Albertsons 2008 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2008 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

NOTE 6—PROPERTY, PLANT AND EQUIPMENT

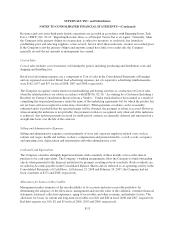

Property, plant and equipment, net, consisted of the following:

2008 2007

Land $ 1,335 $ 1,482

Buildings 3,269 3,488

Property under construction 333 265

Leasehold improvements 1,383 1,347

Equipment 3,777 3,445

Capitalized leases 1,015 1,135

11,112 11,162

Accumulated depreciation (3,347) (2,577)

Accumulated amortization on capital leases (232) (170)

$ 7,533 $ 8,415

Depreciation expense was $911, $793 and $274 for fiscal 2008, 2007 and 2006, respectively. Amortization

expense of capital leases was $64, $54 and $32 for fiscal 2008, 2007 and 2006, respectively.

NOTE 7—FINANCIAL INSTRUMENTS

Interest Rate Swap Agreements

In fiscal 2003, the Company entered into a fixed to floating rate interest rate swap in the aggregate notional

amount of $225 relating to the Company’s 7.875 percent fixed interest rate promissory notes due fiscal 2010. On

April 18, 2007, the Company closed out the swap, resulting in a pre-tax deferred gain of $1 that will be

recognized in earnings over the remaining term of the notes.

Fair Value Disclosures of Financial Instruments

For certain of the Company’s financial instruments, including cash and cash equivalents, receivables and

accounts payable, the fair values approximate book values due to their short maturities.

The estimated fair value of notes receivable approximates the book value at February 23, 2008. Notes receivable

are valued based on a discounted cash flow approach applying a rate that is comparable to publicly traded debt

instruments of similar credit quality.

The estimated fair value of the Company’s long-term debt (including current maturities) was less than the book

value by approximately $42 at February 23, 2008. The estimated fair value was based on market quotes, where

available, or market values for similar instruments.

NOTE 8—DEBT

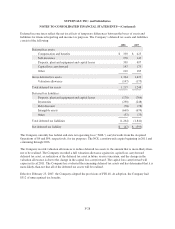

As a result of the acquisition of New Albertsons and the application of the purchase method of accounting, the

Company estimated the fair value of the debt assumed. This resulted in an aggregate net discount related to the

New Albertsons long-term debt of $231 as of the Acquisition Date, which will be amortized to Interest expense

F-22