Albertsons 2008 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2008 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

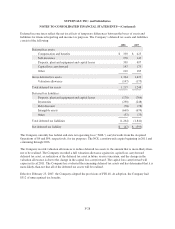

(1) Legacy SUPERVALU benefit obligations and the fair value of plan assets were measured as of

November 30, 2006. The Acquired Operations benefit obligations and the fair value of plan assets were

measured as of February 22, 2007.

(2) Net periodic benefit expense is measured using weighted average assumptions as of the beginning of each

year.

(3) The Company reviews and selects the discount rate to be used in connection with its pension and other

postretirement obligations annually. In determining the discount rate, the Company uses the yield on

corporate bonds (rated AA or better) that coincides with the cash flows of the plans’ estimated benefit

payouts. The model uses a yield curve approach to discount each cash flow of the liability stream at an

interest rate specifically applicable to the timing of each respective cash flow. The model totals the present

values of all cash flows and calculates the equivalent weighted average discount rate by imputing the

singular interest rate that equates the total present value with the stream of future cash flows. This resulting

weighted average discount rate is then used in evaluating the final discount rate to be used by the Company.

(4) Expected long-term return on plan assets is estimated by asset class and is generally based on widely-

accepted capital market principles, long-term return analysis for global fixed income and equity markets, the

active total return-oriented portfolio management style as well as the diversification needs and rebalancing

characteristics of the plan. Long-term trends are evaluated relative to market factors such as inflation,

interest rates and fiscal and monetary polices in order to assess the capital market assumptions.

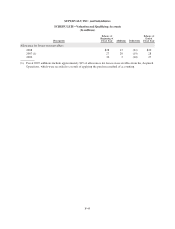

Weighted average assumptions used for the postretirement benefit plans consist of the following:

2008 2007 (1) 2006

Weighted average assumptions used to determine benefit

obligations:

Discount rate 6.75% 5.70-5.85% 5.75%

Weighted average assumptions used to determine net

periodic benefit cost: (2)

Discount rate 5.85% 5.38-5.75% 6.00%

(1) Legacy SUPERVALU benefit obligations were measured as of November 30, 2006. The Acquired

Operations benefit obligations were measured as of February 22, 2007.

(2) Net periodic benefit expense is measured using weighted average assumptions as of the beginning of each

year.

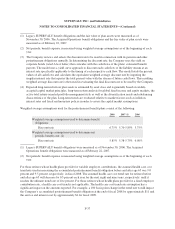

For those retirees whose health plans provide for variable employer contributions, the assumed health care cost

trend rate used in measuring the accumulated postretirement benefit obligation before and after age 65 was 9.0

percent and 9.5 percent, respectively, in fiscal 2008. The assumed health care cost trend rate for retirees before

and after age 65 will decrease by 0.5 percent each year for the next eight and nine years, respectively, until it

reaches the ultimate trend rate of five percent. For those retirees whose health plans provide for a fixed employer

contribution rate, a health care cost trend is not applicable. The health care cost trend rate assumption has a

significant impact on the amounts reported. For example, a 100 basis point change in the trend rate would impact

the Company’s accumulated postretirement benefit obligation at the end of fiscal 2008 by approximately $11 and

the service and interest cost by approximately $1 for fiscal 2009.

F-37