Cincinnati Bell 2012 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

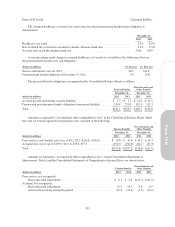

The ultimate realization of the deferred income tax assets depends upon the Company’s ability to generate

future taxable income during the periods in which basis differences and other deductions become deductible, and

prior to the expiration of the net operating loss carryforwards. Due to its historical and future projected earnings,

management believes it will utilize future federal deductions and available net operating loss carryforwards prior

to their expiration. Management also concluded that it was more likely than not that certain state and foreign tax

loss carryforwards would not be realized based upon the analysis described above and therefore provided a

valuation allowance.

The total amount of unrecognized tax benefits that, if recognized, would affect the effective tax rate is $22.3

million at December 31, 2012 and $21.5 million at December 31, 2011. We do not currently anticipate that the

amount of unrecognized tax benefits will change significantly over the next year. Accrued interest and penalties

on income tax uncertainties were immaterial as of December 31, 2012 and 2011.

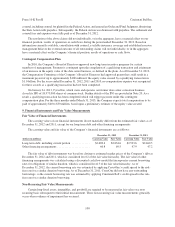

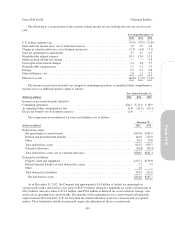

A reconciliation of the unrecognized tax benefits is as follows:

Year Ended December 31,

(dollars in millions) 2012 2011 2010

Balance, beginning of year .................................................. $21.8 $20.5 $16.7

Change in tax positions for the current year .................................... 1.4 1.3 4.0

Change in tax positions for prior years ........................................ (0.4) — (0.2)

Balance, end of year ....................................................... $22.8 $21.8 $20.5

During the year ended December 31, 2010, a change of $4.0 million was recorded due to tax matters

associated with the refinancing of the 8

3

⁄

8

% Subordinated Notes.

The Company and its subsidiaries file income tax returns in the U.S. federal jurisdiction, and various

foreign, state and local jurisdictions. With a few exceptions, the Company is no longer subject to U.S. federal,

state or local examinations for years before 2009.

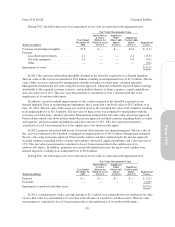

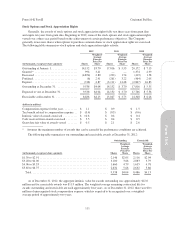

14. Stock-Based and Deferred Compensation Plans

The Company may grant stock options, stock appreciation rights, performance-based awards, and time-

based restricted shares to officers and key employees under the 2007 Long Term Incentive Plan and stock options

and restricted shares to directors under the 2007 Stock Option Plan for Non-Employee Directors. The maximum

number of shares authorized under these plans is 19.0 million. Shares available for award under the plans at

December 31, 2012 were 4.8 million.

110

Form 10-K Part II Cincinnati Bell Inc.