Cincinnati Bell 2012 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

owner of these facilities. As of December 31, 2012 and 2011, the liability related to these financing arrangements

was $60.8 million and $47.9 million, respectively, which was recognized within “Other noncurrent liabilities” in

the Consolidated Balance Sheets.

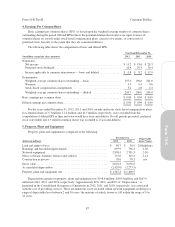

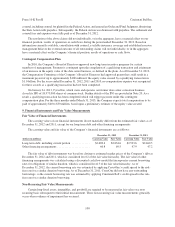

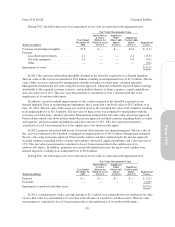

The following table summarizes our annual minimum payments for these financing arrangements for the

five years subsequent to December 31, 2012, and thereafter:

(dollars in millions)

2013 .............................................................................. $ 6.0

2014 .............................................................................. 6.4

2015 .............................................................................. 6.6

2016 .............................................................................. 6.7

2017 .............................................................................. 6.9

Thereafter ......................................................................... 42.3

Total ............................................................................. $ 74.9

Debt Maturity Schedule

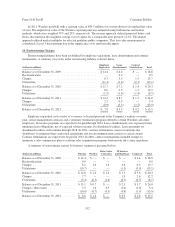

The following table summarizes our annual principal maturities of debt and capital leases for the five years

subsequent to December 31, 2012, and thereafter:

(dollars in millions) Debt

Capital

Leases

Total

Debt

Year ended December 31,

2013 ............................................................. $ 1.2 $ 12.2 $ 13.4

2014 ............................................................. 52.1 9.7 61.8

2015 ............................................................. 0.1 8.5 8.6

2016 ............................................................. — 9.0 9.0

2017 ............................................................. 500.0 5.2 505.2

Thereafter ......................................................... 2,008.4 90.5 2,098.9

2,561.8 135.1 2,696.9

Net unamortized discount ............................................. (7.5) — (7.5)

Total debt ......................................................... $2,554.3 $135.1 $2,689.4

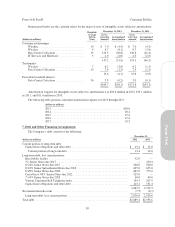

Total capital lease payments including interest are expected to be $21.8 million for 2013, $18.5 million for

2014, $16.7 million for 2015, $16.6 million for 2016, $12.3 million for 2017, and $139.3 million thereafter.

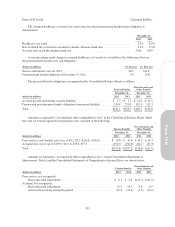

Deferred Financing Costs

Deferred financing costs are costs incurred in connection with obtaining long-term financing. In 2012,

deferred financing costs were incurred in connection with the issuance of the Corporate Credit Agreement,

CyrusOne Credit Agreement and CyrusOne 6 3/8% Senior Notes due 2022. As of December 31, 2012 and 2011,

deferred financing costs totaled $47.1 million and $35.7 million, respectively. Deferred financing costs are

amortized over the term of the related indebtedness or credit agreement. Amortization of deferred financing

costs, included in “Interest expense” in the Consolidated Statements of Operations, totaled $7.2 million in 2012,

$7.0 million in 2011, and $6.6 million in 2010.

Debt Covenants

Credit Facility

The Corporate Credit Agreement has financial covenants that require the Company to maintain certain

leverage and interest coverage ratios. Capital expenditures are permitted subject to predetermined annual

thresholds which are not to exceed $955 million in the aggregate over the next five years. The Corporate Credit

Agreement also contains certain covenants which, among other things, restrict the Company’s ability to incur

96

Form 10-K Part II Cincinnati Bell Inc.