Albertsons 2008 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2008 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

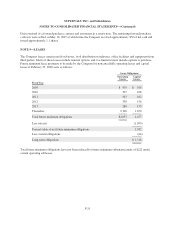

Rent expense and subtenant rentals under operating leases and amortization expense under capital leases were as

follows:

2008 2007 2006

Operating leases:

Minimum rent $450 $366 $147

Contingent rent 7 5 1

457 371 148

Subtenant rentals (66) (54) (26)

$391 $317 $122

Capital Leases:

Amortization expense $ 64 $ 54 $ 32

The Company was party to a synthetic leasing program for one of its major warehouses. The lease qualified for

operating lease accounting treatment under SFAS No. 13, “Accounting for Leases.” For additional information

on the synthetic lease, refer to Note 15—Commitments, Contingencies and Off-Balance Sheet Arrangements.

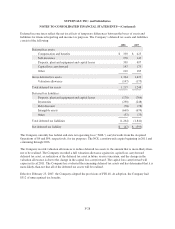

The Company leases certain property to third parties under both operating and direct financing leases. Under the

direct financing leases, the Company leases buildings to independent retailers with terms ranging from five to 20

years. Future minimum lease and subtenant rentals under noncancellable leases in effect at February 23, 2008

were as follows:

Lease Receipts

Fiscal Year

Operating

Leases

Direct

Financing

Leases

2009 $18 $ 9

2010 13 8

2011 10 7

2012 7 6

2013 6 6

Thereafter 9 21

Total minimum lease receipts $63 57

Less unearned income (16)

Net investment in direct financing leases 41

Less current portion (5)

Long-term portion $ 36

F-26