Albertsons 2008 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2008 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

end in these plans and no employees will become eligible to participate in these plans after December 31, 2007.

Pay increases will continue to be reflected in the amount of benefit earned in these plans until December 31,

2012. The amendments to the plans were accounted for as plan curtailments in the first quarter of fiscal 2008.

Effective for fiscal 2007, the Company adopted SFAS No. 158, except for the measurement date provision which

was adopted as of February 25, 2007. SFAS No. 158 requires the recognition of the funded status of the

Company’s sponsored defined benefit plans in its Consolidated Balance Sheets.

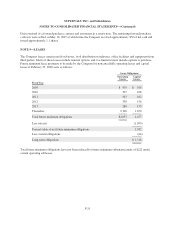

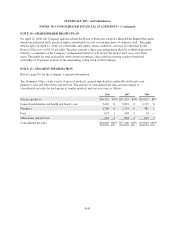

The benefit obligation, fair value of plan assets and funded status of the defined benefit pension plans and other

postretirement benefit plans are as follows:

Pension Benefits

Other

Postretirement

Benefits

2008 2007 2008 2007

Change in Benefit Obligation (1)

Benefit obligation at beginning of year $2,171 $ 801 $ 170 $ 144

Acquired Operations benefit obligation at Acquisition Date — 1,159 — 27

Change in measurement date (9) — (2) —

Service cost 27 33 2 2

Interest cost 124 99 9 9

Curtailment (38) — — —

Transfers (3) (2) — —

Actuarial (gain) loss (263) 150 (16) (1)

Benefits paid (69) (69) (10) (11)

Benefit obligation at end of year $1,940 $2,171 $ 153 $ 170

Changes in Plan Assets

Fair value of plan assets at beginning of year $1,735 $ 556 $ — $ —

Acquired Operations fair value of plan assets at Acquisition Date — 1,015 — —

Change in measurement date 24 — — —

Actual return on plan assets (28) 174 — —

Employer contributions 38 59 15 11

Plan participants’ contributions — — 10 5

Benefits paid (69) (69) (25) (16)

Fair value of plan assets at end of year $1,700 $1,735 $ — $ —

Funded status at end of year $ (240) $ (436) $(153) $(170)

(1) For the defined benefit pension plans, the benefit obligation is the projected benefit obligation. For other

postretirement benefit plans, the benefit obligation is the accumulated postretirement benefit obligation.

The Company’s accumulated benefit obligation for the defined benefit pension plans was $1,901 and $2,098 at

February 23, 2008 and February 24, 2007, respectively.

F-34