Albertsons 2008 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2008 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

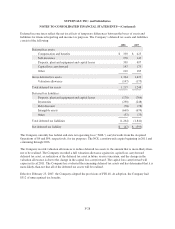

of February 23, 2008, based on the Company’s current credit ratings, were 0.40 percent for the facility fees,

LIBOR plus 1.375 percent for Term Loan A, LIBOR plus 1.50 percent for Term Loan B and LIBOR revolving

advances and Prime Rate plus 0.50 percent for base rate advances.

All obligations under the senior secured credit facilities are guaranteed by each material subsidiary of the

Company. The obligations are also secured by a pledge of the equity interests in those same material subsidiaries,

limited as required by the existing public indentures of the Company and subsidiaries such that the respective

debt issued need not be equally and ratably secured.

The senior secured credit facilities also contain various financial covenants, including a minimum interest

expense coverage ratio and a maximum debt leverage ratio. The interest expense coverage ratio shall not be less

than 2.20 to 1 for each of the fiscal quarters ending up through December 30, 2008, and moves progressively to a

ratio of not less than 2.30 to 1 for the fiscal quarters ending after December 30, 2009. The debt leverage ratio

shall not exceed 4.25 to 1 for each of the fiscal quarters ending up through December 30, 2008 and moves

progressively to a ratio not to exceed 3.75 to 1 for each of the fiscal quarters ending after December 30, 2009. As

of February 23, 2008, the Company was in compliance with the covenants of the senior secured credit facilities.

Borrowings under Term Loan A and Term Loan B may be repaid, in full or in part, at any time without penalty.

Term Loan A has required repayments, payable quarterly, equal to 2.50 percent of the initial drawn balance for

the first four quarterly payments (year one) and 3.75 percent of the initial drawn balance for each quarterly

payment in years two through five, with the entire remaining balance due at the five year anniversary of the

inception date. Term Loan B has required repayments, payable quarterly, equal to 0.25 percent of the initial

drawn balance, with the entire remaining balance due at the six year anniversary of the inception date.

As of February 23, 2008, there were $86 of outstanding borrowings under the Revolving Credit Facility, Term

Loan A had a remaining principal balance of $619, of which $113 was classified as current, and Term Loan B

had a remaining principal balance of $1,228, of which $13 was classified as current. Letters of credit outstanding

under the Revolving Credit Facility were $384 and the unused available credit under the Revolving Credit

Facility was $1,530. The Company also had $62 of outstanding letters of credit issued under separate agreements

with financial institutions. These letters of credit primarily support workers’ compensation, merchandise import

programs and payment obligations. The Company pays fees, which vary by instrument, of up to 1.75 percent on

the outstanding balance of the letters of credit.

In May 2007, the Company executed an amended and restated 364-day accounts receivable program, under

which the Company can borrow up to $300 on a revolving basis, with borrowings secured by eligible accounts

receivable, which remain under the Company’s control. Facility fees under this program range from 0.15 percent

to 1.50 percent, based on the Company’s credit ratings. The facility fee in effect on February 23, 2008, based on

the Company’s current credit ratings, is 0.20 percent. As of February 23, 2008, there were $361 of accounts

receivable pledged as collateral, classified in Receivables in the Consolidated Balance Sheets. Due to the

Company’s intent to renew the facility or refinance it with the Revolving Credit Facility, the facility is classified

in Long-term debt in the Consolidated Balance Sheets.

The Company has $205 of debentures that contain put options exercisable in May 2009 that would require the

Company to repay borrowed amounts prior to the scheduled maturity in May 2037.

Mandatory Convertible Securities

During fiscal 2007, the Company purchased substantially all of the 46 mandatory convertible securities

(“Corporate Units”) that were assumed by the Company upon the acquisition of New Albertsons. Each Corporate

F-24