Albertsons 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Inventories

Inventories are valued at the lower of cost or market. Substantially all of the Company’s inventory consists of

finished goods.

Approximately 82 percent of the Company’s inventories are valued using the last-in, first-out (“LIFO”) method

for both fiscal 2008 and 2007. The Company uses a combination of the retail inventory method (“RIM”) and

replacement cost method to determine the current cost of its inventory before any LIFO reserve is applied. Under

RIM, the current cost of inventories and the gross margins are calculated by applying a cost-to-retail ratio to the

current retail value of inventories. Under the replacement cost method, the most current unit purchase cost is

used to calculate the current cost of inventories. The first-in, first-out method (“FIFO”) is used to determine cost

for some of the remaining highly perishable inventories. If the FIFO method had been used to determine cost of

inventories for which the LIFO method is used, the Company’s inventories would have been higher by

approximately $180 and $178 at February 23, 2008 and February 24, 2007, respectively. In addition, the LIFO

reserve was reduced by $28 as a result of the finalization of the fair value of inventory for the Acquired

Operations during the first quarter of fiscal 2008.

During fiscal 2008, 2007 and 2006, inventory quantities in certain LIFO layers were reduced. These reductions

resulted in a liquidation of LIFO inventory quantities carried at lower costs prevailing in prior years as compared

with the cost of fiscal 2008, 2007 and 2006 purchases. As a result, Cost of sales decreased by $5, $6 and $7 in

fiscal 2008, 2007 and 2006, respectively.

The Company evaluates inventory shortages throughout each fiscal year based on actual physical counts in its

facilities. Allowances for inventory shortages are recorded based on the results of these counts to provide for

estimated shortages as of the end of each fiscal year.

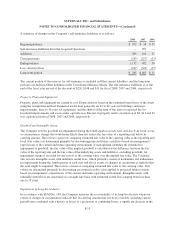

Reserves for Closed Properties and Related Asset Impairment Charges

The Company maintains reserves for costs associated with closures of retail stores, distribution warehouses and

other properties that are no longer being utilized in current operations in accordance with Statement of Financial

Accounting Standards (“SFAS”) No. 146, “Accounting for Costs Associated with Exit or Disposal Activities.”

The Company provides for closed property operating lease liabilities using a discount rate to calculate the present

value of the remaining noncancellable lease payments after the closing date, reduced by estimated subtenant

rentals that could be reasonably obtained for the property. The closed property lease liabilities usually are paid

over the remaining lease terms, which generally range from one to 25 years. Adjustments to closed property

reserves primarily relate to changes in subtenant income or actual exit costs differing from original estimates.

Adjustments are made for changes in estimates in the period in which the changes become known.

Owned properties, capital lease properties and the related equipment and leasehold improvements at operating

leased properties that are closed are reduced to their estimated fair value in accordance with SFAS No. 144,

“Accounting for the Impairment or Disposal of Long-Lived Assets.”

Self-Insurance Liabilities

The Company is primarily self-insured for workers’ compensation, health care for certain employees and general

and automobile liability costs. It is the Company’s policy to record its self-insurance liabilities based on

management’s estimate of the ultimate cost of reported claims and claims incurred but not yet reported and

related expenses, discounted at a risk-free interest rate. The present value of such claims was calculated using

discount rates ranging from 2.4 to 5.1 percent for fiscal 2008, 4.7 to 5.0 percent for fiscal 2007 and 3.7 to 6.8

percent for fiscal 2006.

F-14