Albertsons 2008 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2008 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

determined by the Board of Directors or the Compensation Committee. Generally, stock-based awards granted

prior to fiscal 2006 have a term of 10 years and effective in fiscal 2006, stock-based awards granted will not be

for a term of more than seven years.

Stock options are granted to key salaried employees and to the Company’s non-employee directors to purchase

common stock at an exercise price not less than 100 percent of the fair market value of the Company’s common

stock on the date of grant. Generally, stock options vest over four years. In fiscal 2007, in accordance with the

New Albertsons acquisition agreement, the Company assumed approximately 21 fully vested stock options of

holders of Albertsons stock options who became employees of the Company after the acquisition.

Restricted stock awards are also awarded to key salaried employees. The vesting of restricted stock awards

granted is determined at the discretion of the Board of Directors or the Compensation Committee. The

restrictions on the restricted stock awards generally lapse between one and five years from the date of grant and

the expense is recognized over the lapsing period. In fiscal 2007, in accordance with the New Albertsons

acquisition agreement, the Company assumed approximately 366 unvested restricted stock awards of holders of

Albertsons restricted stock awards who became employees of the Company after the acquisition.

Common stock is delivered out of treasury stock upon the exercise of stock-based awards. The provisions of

future stock-based awards may change at the discretion of the Board of Directors or the Compensation

Committee.

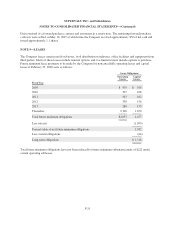

Stock Options

Stock options granted, exercised and outstanding were as follows:

Shares

Under Option

Weighted Average

Exercise Price

Weighted Average

Remaining

Contractual Term

Aggregate

Intrinsic Value

(In thousands) (In years) (In thousands)

Outstanding, February 24, 2007 22,035 $32.40

Granted 5,415 43.86

Exercised (6,366) 29.51

Canceled and forfeited (1,087) 44.98

Outstanding, February 23, 2008 19,997 $35.72 4.2 $17,534

Vested and expected to vest in future at

February 23, 2008 19,564 $35.65 4.2 $17,531

Exercisable at February 23, 2008 14,162 $34.68 3.6 $17,508

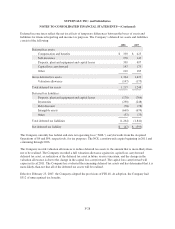

The weighted average grant date fair value of all stock options granted during fiscal 2008, 2007 and 2006 was

$8.97, $6.18 and $8.42 per share, respectively. In fiscal 2007, the weighted average grant date fair value of stock

options granted to holders of Albertsons stock options who became employees of the Company after the

Acquisition was $6.07 per share. The weighted average grant date fair value of all other stock options granted

during fiscal 2007 was $6.96 per share. The total intrinsic value of stock options exercised during fiscal 2008,

2007, and 2006 was $93, $71 and $29, respectively. Intrinsic value is measured using the fair market value at the

date of exercise for stock options exercised and at February 23, 2008, less the applicable exercise price.

The fair value of each stock option is estimated as of the date of grant using the Black-Scholes option pricing

model. Expected volatility is estimated based on an average of actual historical volatility and implied volatility

F-30