Albertsons 2008 Annual Report Download - page 69

Download and view the complete annual report

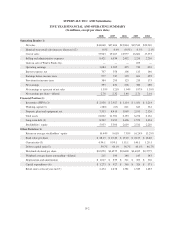

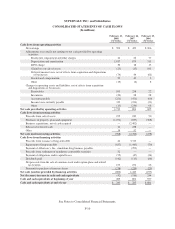

Please find page 69 of the 2008 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(1) Fiscal 2007 information presented above includes results of the Acquired Operations beginning June 2, 2006

as well as the assets and liabilities of the Acquired Operations as of the end of fiscal 2007. Fiscal 2004

statement of earnings data includes 53 weeks and all other years include 52 weeks.

(2) The change in identical store sales is calculated as the change in net sales for stores operating for four full

quarters, including store expansions and excluding fuel and planned store closures, and as if the Acquired

Operations stores were in the identical store base for four full quarters in fiscal 2008 and 2007.

(3) Inventories (FIFO), working capital and current ratio are calculated after adding back the LIFO reserve. The

LIFO reserve for each year is as follows: $180 for fiscal 2008, $178 for fiscal 2007, $160 for fiscal 2006,

$149 for fiscal 2005 and $136 for fiscal 2004.

(4) Long-term debt includes Long-term debt and Long-term obligations under capital leases.

(5) The debt to capital ratio is calculated as debt, which includes Current maturities of long-term debt, Current

obligations under capital leases, Long-term debt and Long-term obligations under capital leases, divided by

the sum of debt and Total stockholders’ equity.

(6) Capital expenditures includes fixed asset additions and capital leases.

(7) Retail stores at fiscal year end includes licensed limited assortment food stores and is adjusted for planned

sales and closures at the end of each fiscal year.

Historical data is not necessarily indicative of the Company’s future results of operations or financial condition.

See discussion of “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K.

F-3