Albertsons 2008 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2008 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Pension Plan / Health and Welfare Plan Contingencies

The Company contributes to various multi-employer pension plans under collective bargaining agreements,

primarily defined benefit pension plans. These plans generally provide retirement benefits to participants based

on their service to contributing employers. Based on available information, the Company believes that some of

the multi-employer plans to which it contributes are underfunded. Company contributions to these plans are

likely to continue to increase in the near term. However, the amount of any increase or decrease in contributions

will depend on a variety of factors, including the results of the Company’s collective bargaining efforts,

investment return on the assets held in the plans, actions taken by the trustees who manage the plans and

requirements under the Pension Protection Act and Section 412(e) of the Internal Revenue Code. Furthermore, if

the Company were to exit certain markets or otherwise cease making contributions to these plans at this time, it

could trigger a withdrawal liability that would require the Company to fund its proportionate share of a plan’s

unfunded vested benefits.

The Company also makes contributions to multi-employer health and welfare plans in amounts set forth in the

related collective bargaining agreements. Some of the collective bargaining agreements contain reserve

requirements that may trigger unanticipated contributions resulting in increased health care expenses. If these

health care provisions cannot be renegotiated in a manner that reduces the prospective health care cost as the

Company intends, the Company’s Selling and administrative expenses could increase in the future.

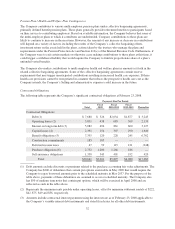

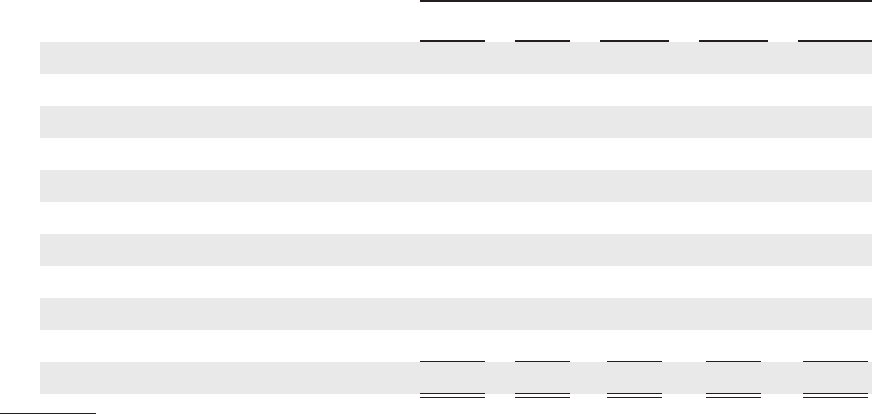

Contractual Obligations

The following table represents the Company’s significant contractual obligations at February 23, 2008.

Payments Due Per Period

Total

Fiscal

2009

Fiscal

2010-2011

Fiscal

2012-2013 Thereafter

Contractual Obligations:

Debt (1) $ 7,680 $ 526 $2,034 $1,877 $ 3,243

Operating leases (2) 3,831 438 685 569 2,139

Interest on long-term debt (3) 5,082 494 861 600 3,127

Capital leases (4) 2,391 154 307 290 1,640

Benefit obligations (5) 7,355 120 228 245 6,762

Construction commitments 185 185 — — —

Deferred income taxes 47 59 115 121 (248)

Purchase obligations (6) 2,732 1,280 1,266 186 —

Self-insurance obligations 1,358 345 401 192 420

Total $30,661 $3,601 $5,897 $4,080 $17,083

(1) Debt amounts exclude discounts or premiums related to the purchase accounting fair value adjustments. The

Company has $200 of debentures that contain put options exercisable in May 2009 that would require the

Company to repay borrowed amounts prior to the scheduled maturity in May 2037. For the purpose of the

table above, payments of these debentures are assumed to occur at scheduled maturity. The Company also

has $50 of medium term notes that contain put options, which will be exercised in April 2008 and are

reflected as such in the table above.

(2) Represents the minimum rents payable under operating leases, offset by minimum subtenant rentals of $222,

$42, $75, $49 and $56, respectively.

(3) Amounts include contractual interest payments using the interest rate as of February 23, 2008 applicable to

the Company’s variable interest debt instruments and stated fixed rates for all other debt instruments.

32