Cincinnati Bell 2012 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K Part II Cincinnati Bell Inc.

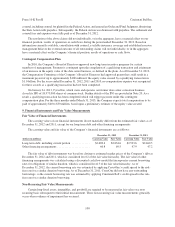

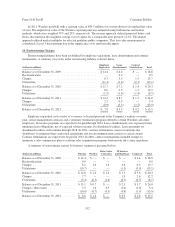

The assumed healthcare cost trend rate used to measure the postretirement health benefit obligation is

shown below:

December 31,

2012 2011

Healthcare cost trend .......................................................... 6.5% 8.0%

Rate to which the cost trend is assumed to decline (ultimate trend rate) .................. 4.5% 4.5%

Year the rates reach the ultimate trend rate ......................................... 2016 2019

A one-percentage point change in assumed healthcare cost trend rates would have the following effect on

the postretirement benefit costs and obligation:

(dollars in millions) 1% Increase 1% Decrease

Service and interest costs for 2012 .......................................... $0.2 $(0.2)

Postretirement benefit obligation at December 31, 2012 ......................... 5.4 (4.8)

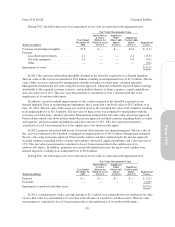

The projected benefit obligation is recognized in the Consolidated Balance Sheets as follows:

Pension Benefits

Postretirement and

Other Benefits

December 31, December 31,

(dollars in millions) 2012 2011 2012 2011

Accrued payroll and benefits (current liability) ....................... $ 1.7 $ 1.7 $ 21.4 $ 21.5

Pension and postretirement benefit obligations (noncurrent liability) ...... 239.4 255.0 119.3 131.3

Total ........................................................ $241.1 $256.7 $140.7 $152.8

Amounts recognized in “Accumulated other comprehensive loss” in the Consolidated Balance Sheets which

have not yet been recognized in net pension costs consisted of the following:

Pension Benefits

Postretirement and

Other Benefits

December 31, December 31,

(dollars in millions) 2012 2011 2012 2011

Prior service (cost) benefit, net of tax of $0.2, $0.2, $(26.0), $(30.8) ...... $ (0.3) $ (0.4) $ 45.9 $ 54.3

Actuarial loss, net of tax of $109.0, $111.6, $35.6, $37.3 ............... (192.5) (196.8) (62.7) (65.9)

Total ........................................................ $(192.8) $(197.2) $(16.8) $(11.6)

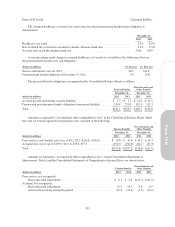

Amounts recognized in “Accumulated other comprehensive loss” on the Consolidated Statements of

Shareowners’ Deficit and the Consolidated Statements of Comprehensive Income/(Loss) are shown below:

Pension Benefits

Postretirement and

Other Benefits

(dollars in millions) 2012 2011 2012 2011

Prior service cost recognized:

Reclassification adjustments ................................... $ 0.1 $ 4.5 $(13.2) $(13.2)

Actuarial loss recognized:

Reclassification adjustments ................................... 19.4 14.3 6.8 6.5

Actuarial loss arising during the period ........................... (12.5) (74.2) (1.8) (13.2)

105

Form 10-K