Cincinnati Bell 2012 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

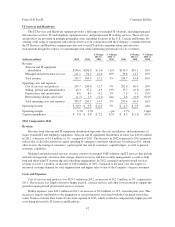

Form 10-K Part II Cincinnati Bell Inc.

Demand for IT hardware is cyclical in nature. That is, in periods of fiscal restraint, a customer may defer

these capital purchases and, instead, use its existing equipment for a longer period of time. As such, IT and

telephony equipment sales in 2013 are somewhat dependent on the business economy and outlook in 2013.

In 2013, we plan to integrate our IT Services and Hardware sales, service, marketing and back office

functions into our Wireline business markets operations. We expect the integration of these operations to reduce

costs, improve technical and customer services, and drive back-office efficiencies.

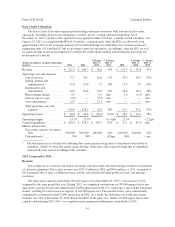

Data Center Colocation

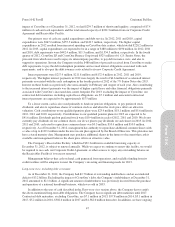

In connection with the formation of CyrusOne, its debt issuance and IPO, CyrusOne and all its subsidiaries

were released from their guarantees of our 8

3

⁄

8

% Senior Notes due 2020, 8

3

⁄

4

% Senior Subordinated Notes due

2018, and 8

1

⁄

4

% Senior Notes due 2017. On January 24, 2013, we completed the IPO of CyrusOne, which owns

and operates our former Data Center Colocation business. We currently own approximately 1.9 million shares, or

8.6%, of CyrusOne’s common stock and are a limited partner in CyrusOne LP, owning approximately

42.6 million, or 66%, of its partnership units. CyrusOne LP units are exchangeable into common stock of

CyrusOne on a one-to-one basis, or cash at the fair value of a share of CyrusOne common stock, at the option of

CyrusOne, commencing on January 17, 2014.

Although we effectively own approximately 69% of the economic interests of CyrusOne through our

ownership of its common stock and partnership units of CyrusOne LP, we no longer control its operations as we

are a limited partner in CyrusOne LP, and own less than 10% of CyrusOne’s common stock. Upon completion of

the IPO, we deconsolidated CyrusOne’s assets and liabilities and recognized our investment in CyrusOne’s

common stock as an available-for-sale security on our balance sheet. Any fair value changes due to CyrusOne’s

stock price will be recognized in other comprehensive income. In addition, our investment in CyrusOne LP was

recorded as an equity method investment, and we will recognize our share of CyrusOne LP’s net income as non-

operating income.

In 2012, CyrusOne experienced strong demand for data center colocation services, and we expect this trend

to continue for the foreseeable future. CyrusOne plans to continue to expand its data center capacity in 2013.

It is management’s intent to sell down the Company’s interests in CyrusOne over time and use such

proceeds to further de-leverage the Company. As of January 24, 2013, the Company’s tax basis in CyrusOne was

approximately $600 million.

51

Form 10-K