Albertsons 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

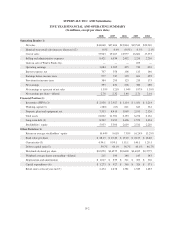

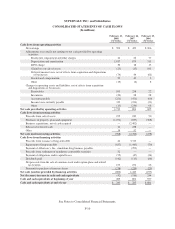

SUPERVALU INC. AND Subsidiaries

FIVE YEAR FINANCIAL AND OPERATING SUMMARY

(In millions, except per share data)

2008 2007 2006 2005 2004

Operating Results (1)

Net sales $44,048 $37,406 $19,864 $19,543 $20,210

Identical store retail sales increase (decrease) (2) 0.5% 0.4% (0.5%) 0.3% 2.1%

Cost of sales 33,943 29,267 16,977 16,681 17,373

Selling and administrative expenses 8,421 6,834 2,452 2,255 2,236

Gain on sale of WinCo Foods, Inc. — — — 109 —

Operating earnings 1,684 1,305 435 716 601

Interest expense, net 707 558 106 115 146

Earnings before income taxes 977 747 329 601 455

Provision for income taxes 384 295 123 215 175

Net earnings 593 452 206 386 280

Net earnings as a percent of net sales 1.35% 1.21% 1.04% 1.97% 1.39%

Net earnings per share—diluted 2.76 2.32 1.46 2.71 2.01

Financial Position (1)

Inventories (FIFO) (3) $ 2,956 $ 2,927 $ 1,114 $ 1,181 $ 1,214

Working capital (3) (280) (67) 821 643 361

Property, plant and equipment, net 7,533 8,415 1,969 2,191 2,126

Total assets 21,062 21,702 6,153 6,274 6,162

Long-term debt (4) 8,502 9,192 1,406 1,579 1,634

Stockholders’ equity 5,953 5,306 2,619 2,511 2,210

Other Statistics (1)

Return on average stockholders’ equity 10.44% 9.61% 7.95% 16.24% 13.29%

Book value per share $ 28.13 $ 25.40 $ 19.20 $ 18.53 $ 16.40

Current ratio (3) 0.94:1 0.99:1 1.51:1 1.40:1 1.20:1

Debt to capital ratio (5) 59.7% 64.1% 36.7% 40.1% 46.7%

Dividends declared per share $0.6750 $0.6575 $0.6400 $0.6025 $0.5775

Weighted average shares outstanding—diluted 215 196 146 145 143

Depreciation and amortization $ 1,017 $ 879 $ 311 $ 303 $ 302

Capital expenditures (6) $ 1,273 $ 927 $ 365 $ 326 $ 371

Retail stores at fiscal year end (7) 2,474 2,478 1,381 1,549 1,483

F-2