Albertsons 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

corresponding to the estimated expected term of such stock options. The Company believes this approach to

determine volatility is representative of future stock volatility. The expected term of a stock option is estimated

based on analysis of stock options already exercised and foreseeable trends or changes in behavior. The risk-free

interest rates are based on the U.S. Treasury securities maturities as of each applicable grant date. The dividend

yield is based on analysis of actual historical dividend yield.

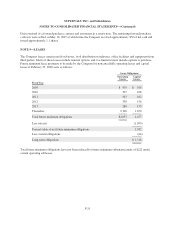

The significant weighted average assumptions relating to the valuation of the Company’s stock options were as

follows:

2008 2007 2006

Dividend yield 2.0% 2.0% 2.0%

Volatility rate 19.1 - 30.8% 20.6 - 29.5% 28.9%

Risk-free interest rate 3.0 - 5.1% 4.5 - 5.2% 3.9%

Expected option life 1.0 - 5.5 years 1.0 - 5.4 years 4.8 years

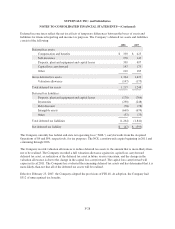

Restricted Stock Awards

Restricted stock award activity was as follows:

Restricted

Stock

Weighted Average

Grant-Date

Fair Value

(In thousands)

Outstanding, February 24, 2007 1,539 $28.91

Granted 51 37.19

Lapsed (646) 29.69

Canceled and forfeited (25) 21.12

Outstanding, February 23, 2008 919 $28.97

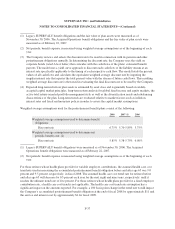

Compensation Expense

The components of pre-tax stock-based compensation expense (included primarily in Selling and administrative

expenses in the Consolidated Statements of Earnings) and related tax benefits were as follows:

2008 2007 2006

Stock-based compensation $ 52 $ 43 $ 3

Income tax benefits (20) (17) (1)

Stock-based compensation (net of tax) $ 32 $ 26 $ 2

The Company realized excess tax benefits of $20 and $22 related to the exercise of stock-based awards during

fiscal 2008 and 2007, respectively.

Unrecognized Compensation Expense

As of February 23, 2008, there was $55 of unrecognized compensation expense related to unvested stock-based

awards granted under the Company’s stock plans. The expense is expected to be recognized over a weighted

average remaining vesting period of approximately two years.

F-31