Cincinnati Bell 2012 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

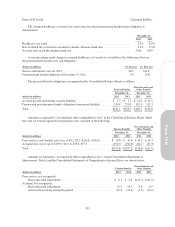

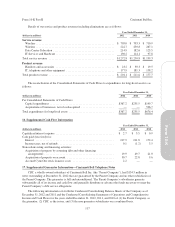

service. No phantom shares were granted to non-employee directors in 2012. Distributions to the directors are

generally in the form of cash. The executive deferred compensation plan allows for certain executives to defer a

portion of their annual base pay, bonus, or stock awards. Under the executive deferred compensation plan,

participants can elect to receive distributions in the form of either cash or common shares.

At December 31, 2012 and 2011, there were 0.7 million common shares deferred in these plans. As these

awards can be settled in cash, we record compensation costs each period based on the change in the Company’s

stock price. We recognized compensation expense of $1.8 million in 2012, $0.3 million in 2011, and a benefit of

$0.2 million in 2010.

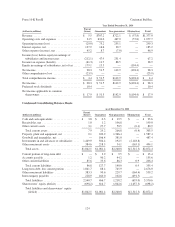

15. Business Segment Information

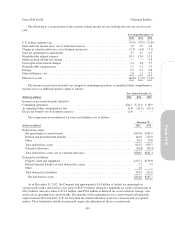

During 2012, the Company operated in four business segments: Wireline, Wireless, Data Center Colocation,

and IT Services and Hardware, as described below. The Company’s segments are strategic business units that

offer distinct products and services and are aligned with its internal management structure and reporting. On

January 24, 2013, we completed the IPO of CyrusOne, which owns and operates our former data center

colocation business. For further details of this transaction, see Note 20 of Notes to Consolidated Financial

Statements.

The Wireline segment provides local voice, data, long distance, entertainment, voice over internet protocol

(“VoIP”), and other services over its owned and other wireline networks. Local voice services include local

telephone service, switched access, and value-added services such as caller identification, voicemail, call waiting,

and call return. Data services include high-speed internet using digital subscriber line technology and over fiber

using its gigabit passive optical network. Data services also provide data transport for businesses, including local

area network services, dedicated network access, and metro ethernet and dense wavelength division multiplexing

(“DWDM”)/optical wave data transport, which principally are used to transport large amounts of data over

private networks. Long distance and VoIP services include long distance voice, audio conferencing, VoIP and

other broadband services including private line and multi-protocol label switching, a technology that enables a

business customer to privately interconnect voice and data services at its locations. Entertainment services are

comprised of television media through our Fioptics product suite and DirecTV®. Other services primarily include

inside wire installation for business enterprises and rental revenue. These services are primarily provided to

customers in southwestern Ohio, northern Kentucky, and southeastern Indiana. In 2011, the Company sold

substantially all of the assets associated with its home security monitoring business and recognized a pretax gain

of $8.4 million. Wireline recognized restructuring charges of $3.5 million, $7.7 million, and $8.2 million in 2012,

2011 and 2010, respectively, for costs associated with employee separation, lease abandonments and contract

termination costs.

The Wireless segment provides advanced digital wireless voice and data communications services and sales

of related handset equipment to customers in the Greater Cincinnati and Dayton, Ohio operating areas. In 2011,

the Wireless segment recognized a goodwill impairment loss of $50.3 million. In 2012 and 2011, other asset

impairments were $0.4 million and $1.1 million, respectively, related to the write-off of canceled or abandoned

capital projects. Wireless incurred restructuring charges of $1.6 million in 2012 and $1.0 million in 2010, with no

such charges in 2011.

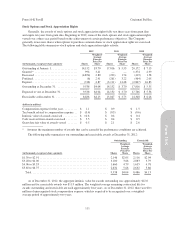

The Data Center Colocation segment provided data center colocation services to primarily large businesses.

As of December 31, 2012, we owned or maintained 24 data centers in Texas, Ohio, Kentucky, Indiana, Illinois,

Arizona, England, and Singapore. In 2012, the Data Center Colocation segment recognized impairment losses of

$13.3 million on long-lived assets and a customer relationship intangible primarily related to our GramTel

acquisition. In 2012, the Data Center Colocation segment recognized restructuring charges of $0.5 million for

severance associated with management contracts. In 2010, a restructuring charge of $1.4 million was incurred to

conform the Cincinnati-based operation’s commission incentive program to the Cyrus Networks program. No

restructuring charges were incurred in 2011. On June 11, 2010, the Company purchased Cyrus Networks, a data

center operator based in Texas, for approximately $526 million, net of cash acquired.

114

Form 10-K Part II Cincinnati Bell Inc.