Albertsons 2008 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2008 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Net Earnings

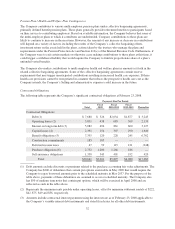

Net earnings were $593 for fiscal 2008, compared with $452 last year. Results for fiscal 2008 include

Acquisition-related costs of $45 after tax. Results for fiscal 2007 include Acquisition-related costs of $40 after

tax and charges related to the disposal of 18 Scott’s banner stores of $23 after tax.

Weighted average basic shares increased to 211 for fiscal 2008, compared with 189 shares last year. Weighted

average diluted shares increased to 215 for fiscal 2008, compared with 196 shares last year.

Comparison of fifty-two weeks ended February 24, 2007 (fiscal 2007) with fifty-two weeks ended

February 25, 2006 (fiscal 2006):

In fiscal 2007, the Company achieved Net sales of $37,406 compared with $19,864 in fiscal 2006. Net earnings

for fiscal 2007 were $452 and diluted net earnings per share were $2.32 compared with Net earnings of $206 and

diluted net earnings per share of $1.46 in fiscal 2006. Results for fiscal 2007 include Acquisition-related costs of

$40 after tax, charges related to the Company’s disposal of 18 Scott’s banner stores of $23 after tax and

incremental stock-based compensation expense related to the Company’s adoption of Statement of Financial

Accounting Standards (“SFAS”) No. 123 (revised 2004), “Share-Based Payment” (“SFAS No. 123(R)”) of $15

after tax. Results for fiscal 2006 include charges of $111 after tax primarily related to the sale of 26 Cub Foods

stores in Chicago in January 2006 (“Chicago”) and the disposal of 20 Shop ‘n Save retail stores in Pittsburgh

(“Pittsburgh”). The Pittsburgh stores were all disposed of in fiscal 2006 and fiscal 2007.

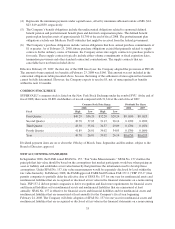

Net Sales

Net sales for fiscal 2007 were $37,406 compared with $19,864 in fiscal 2006, an increase of 88.3 percent. Retail

food sales were 74.9 percent of Net sales and Supply chain services sales were 25.1 percent of Net sales for fiscal

2007, compared with 53.5 percent and 46.5 percent, respectively, in fiscal 2006.

Retail food sales for fiscal 2007 were $28,016 compared with $10,635 in fiscal 2006, an increase of 163.4

percent. The increase was due primarily to the Acquisition. Identical store retail sales growth (defined as stores

operating for four full quarters) including store expansions and excluding fuel and planned closures, for fiscal

2007 as compared to fiscal 2006 was negative 1.1 percent. Identical store retail sales growth on a combined basis,

as if the Acquired Operations stores were in the store base for four full quarters, was positive 0.4 percent.

During fiscal 2007, the Company acquired 1,117 stores through the Acquisition, added 73 new stores through

new store development and closed 75 stores, 47 of which were acquired through the Acquisition.

Total retail square footage increased to approximately 73 million square feet at the end of fiscal 2007 compared

with approximately 18 million square feet at the end of fiscal 2006.

Supply chain services sales for fiscal 2007 were $9,390 compared with $9,229 in fiscal 2006, an increase of 1.8

percent. This increase primarily reflects new business growth, which was partially offset by customer attrition.

Gross Profit

Gross profit, as a percent of Net sales, was 21.8 percent for fiscal 2007 compared with 14.5 percent in fiscal

2006. The increase in Gross profit, as a percent of Net sales, primarily reflects the increase in Retail food sales,

which has a higher gross profit percentage than Supply chain services, as a percent of total Net sales as a result of

the Acquisition.

Selling and Administrative Expenses

Selling and administrative expenses increased by $4,382, primarily due to 38 weeks of operating results of the

Acquired Operations in fiscal 2007. The Acquisition greatly increased the size of the Company. The Acquisition

also greatly increased the relative size of the Company’s Retail food segment compared to its Supply chain

services segment. In fiscal 2007, 74.9 percent of the Company’s Net sales came from the Company’s Retail food

23