Albertsons 2008 Annual Report Download - page 30

Download and view the complete annual report

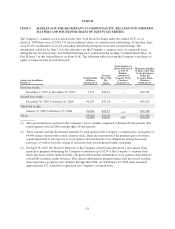

Please find page 30 of the 2008 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.segment, compared to 53.5 percent in fiscal 2006. Retail food traditionally has higher Selling and administrative

expenses than Supply chain services. Selling and administrative expenses, as a percent of Net sales, were 18.3

percent for fiscal 2007 compared with 12.3 percent in fiscal 2006. The increase in Selling and administrative

expenses, as a percent of Net sales, primarily reflects the higher percentage of Retail food sales as a percentage

of total Net sales as a result of the Acquisition, as well as Acquisition-related pre-tax costs of $65, a pre-tax

charge for Scott’s of $26 and incremental pre-tax stock-based compensation expense associated with the

Company’s adoption of SFAS No. 123(R) of $25. Fiscal 2006 included pre-tax charges of $174 primarily related

to Chicago and Pittsburgh.

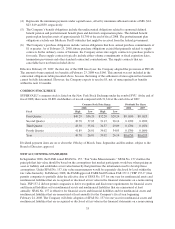

Operating Earnings

Operating earnings for fiscal 2007 were $1,305 compared with $435 in fiscal 2006, primarily as a result of the

Acquisition. Operating earnings for fiscal 2007 were impacted by Acquisition-related pre-tax costs of $65, a

pre-tax charge for Scott’s of $26 and incremental pre-tax stock-based compensation expense associated with the

Company’s adoption of SFAS No. 123(R) of $25. Retail food Operating earnings for fiscal 2007 were $1,179, or

4.2 percent of Retail food sales, compared with fiscal 2006 Retail food Operating earnings of $269, or 2.5

percent of Retail food sales. The increase in Retail food Operating earnings, as a percent of Retail food sales,

primarily reflects the results of the Acquisition and pre-tax charges of $174 in fiscal 2006 primarily related to

Chicago and Pittsburgh. Supply chain services Operating earnings for fiscal 2007 were $257, or 2.7 percent of

Supply chain services sales, compared with fiscal 2006 Supply chain services Operating earnings of $214, or 2.3

percent of Supply chain services sales. The increase in Supply chain services Operating earnings, as a percent of

Supply chain services sales, primarily reflects improved sales leverage.

Net Interest Expense

Net interest expense was $558 in fiscal 2007 compared with $106 in fiscal 2006. The increase primarily reflects

interest expense related to assumed debt and new borrowings related to the Acquisition.

Provision for Income Taxes

The effective tax rates were 39.5 percent and 37.4 percent in fiscal 2007 and fiscal 2006, respectively. The

increase is primarily due to the Acquisition and the write-off of non tax-deductible goodwill primarily related to

the disposal of 18 Scott’s banner stores in fiscal 2007. The fiscal 2006 effective tax rate was primarily impacted

by the write-off of non tax-deductible goodwill related to the sale of Chicago. Without these items, the effective

tax rates would have been 38.6 percent and 37.0 percent for fiscal 2007 and fiscal 2006, respectively.

Net Earnings

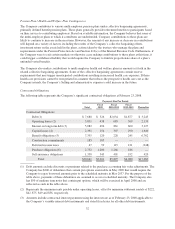

Net earnings were $452 for fiscal 2007 compared with Net earnings of $206 in fiscal 2006. Results for fiscal

2007 include Acquisition-related costs of $40 after tax, a charge related to the disposal of Scott’s banner stores of

$23 after tax and incremental stock-based compensation expense related to the Company’s adoption of SFAS

No. 123(R) of $15 after tax. Results for fiscal 2006 included charges of $111 after tax primarily related to

Chicago and Pittsburgh.

Weighted average basic shares increased to 189 for fiscal 2007 compared with 136 shares in fiscal 2006.

Weighted average diluted shares increased to 196 for fiscal 2007 compared with 146 shares in fiscal 2006. The

increase is primarily due to the shares issued in conjunction with the Acquisition on June 2, 2006.

CRITICAL ACCOUNTING POLICIES

The preparation of consolidated financial statements in conformity with accounting principles generally accepted

in the United States of America requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial

statements and the reported amounts of revenues and expenses during the reporting period. Actual results could

differ from those estimates.

24