Albertsons 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(4) Represents the minimum payments under capital leases, offset by minimum subtenant rentals of $86, $14,

$23, $19 and $30, respectively.

(5) The Company’s benefit obligations include the undiscounted obligations related to sponsored defined

benefit pension and postretirement benefit plans and deferred compensation plans. The defined benefit

pension plan has plan assets of approximately $1,700 at the end of fiscal 2008. The postretirement plan

obligations exclude any Medicare Part D subsidies that might be received from the federal government.

(6) The Company’s purchase obligations include various obligations that have annual purchase commitments of

$1 or greater. As of February 23, 2008, future purchase obligations existed that primarily related to supply

contracts. In the ordinary course of business, the Company enters into supply contracts to purchase products

for resale. These supply contracts typically include either volume commitments or fixed expiration dates,

termination provisions and other standard contractual considerations. The supply contracts that are

cancelable have not been included above.

Effective February 25, 2007, the first day of the 2008 fiscal year, the Company adopted the provisions of FIN 48.

The amount of unrecognized tax benefits at February 23, 2008 was $146. This amount was not included in the

contractual obligations table presented above, because the timing of the settlement of unrecognized tax benefits

cannot be fully determined. However, the Company expects to resolve $5, net, of unrecognized tax benefits

within the next 12 months.

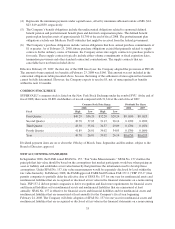

COMMON STOCK PRICE

SUPERVALU’s common stock is listed on the New York Stock Exchange under the symbol SVU. At the end of

fiscal 2008, there were 28,890 stockholders of record compared with 31,614 at the end of fiscal 2007.

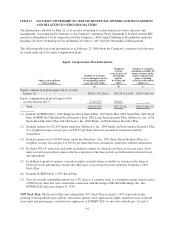

Common Stock Price Range Dividends Per Share

2008 2007 2008 2007

Fiscal High Low High Low

First Quarter $49.29 $36.20 $32.28 $28.24 $0.1650 $0.1625

Second Quarter 49.78 37.03 31.13 26.14 0.1700 0.1650

Third Quarter 43.30 35.02 34.57 29.09 0.1700 0.1650

Fourth Quarter 41.89 26.01 39.02 34.03 0.1700 0.1650

Year 49.78 26.01 39.02 26.14 $0.6750 $0.6575

Dividend payment dates are on or about the 15th day of March, June, September and December, subject to the

Board of Directors approval.

NEW ACCOUNTING STANDARDS

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements.” SFAS No. 157 clarifies the

principle that fair value should be based on the assumptions that market participants would use when pricing an

asset or liability and establishes a fair value hierarchy that prioritizes the information used to develop those

assumptions. Under SFAS No. 157, fair value measurements would be separately disclosed by level within the

fair value hierarchy. In February 2008, the FASB approved FASB Staff Position FAS 157-2 (“FSP 157-2”) that

permits companies to partially defer the effective date of SFAS No. 157 for one year for nonfinancial assets and

nonfinancial liabilities that are recognized or disclosed at fair value in the financial statements on a nonrecurring

basis. FSP 157-2 did not permit companies to defer recognition and disclosure requirements for financial assets

and financial liabilities or for nonfinancial assets and nonfinancial liabilities that are remeasured at least

annually. SFAS No. 157 is effective for financial assets and financial liabilities and for nonfinancial assets and

nonfinancial liabilities that are remeasured at least annually for the Company’s fiscal year beginning

February 24, 2008. The Company will defer adoption of SFAS No. 157 for one year for nonfinancial assets and

nonfinancial liabilities that are recognized or disclosed at fair value in the financial statements on a nonrecurring

33