 million was recognized by

the Data Center Colocation segment on a customer relationship intangible that was obtained with the 2007

GramTel acquisition. No impairments were recognized on intangible assets subject to amortization in 2011 or

2010.

88

Form 10-K Part II Cincinnati Bell Inc.