Albertsons 2008 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2008 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

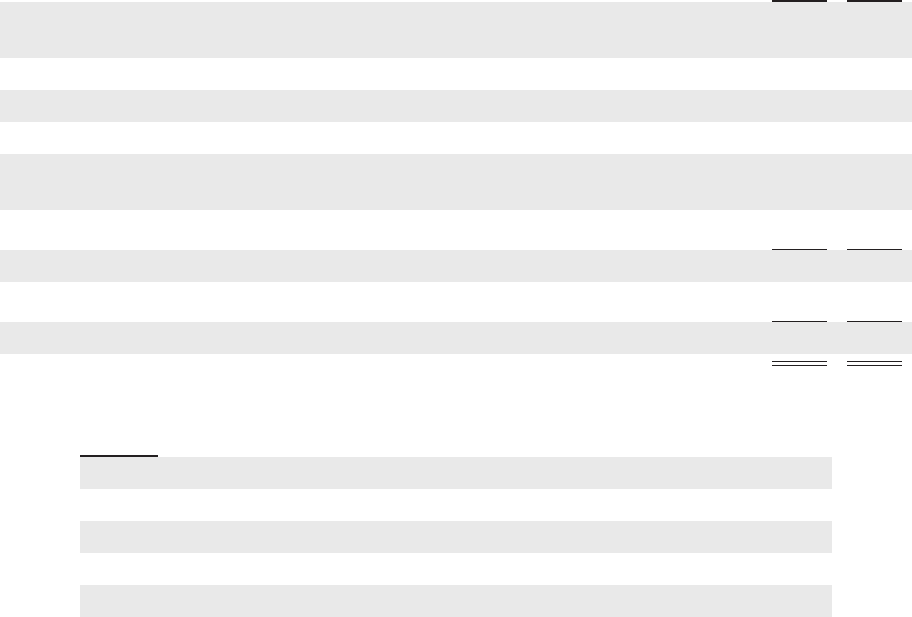

using the effective interest method over the remaining terms of the respective debt instruments. In the table

below, the stated interest rates for the debt assumed from New Albertsons are followed by the effective rates in

parentheses resulting from the discounts and premiums due to purchase accounting fair value adjustments.

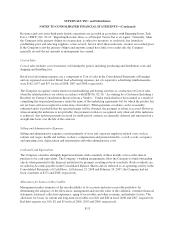

2008 2007

6.01% to 8.70% (5.44% to 8.97%) Senior Notes, Medium Term Notes and Debentures due

through May 2037 (face amounts $5,340) $5,133 $5,174

4.50% to 6.50% Revolving Credit Facility and Variable Rate Notes 1,933 2,608

3.91% Accounts Receivable Securitization Facility 272 159

2.27% to 2.45% Variable Rate Industrial Revenue Bonds 47 49

3.93% to 10.74% (3.93% to 7.75%) Secured Mortgages, secured by assets with a net book

value of $67, due through May 2014 (face amount $45) 46 38

Other 20 61

7,451 8,089

Less current maturities (267) (226)

Long-term debt $7,184 $7,863

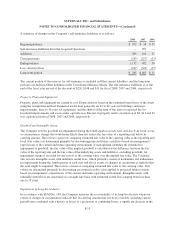

Aggregate amount of payments for debt as of February 23, 2008 were:

Fiscal Year

2009 $ 267

2010 1,119

2011 1,129

2012 391

2013 1,485

Thereafter 3,060

The payments above include the potential accelerations due to the debt holders’ ability to cause the Company to

repurchase the debt.

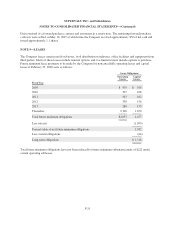

Certain of the Company’s credit facilities and long-term debt agreements have restrictive covenants and cross-

default provisions which generally provide, subject to the Company’s right to cure, for the acceleration of

payments due in the event of a breach of the covenant or a default in the payment of a specified amount of

indebtedness due under certain other debt agreements. The Company was in compliance with all such covenants

and provisions for all periods presented.

On June 1, 2006, the Company executed senior secured credit facilities in the amount of $4,000. These facilities

were provided by a group of lenders and consist of a $2,000 five-year revolving credit facility (the “Revolving

Credit Facility”), a $750 five-year term loan (“Term Loan A”) and a $1,250 six-year term loan (“Term Loan B”).

Pursuant to an amendment to the facilities effective March 8, 2007, rates on the facilities were tied to LIBOR

plus 0.375 percent to 1.75 percent or the Prime Rate plus 0.00 percent to 0.75 percent, depending on the type of

borrowing and the Company’s credit ratings, with facility fees ranging from 0.10 percent to 0.50 percent, also

depending on the Company’s credit ratings. The rates in effect on outstanding borrowings under the facilities as

F-23