Albertsons 2008 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2008 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.management’s selection of certain actuarial assumptions used in calculating these amounts. These assumptions

include, among other things, the discount rate, the expected long-term rate of return on plan assets and the rates

of increase in compensation and health care costs. The discount rate is based on current investment yields on

high-quality fixed-income investments. The expected long-term rate of return on plan assets is based on the

historical experience of the Company’s investment portfolio and the projected returns by asset category. In

accordance with generally accepted accounting principles, actual results that differ from the Company’s

assumptions are accumulated and amortized over future periods and, therefore, affect expense and obligation in

future periods.

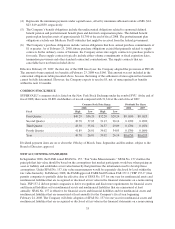

For fiscal 2009, each 25 basis point reduction in the discount rate would increase pension expense by

approximately $1 and each 25 basis point reduction in expected return on plan assets would increase pension

expense by approximately $4. Similarly, for postretirement benefits, a 100 basis point change in the health care

cost trend rate would impact the accumulated postretirement benefit obligation at the end of fiscal 2008 by

approximately $11 and the service and interest cost by $1 in fiscal 2009. Although the Company believes that its

assumptions are appropriate, the actuarial assumptions may differ from actual results due to changing market and

economic conditions, higher or lower withdrawal rates, and longer or shorter life spans of participants.

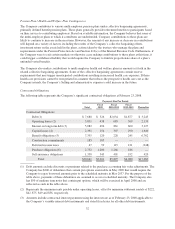

In addition, the Company contributes to various multi-employer pension plans under collective bargaining

agreements, primarily defined benefit pension plans. These plans generally provide retirement benefits to

participants based on their service to contributing employers. Based on available information, the Company

believes that some of the multi-employer plans to which it contributes are underfunded. Company contributions

to these plans are likely to continue to increase in the near term. However, the amount of any increase or decrease

in contributions will depend on a variety of factors, including the results of the Company’s collective bargaining

efforts, investment return on the assets held in the plans, actions taken by the trustees who manage the plans, and

requirements under the Pension Protection Act of 2006 and Section 412(e) of the Internal Revenue Code of 1986,

as amended (the “Internal Revenue Code”). Furthermore, if the Company were to exit certain markets or

otherwise cease making contributions to these plans at this time, it could trigger a withdrawal liability that would

require the Company to fund its proportionate share of a plan’s unfunded vested benefits. The Company

contributed $142, $122 and $37 to these plans for fiscal 2008, 2007 and 2006, respectively.

Income Taxes

The Company’s current and deferred tax provision is based on estimates and assumptions that could materially

differ from the actual results reflected in its income tax returns filed during the subsequent year and could

significantly affect the effective tax rate and cash flows in future years. The Company records adjustments based

on filed returns when it has identified and finalized them, which is generally in a subsequent period.

The Company recognizes deferred tax assets and liabilities for the expected tax consequences of temporary

differences between the tax bases of assets and liabilities and their reported amounts using enacted tax rates in

effect for the year in which it expects the differences to reverse.

The Company’s effective tax rate is influenced by tax planning opportunities available in the various

jurisdictions in which the Company operates. Management’s judgment is involved in determining the effective

tax rate and in evaluating the ultimate resolution of any uncertain tax positions. In addition, the Company is

currently in various stages of audits, appeals or other methods of review with taxing authorities from various

taxing jurisdictions. The Company establishes liabilities for unrecognized tax benefits in a variety of taxing

jurisdictions when, despite management’s belief that the Company’s tax return positions are supportable, certain

positions may be challenged and may need to be revised. Unrecognized tax benefits are accounted for in

accordance with Financial Accounting Standards Board (“FASB”) Interpretation No. 48, “Accounting for

Uncertainty in Income Taxes–an Interpretation of FASB Statement No. 109” (“FIN 48”) beginning on

February 25, 2007 for the Company. The Company adjusts these liabilities in light of changing facts and

circumstances, such as the progress of a tax audit. The effective income tax rate includes the impact of reserve

28