Albertsons 2008 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2008 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

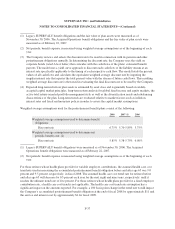

Shares available for grant were 35 and 17 at February 23, 2008 and February 24, 2007, respectively. As of

February 23, 2008, the Company has reserved 55 shares, in aggregate, for the plans.

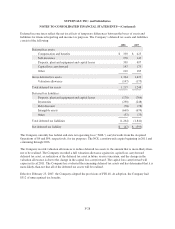

Adoption of SFAS No. 123(R)

Effective February 26, 2006, the Company adopted the provisions of SFAS No. 123(R) using the modified-

prospective transition method. Under this transition method, compensation expense recognized during fiscal

2007 included: (1) compensation expense for all stock-based awards granted prior to, but not yet vested as of

February 25, 2006 based on the grant date fair value estimated in accordance with the original provisions of

SFAS No. 123 and (2) compensation expense for all stock-based awards granted on or after February 26, 2006

based on the grant date fair value estimated in accordance with the provisions of SFAS No. 123(R). Prior to

February 26, 2006, the Company applied APB Opinion No. 25 and related interpretations in accounting for

stock-based awards. Stock-based awards previously granted under these plans had exercise prices not less than

100 percent of the fair market value of the common stock on the date of grant, and accordingly, no compensation

expense was recognized. In accordance with the provisions of the modified-prospective transition method, results

for prior periods have not been restated. Had compensation expense for fiscal 2006 been determined based on the

fair value at the grant dates of stock-based awards, consistent with SFAS No. 123, as amended by SFAS No. 148,

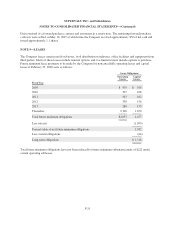

net earnings, basic net earnings per share, and diluted net earnings per share would have been as follows:

2006

Net earnings, as reported $ 206

Add: stock-based compensation expense included in reported net earnings, net of related tax effect 2

Deduct: total stock-based compensation expense determined under fair value based method for all

awards, net of related tax effect (18)

Pro forma net earnings 190

Add: interest on dilutive contingently convertible debentures, net of related tax effect 7

Pro forma net earnings for diluted earnings per share $ 197

Net earnings per share—basic:

As reported $1.52

Pro forma 1.40

Net earnings per share—diluted:

As reported 1.46

Pro forma 1.36

NOTE 12—TREASURY STOCK PURCHASE PROGRAM

On April 18, 2007, the Company’s Board of Directors adopted a new annual share repurchase program authorizing

the Company to purchase up to $235 of the Company’s common stock. Share repurchases will be made with the

cash generated from the settlement of stock options and mandatory convertible securities equity issuance. This

annual authorization program replaced all existing share repurchase programs and continues through June 2008.

During fiscal 2008, the Company purchased 5 shares under this program at an average cost of $45.05 per share. As

of February 23, 2008, there remained approximately $17 available to repurchase the Company’s common stock.

During fiscal 2007 and 2006, the Company purchased 8 shares and 1 shares, respectively, under former share

repurchase programs. No repurchases were made under former share repurchase programs during fiscal 2008.

F-32