Cincinnati Bell 2012 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K Part II Cincinnati Bell Inc.

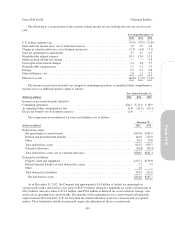

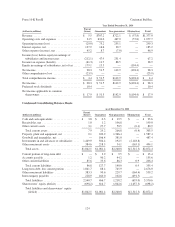

Details of our service and product revenues including eliminations are as follows:

Year Ended December 31,

(dollars in millions) 2012 2011 2010

Service revenue

Wireline ....................................................... $ 705.0 $ 703.3 $ 710.9

Wireless ....................................................... 222.7 250.8 267.1

Data Center Colocation ........................................... 214.9 182.6 123.5

IT Services and Hardware ......................................... 130.2 114.1 97.8

Total service revenue .............................................. $1,272.8 $1,250.8 $1,199.3

Product revenue

Handsets and accessories ......................................... $ 23.2 $ 30.3 $ 19.5

IT, telephony and other equipment .................................. 177.9 181.3 158.2

Total product revenue .............................................. $ 201.1 $ 211.6 $ 177.7

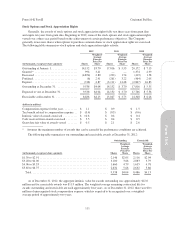

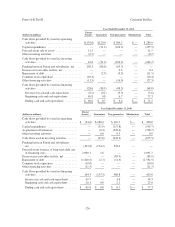

The reconciliation of the Consolidated Statements of Cash Flows to expenditures for long-lived assets is as

follows:

Year Ended December 31,

(dollars in millions) 2012 2011 2010

Per Consolidated Statements of Cash Flows:

Capital expenditures ............................................. $367.2 $255.5 $149.7

Acquisitions of businesses, net of cash acquired ....................... — — 526.7

Total expenditures for long-lived assets ................................ $367.2 $255.5 $676.4

16. Supplemental Cash Flow Information

Year Ended December 31,

(dollars in millions) 2012 2011 2010

Capitalized interest expense ......................................... $ 2.7 $ 3.5 $ 0.9

Cash paid /(received) for:

Interest ....................................................... 217.9 211.8 172.4

Income taxes, net of refunds ....................................... 0.1 (1.2) 3.5

Noncash investing and financing activities:

Acquisition of property by assuming debt and other financing

arrangements ................................................. 19.9 49.7 21.0

Acquisition of property on account ................................. 30.7 22.8 9.6

Accrued CyrusOne stock issuance costs ............................. 2.2 — —

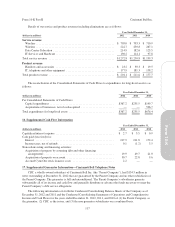

17. Supplemental Guarantor Information—Cincinnati Bell Telephone Notes

CBT, a wholly-owned subsidiary of Cincinnati Bell Inc. (the “Parent Company”), had $134.5 million in

notes outstanding at December 31, 2012 that are guaranteed by the Parent Company and no other subsidiaries of

the Parent Company. The guarantee is full and unconditional. The Parent Company’s subsidiaries generate

substantially all of its income and cash flow and generally distribute or advance the funds necessary to meet the

Parent Company’s debt service obligations.

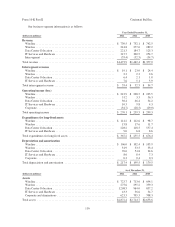

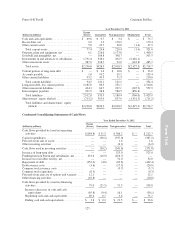

The following information sets forth the Condensed Consolidating Balance Sheets of the Company as of

December 31, 2012 and 2011 and the Condensed Consolidating Statements of Operations and Comprehensive

Income and Cash Flows for the years ended December 31, 2012, 2011, and 2010 of (1) the Parent Company, as

the guarantor, (2) CBT, as the issuer, and (3) the non-guarantor subsidiaries on a combined basis.

117

Form 10-K