Albertsons 2008 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2008 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

wrongful conduct. On June 6, 2007, a jury awarded Mr. Johnson $0.5 for intentional infliction of emotional

distress and $16 for negligent misrepresentation. Previously, the Company prevailed in an arbitration action

against Market Place Holdings and obtained a $4 judgment against it for unpaid notes and accounts receivable.

The Company believes the jury verdict is contrary to the law and the facts presented at trial, and an appeal is now

before the Virginia Supreme Court. Management does not expect that the ultimate resolution of this lawsuit will

have a material adverse effect on the Company’s financial condition, results of operations or cash flows.

The Company is also involved in routine legal proceedings incidental to its operations. Some of these routine

proceedings involve class allegations, many of which are ultimately dismissed. Management does not expect that

the ultimate resolution of these legal proceedings will have a material adverse effect on the Company’s financial

condition, results of operations or cash flows.

The statements above reflect management’s current expectations based on the information presently available to

the Company. However, predicting the outcomes of claims and litigation and estimating related costs and

exposures involves substantial uncertainties that could cause actual outcomes, costs and exposures to vary

materially from current expectations. In addition, the Company regularly monitors its exposure to the loss

contingencies associated with these matters and may from time to time change its predictions with respect to

outcomes and its estimates with respect to related costs and exposures and believes recorded reserves are

adequate. It is possible that material differences in actual outcomes, costs and exposures relative to current

predictions and estimates, or material changes in such predictions or estimates, could have a material adverse

effect on the Company’s financial condition, results of operations or cash flows.

Insurance Contingencies

As previously reported, the Company had outstanding workers’ compensation and general liability claims for

specific years of coverage with a former insurance carrier that was experiencing financial difficulties. On

January 3, 2008, the carrier agreed to pay the Company to assume the obligations covered under the previous

policy. The Company has recorded these obligations in its self-insurance liabilities and has obtained additional

policies where required. The resolution of this matter did not have a material adverse effect on the Company’s

financial condition, results of operations or cash flows.

Pension Plan / Health and Welfare Plan Contingencies

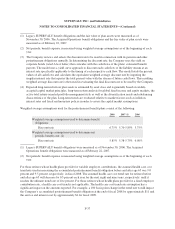

The Company contributes to various multi-employer pension plans under collective bargaining agreements,

primarily defined benefit pension plans. These plans generally provide retirement benefits to participants based on

their service to contributing employers. Based on available information, the Company believes that some of the

multi-employer plans to which it contributes are underfunded. Company contributions to these plans are likely to

continue to increase in the near term. However, the amount of any increase or decrease in contributions will depend

on a variety of factors, including the results of the Company’s collective bargaining efforts, investment return on the

assets held in the plans, actions taken by the trustees who manage the plans and requirements under the Pension

Protection Act and Section 412(e) of the Internal Revenue Code. Furthermore, if the Company were to exit certain

markets or otherwise cease making contributions to these plans at this time, it could trigger a withdrawal liability

that would require the Company to fund its proportionate share of a plan’s unfunded vested benefits.

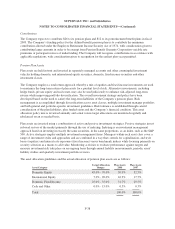

The Company also makes contributions to multi-employer health and welfare plans in amounts set forth in the

related collective bargaining agreements. Some of the collective bargaining agreements contain reserve

requirements that may trigger unanticipated contributions resulting in increased health care expenses. If these

health care provisions cannot be renegotiated in a manner that reduces the prospective health care cost as the

Company intends, the Company’s Selling and administrative expenses could increase in the future.

F-42