Albertsons 2008 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2008 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.impairment charge is recorded for any excess of the carrying value over the implied fair value. Fair value

calculations contain significant judgments and estimates to estimate each reporting unit’s future revenues,

profitability and cash flows. When preparing these estimates, management considers each reporting unit’s

historical results, current operating trends, and specific plans in place. These estimates are impacted by variable

factors including inflation, the general health of the economy, and market competition.

The Company also reviews intangible assets with indefinite useful lives, which primarily consist of trademarks

and tradenames, for impairment during the fourth quarter of each year, and also if events or changes in

circumstances indicate that the asset might be impaired. The reviews consist of comparing estimated fair value to

the carrying value. Fair values are determined primarily by discounting an assumed royalty value applied to

projected future revenue based on management’s expectations of the current and future operating environment.

These estimates are impacted by variable factors including inflation, the general health of the economy, and

market competition.

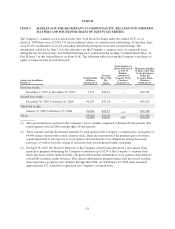

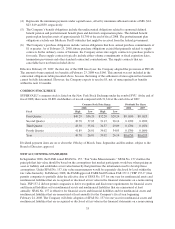

Goodwill and intangible assets with indefinite useful lives were $6,957 and $1,952 as of February 23, 2008,

respectively, and $5,921 and $2,450 as of February 24, 2007, respectively. The Company did not record any

impairment losses related to goodwill or intangible assets during 2008, 2007 and 2006, excluding charges related

to disposals of $19 and $7 during fiscal 2007 and 2006, respectively. The Company has sufficient current and

historical information available to support its judgments and estimates. However, if actual results are not

consistent with the Company’s estimates, future operating results may be materially impacted.

Self-Insurance Liabilities

The Company is primarily self-insured for workers’ compensation, health care for certain employees and general

and automobile liability costs. It is the Company’s policy to record its self-insurance liabilities based on

management’s estimate of the ultimate cost of reported claims and claims incurred but not yet reported and

related expenses, discounted at a risk-free interest rate.

In determining its self-insurance liabilities, the Company performs a continuing review of its overall position and

reserving techniques. Since recorded amounts are based on estimates, the ultimate cost of all incurred claims and

related expenses may be more or less than the recorded liabilities. Any projection of losses concerning workers’

compensation, health care and general and automobile liability is subject to a degree of variability. Among the

causes of this variability are unpredictable external factors affecting future inflation rates, discount rates,

litigation trends, legal interpretations, regulatory changes, benefit level changes and actual claim settlement

patterns. The majority of the self-insurance liability for workers’ compensation is related to claims occurring in

California. California workers’ compensation has received intense scrutiny from the state’s politicians, insurers,

and providers. In recent years, there has been an increase in the number of legislative reforms and judicial rulings

affecting the handling of claim activity. The impact of many of these variables on ultimate costs is difficult to

estimate. The effects of changes in such estimated items are included in results of operations in the period in

which the estimates are changed. Such changes may be material to the results of operations and could occur in a

future period. If, in the future, the Company was to experience significant volatility in the amount and timing of

cash payments compared to its earlier estimates, the Company would assess whether to continue to discount

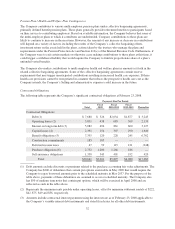

these liabilities. The Company had self-insurance liabilities of approximately $1,132, net of the discount of $226,

and $992, net of the discount of $148, as of February 23, 2008 and February 24, 2007, respectively. As of

February 23, 2008, each 25 basis point change in the discount rate would impact the self-insurance liabilities by

approximately $1.

Benefit Plans

The Company sponsors pension and other postretirement plans in various forms covering substantially all

employees who meet eligibility requirements. The determination of the Company’s obligation and related

expense for Company-sponsored pension and other postretirement benefits is dependent, in part, on

27