Albertsons 2008 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2008 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

NOTE 5—RESERVES FOR CLOSED PROPERTIES AND RELATED ASSET IMPAIRMENT

CHARGES

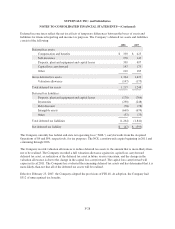

Reserves for Closed Properties

The Company maintains reserves for costs associated with closures of retail stores, distribution warehouses and

other properties that are no longer being utilized in current operations. The Company provides for closed

property operating lease liabilities using a discount rate to calculate the present value of the remaining

noncancellable lease payments after the closing date, reduced by estimated subtenant rentals that could be

reasonably obtained for the property.

A summary of changes in the Company’s reserves for closed properties is as follows:

2008 2007 2006

Beginning balance $118 $ 62 $ 81

Additions 18 36 10

Payments (40) (42) (30)

Adjustments 162 1

Ending balance $ 97 $118 $ 62

Fiscal 2007 additions included approximately $19 of reserves for closed properties from the Acquired

Operations, which were recorded in purchase accounting. Fiscal 2007 adjustments related to the fair value of

liabilities recognized in purchase accounting at the Acquisition Date for acquired closed property lease liabilities.

Asset Impairment Charges

During the fourth quarter of fiscal 2008, the Company recorded $14 of property, plant and equipment-related

impairments and other charges.

During fiscal 2007, the Company recorded a charge of $26 related to the disposal of 18 Scott’s retail stores which

included property, plant and equipment-related impairment charges of $6, goodwill impairment charges of $19

and other charges of $1.

During fiscal 2006, the Company recorded a charge of $65 related to the disposal of 20 Company operated Shop

‘n Save retail stores in Pittsburgh which included property, plant and equipment-related impairment charges of

$52, goodwill impairment charges of $7 and other charges of $6. In addition, the Company recognized asset

impairment charges of $14 for certain assets following the disposition of the Deals banner stores.

During fiscal 2006, the Company sold 26 Cub Foods stores located primarily in the Chicago area to the Cerberus

Group for a loss of approximately $95.

Additions and adjustments to the reserves for closed properties and asset impairment charges for fiscal 2008,

2007 and 2006 were all related to the Retail food segment, and were recorded as a component of Selling and

administrative expenses in the Consolidated Statements of Earnings, except for amounts related to the Acquired

Operations as noted above.

F-21