Albertsons 2008 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2008 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

At February 23, 2008 and February 24, 2007, the accumulated benefit obligation for all defined benefit pension

plans exceeded the fair value of the respective plan assets.

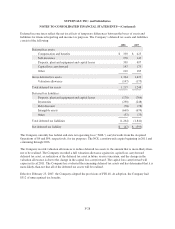

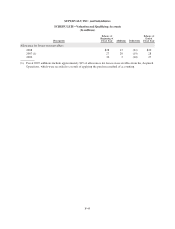

Amounts recognized in accumulated other comprehensive losses for the defined benefit pension plans and other

postretirement benefit plans consists of the following:

Pension Benefits

Other

Postretirement

Benefits

2008 2007 2008 2007

Prior service cost (benefit) $ — $ 7 $ (2) $ (4)

Net actuarial loss 127 324 29 56

Total recognized in accumulated other comprehensive losses, before tax $127 $331 $27 $52

Total recognized in accumulated other comprehensive losses, after tax $ 79 $203 $16 $32

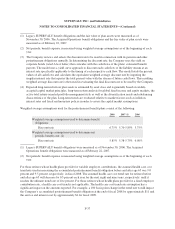

The estimated future benefit payments to be paid from the Company’s defined benefit pension plans and other

postretirement benefit plans, which reflect expected future service, are as follows:

Pension Benefits

Other

Postretirement

Benefits

Fiscal Year

2009 $ 69 $12

2010 75 12

2011 81 13

2012 88 14

2013 96 14

Years 2014-2018 614 81

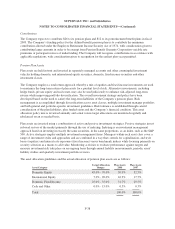

Assumptions

Weighted average assumptions used for the defined benefit pension plans consist of the following:

2008 2007 (1) 2006

Weighted average assumptions used to determine benefit

obligations:

Discount rate 6.75% 5.70-5.85% 5.75%

Rate of compensation increase 3.75% 3.00-3.07% 3.00%

Weighted average assumptions used to determine net

periodic benefit cost: (2)

Discount rate (3) 5.85% 5.75-6.30% 6.00%

Rate of compensation increase 3.00% 3.00-3.07% 3.00%

Expected return on plan assets (4) 8.00% 8.00% 8.00%

F-36