Albertsons 2008 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2008 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

variable payments to the Company. In July 2007, Albertsons LLC and the Company amended the TSA to provide

for a one-year extension commencing June 3, 2008 and ending June 2, 2009. The TSA fees are reflected in the

Consolidated Statements of Earnings as a reduction of Selling and administrative expenses.

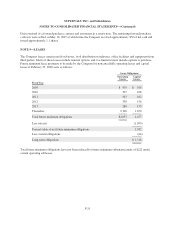

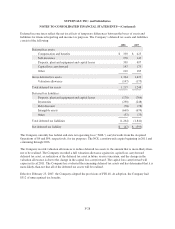

NOTE 4—GOODWILL AND INTANGIBLE ASSETS

A summary of changes in the Company’s Goodwill and Intangible assets is as follows:

February 25,

2006

Additions /

Amortization

Other net

adjustments

February 24,

2007

Additions /

Amortization

Other net

adjustments

February 23,

2008

Goodwill $1,614 $4,333 $(26) $5,921 $ 57 $ 979 $6,957

Intangible assets:

Trademarks and tradenames $ 22 $1,362 $ — $1,384 $ 1 $ (15) $1,370

Favorable operating leases,

customer lists and

other (accumulated

amortization of $130 and

$63, at February 23,

2008 and February 24,

2007, respectively) 50 1,043 (11) 1,082 12 (425) 669

Customer relationships

(accumulated

amortization of $11 and

$8 at February 23, 2008

and February 24, 2007,

respectively) 48 — — 48 — — 48

Non-compete agreements

(accumulated

amortization of $9 and

$6 at February 23, 2008

and February 24, 2007,

respectively) 8 6 (1) 13 3 (1) 15

Total intangible assets 128 2,411 (12) 2,527 16 (441) 2,102

Accumulated amortization (34) (48) 5 (77) (55) (18) (150)

Total intangible assets, net $ 94 $2,450 $1,952

The increase in Goodwill from $5,921 as of February 24, 2007 to $6,957 as of February 23, 2008 resulted

primarily from final purchase accounting adjustments for the Acquired Operations of $958 in the first quarter of

fiscal 2008 and other purchase accounting adjustments during fiscal 2008 for income tax-related amounts.

Goodwill also increased $57 related to other store acquisitions.

The increase in Goodwill from $1,614 as of February 25, 2006 to $5,921 at February 24, 2007 resulted primarily

from the addition of $4,333 of Goodwill related to the Acquired Operations. Other net adjustments consist

primarily of a Goodwill impairment charge of $19 related to the disposal of 18 Scott’s banner stores.

Amortization expense of intangible assets with a definite life of $55, $48 and $7 was recorded in fiscal 2008,

2007 and 2006, respectively. Future amortization expense will be approximately $56 per year for each of the next

five years.

F-20