Cincinnati Bell 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

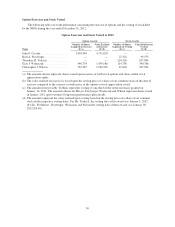

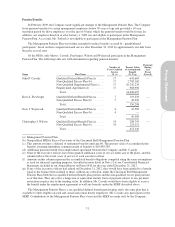

Outstanding Equity Awards at Fiscal Year End

The following table sets forth information concerning options and other equity awards held by the NEOs at

December 31, 2012:

Option Awards Stock Awards

Name

Number of

Securities

Underlying

Unexercised

Option (#)

Exercisable

Number of

Securities

Underlying

Unexercised

Option (#)

Unexercisable

(a)

Equity

Incentive Plan

Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options (#)

Option

Exercise

Price

($)

Option

Expiration

Date (b)

Number of

Shares or

Units of

Stocks That

Have Not

Vested

(#) (c)

Market

Value of

Shares or

Units of

Stocks That

Have Not

Vested

($)

Equity

Incentive

Plan Awards:

Number of

Unearned

Shares, Units

or Other

Rights That

Have Not

Vested

(#) (d)

Equity

Incentive

Plan Awards:

Market or

Payout Value

of Unearned

Shares, Units

or Other

Rights That

Have Not

Vested

($) (e)

John F.

Cassidy (f) ...... 801,000 — 5.66 12/4/2013

666,100 — 3.70 12/3/2014

425,000 — 4.00 12/1/2015

85,000 — 3.49 1/27/2016

574,350 — 4.74 12/8/2016

559,355 — 4.91 12/7/2017

680,000 — 1.67 12/5/2018

591,124 18,282 2.91 1/29/2020

481,080 307,576 2.85 1/28/2021

— 988,637 3.40 1/27/2022

— — 447,795 2,453,917

Kurt A.

Freyberger ...... 15,000 — 4.21 3/31/2015

20,000 — 4.00 12/1/2015

25,000 — 4.74 12/8/2016

25,000 — 4.91 12/7/2017

54,856 — 1.67 12/5/2018

18,222 — 1.39 1/30/2019

32,182 995 2.91 1/29/2020

45,713 22,515 2.54 12/7/2020

— 243,507 3.40 1/27/2022

— — 143,145 784,435

Theodore H.

Torbeck ........ — — — — 994,301 5,448,769 — —

Gary J.

Wojtaszek (g) . . . 83,590 — 1.67 12/5/2018

207,352 — 1.39 1/30/2019

204,946 6,338 2.91 1/29/2020

108,428 87,883 2.54 12/7/2020

— 243,507 3.40 1/27/2022

— — 228,882 1,254,273

Christopher J.

Wilson ......... 51,000 — 5.66 12/4/2013

24,726 6,181 2.91 1/29/2020

26,412 58,104 2.54 12/7/2020

— 194,805 3.40 1/27/2022

— — 178,884 980,284

(a) These awards, with the exception of awards expiring January 27, 2022, vest 28% on the first anniversary of the original date of grant and,

thereafter, at the rate of 3% per month for the next 24 months. The options and SARs awards expiring January 27, 2022 are performance-

based and vest 50% on the first anniversary, and 25% on the second and third anniversaries if the performance condition is achieved. The

amounts shown above for the 2012 awards reflect payout at the maximum level.

(b) All options and SARs granted are for a maximum period of ten years from the date of grant and vest over a three-year period.

(c) These awards represent restricted shares granted to Mr. Torbeck on January 3, 2012.

(d) Amounts in the column include performance shares granted for the 2010 – 2012 performance cycle less performance units earned and

vested for (i) the 2010 period on February 28, 2011 and (ii) the 2010-2011 cumulative period on February 28, 2012. Amounts also include

performance units granted for the 2011 – 2013 performance cycle less performance units earned and vested for the 2011 period on

February 28, 2012. The amount also includes the performance unit grant made to each of the executives for the 2012 – 2014 performance

cycle on January 28, 2012. These awards are performance-based and the amounts shown above reflect payout at the maximum level.

(e) Assuming the maximum number of shares is earned, amounts represent the equity incentive plan awards not yet vested. The value is

based on the closing price of the Company’s common shares as of December 31, 2012 ($5.48).

(f) Mr. Cassidy retired effective January 31, 2013 but will continue to vest in his options and stock awards.

(g) Mr. Wojtaszek resigned effective January 23, 2013 and forfeited all hisoptionawardsandstockawardsthatremainedunvestedatthattime.

49

Proxy Statement