Albertsons 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

NOTE 3—BUSINESS ACQUISITION

Albertsons Acquisition

The Company acquired New Albertsons for a purchase price of approximately $11,370, net of approximately

$4,911 of cash for the sale of the Albertsons’ standalone drug store business to CVS Corporation and the sale of

Albertsons’ non-core supermarket business (“Albertsons LLC”) to an investment group led by Cerberus Capital

Management, L.P. (the “Cerberus Group”). The consideration paid by the Company consisted of approximately

$2,661 in cash, $2,251 of SUPERVALU common stock, $6,123 of debt assumed and approximately $335 related

to cash settlement and assumption of restricted stock unit and stock option awards and direct costs of the

acquisition of New Albertsons.

The acquisition of New Albertsons was accounted for under the purchase method of accounting with the

Company as the acquirer in accordance with SFAS No. 141, “Business Combinations.” As a result, the Company

applied the purchase method of accounting to the separable assets, including goodwill and liabilities of New

Albertsons. The Company completed the purchase price allocation during the first quarter of fiscal 2008, with the

exception of income taxes which are adjusted in accordance with EITF No. 93-7, “Uncertainties Related to

Income Taxes in a Purchase Business Combination.” The purchase price allocations are based on the use of

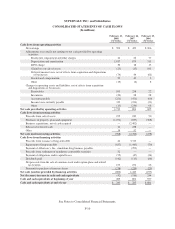

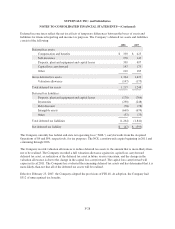

multiple valuation techniques, including the cost, income and market approaches. The following table

summarizes the assets acquired and liabilities assumed as of the Acquisition Date, with purchase price

adjustments since the preliminary purchase price allocation as previously disclosed as of February 24, 2007:

Purchase

Price

Allocation

February 24,

2007

Purchase

Price

Adjustments

Purchase

Price

Allocation

February 23,

2008

Current assets $ 3,339 $ 56 $ 3,395

Property, plant and equipment 6,613 (954) 5,659

Goodwill 4,333 1,004 5,337

Intangible assets 2,410 (440) 1,970

Other assets 376 94 470

Total assets acquired 17,071 (240) 16,831

Current liabilities 3,948 (30) 3,918

Long-term debt and obligations under capital leases 6,045 15 6,060

Deferred income taxes 610 (437) 173

Other liabilities 1,356 208 1,564

Total liabilities assumed 11,959 (244) 11,715

Net assets acquired $ 5,112 $ 4 $ 5,116

The purchase price adjustments relate primarily to the receipt of additional information regarding the fair values

of long-lived assets, inventories, intangible assets, capital and operating lease obligations, income taxes and

deferred income taxes and residual goodwill.

Transition Services Agreement

In connection with the purchase of Albertsons LLC by the Cerberus Group, the Company entered into a

Transition Services Agreement (“TSA”). The TSA provided for a two-year term and a combination of fixed and

F-19