Albertsons 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

AND RELATED STOCKHOLDER MATTERS

The information called for by Item 12, as to security ownership of certain beneficial owners, directors and

management, is incorporated by reference to the Company’s definitive Proxy Statement to be filed with the SEC

pursuant to Regulation 14A in connection with the Company’s 2008 Annual Meeting of Stockholders under the

headings “Security Ownership of Certain Beneficial Owners” and “Security Ownership of Management.”

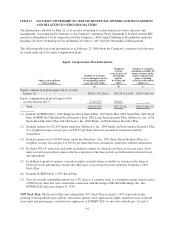

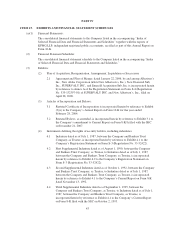

The following table sets forth information as of February 23, 2008 about the Company’s common stock that may

be issued under all of its equity compensation plans:

Equity Compensation Plan Information

(shares not in millions)

Plan Category

Number of securities

to be issued upon exercise

of outstanding options,

warrants and rights

Weighted

average

exercise price of

outstanding

options,

warrants and

rights

Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (a))

(a) (b) (c)

Equity compensation plans approved by security

holders (1) 18,011,392 (2)(3) $36.78 (2)(3)(4) 34,675,686 (5)

Equity compensation plans not approved by

security holders (6)(7) 2,447,927 $28.01 —

Total 20,459,319 $35.72 (4) 34,675,686 (5)

(1) Includes SUPERVALU’s 1983 Employee Stock Option Plan, 1993 Stock Plan, 2002 Stock Plan, 2007 Stock

Plan, SUPERVALU/Richfood Stock Incentive Plan, 2002 Long Term Incentive Plan, Albertson’s, Inc. 1995

Stock-Based Incentive Plan and Albertson’s, Inc. 2004 Equity and Performance Incentive Plan.

(2) Includes options for 425,299 shares under the Albertson’s, Inc. 2004 Equity and Performance Incentive Plan

at a weighted average exercise price of $28.87 per share that were assumed in connection with the

Acquisition.

(3) Includes options for 6,104,894 shares under the Albertson’s, Inc. 1995 Stock-Based Incentive Plan at a

weighted average exercise price of $39.16 per share that were assumed in connection with the Acquisition.

(4) Excludes 505,157 restricted stock units included in column (a) which do not have an exercise price. Such

units vest and are payable in shares after the expiration of the time periods set forth in their restricted stock

unit agreements.

(5) In addition to grants of options, warrants or rights, includes shares available for issuance in the form of

restricted stock, performance awards and other types of stock-based awards under the Company’s 2007

Stock Plan.

(6) Includes SUPERVALU’s 1997 Stock Plan.

(7) Does not include outstanding options for 2,472 shares of common stock at a weighted average exercise price

of $26.00 per share that were assumed in connection with the merger of Richfood Holdings, Inc. into

SUPERVALU effective August 31, 1999.

1997 Stock Plan. The Board of Directors adopted the 1997 Stock Plan on April 9, 1997 to provide for the

granting of non-qualified stock options, restoration options, stock appreciation rights, restricted stock, restricted

stock units and performance awards to key employees of SUPERVALU or any of its subsidiaries. A total of

41