Albertsons 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

A summary of changes in the Company’s self-insurance liabilities is as follows:

2008 2007 2006

Beginning balance $ 992 $ 58 $ 59

Self-insurance liabilities from the Acquired Operations — 957 —

Additions 385 194 51

Claim payments (245) (217) (52)

Ending balance 1,132 992 58

Less current portion (347) (329) (27)

Long-term portion $ 785 $ 663 $ 31

The current portion of the reserves for self-insurance is included in Other current liabilities, and the long-term

portion is included in Other liabilities in the Consolidated Balance Sheets. The self-insurance liabilities as of the

end of the fiscal year are net of the discount of $226, $148 and $11 for fiscal 2008, 2007 and 2006, respectively.

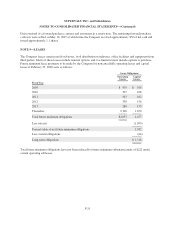

Property, Plant and Equipment

Property, plant and equipment are carried at cost. Depreciation is based on the estimated useful lives of the assets

using the straight-line method. Estimated useful lives generally are 10 to 40 years for buildings and major

improvements, three to 10 years for equipment, and the shorter of the term of the lease or expected life for

leasehold improvements and assets under capital leases. Interest on property under construction of $8, $11 and $2

was capitalized in fiscal 2008, 2007 and 2006, respectively.

Goodwill and Intangible Assets

The Company reviews goodwill for impairment during the fourth quarter of each year, and also if an event occurs

or circumstances change that would more-likely-than-not reduce the fair value of a reporting unit below its

carrying amount. The reviews consist of comparing estimated fair value to the carrying value at the reporting unit

level. Fair values are determined primarily by discounting projected future cash flows based on management’s

expectations of the current and future operating environment. If management identifies the potential for

impairment of goodwill, the fair value of the implied goodwill is calculated as the difference between the fair

value of the reporting unit and the fair value of the underlying assets and liabilities, excluding goodwill. An

impairment charge is recorded for any excess of the carrying value over the implied fair value. The Company

also reviews intangible assets with indefinite useful lives, which primarily consist of trademarks and tradenames,

for impairment during the fourth quarter of each year and also if events or changes in circumstances indicate that

the asset might be impaired. The reviews consist of comparing estimated fair value to the carrying value. Fair

values are determined primarily by discounting an assumed royalty value applied to projected future revenue

based on management’s expectations of the current and future operating environment. Intangible assets with

estimable useful lives are amortized on a straight-line basis with estimated useful lives ranging from less than

one to 35 years.

Impairment of Long-Lived Assets

In accordance with SFAS No. 144, the Company monitors the recoverability of its long-lived assets whenever

events or changes in circumstances indicate that its carrying amount may not be recoverable, including current

period losses combined with a history of losses or a projection of continuing losses, a significant decrease in the

F-15