eBay 2005 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2005 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

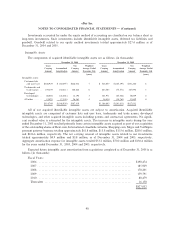

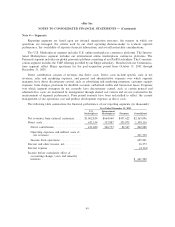

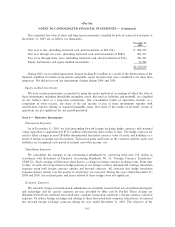

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

accordingly, the purchase price for each acquisition has been allocated to the tangible and intangible assets

acquired and liabilities assumed on the basis of their respective estimated fair values on the applicable

acquisition date.

The estimated useful economic lives of the identifiable intangible assets acquired in these acquisitions are

five years for both the trade names and for the customer lists. The final purchase price allocation will depend

primarily upon the completion of our integration plan.

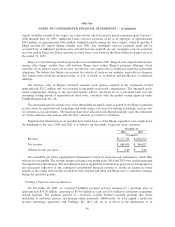

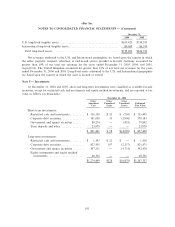

Shopping.com

On August 30, 2005, we acquired Shopping.com Ltd., or Shopping.com, for a purchase price of

approximately $685.3 million. We acquired all outstanding shares of Shopping.com's common stock for

$21 per share in cash totaling approximately $634.5 million and we assumed Shopping.com's outstanding

common stock options, valued at approximately $43.2 million. The total purchase price also includes

approximately $7.6 million in estimated acquisition-related expenses. Shopping.com is a provider of online

comparison shopping and consumer reviews. This acquisition is consistent with our strategy of growing our

global online marketplaces and we believe that it will create a premier online shopping experience for

individuals and businesses of all sizes. We accounted for the acquisition as a taxable purchase transaction and,

accordingly, the purchase price has been allocated to the tangible and intangible assets acquired and liabilities

assumed on the basis of their respective estimated fair values on the acquisition date.

The intrinsic value of Shopping.com's unvested common stock options assumed in the acquisition totaled

approximately $16.8 million and was recorded as unearned stock-based compensation. The unearned stock-

based compensation relating to the unvested options is being amortized on an accelerated basis over the

remaining vesting period of less than one year to four years, consistent with the graded vesting approach under

FASB Interpretation No. 28.

The estimated useful economic lives of the identifiable intangible assets acquired in the Shopping.com

acquisition are four years for the customer base and five years for the trade names and the developed

technology. The final purchase price allocation will depend primarily upon the completion of our integration

plan and the final valuation of certain acquired tax attributes.

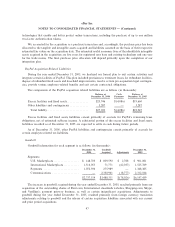

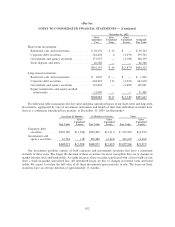

Skype

On October 14, 2005, we acquired all of the outstanding securities of Skype Technologies S.A.

(""Skype''), for a total initial consideration of approximately $2.6 billion, plus potential performance-based

payments of up to approximately $1.3 billion. In addition, we agreed to assume Skype's stock options

outstanding as of the closing date and convert them into options to acquire approximately 1.9 million shares of

our common stock. The initial consideration of approximately $2.6 billion is comprised of approximately

$1.3 billion in cash and 32.8 million shares of our common stock. For accounting purposes, the stock portion of

the initial consideration is valued at approximately $1.3 billion based on the average closing price of our

common stock surrounding the acquisition announcement date of September 12, 2005. The shares of our

common stock issued in connection with the acquisition are subject to certain contractual restrictions on

resale. Additionally, the assumed options have been valued at $64.6 million and were included as part of the

purchase price. The purchase price will be allocated to the tangible and intangible assets acquired and

liabilities assumed based on their respective fair values at the acquisition date.

In addition to the initial consideration, the maximum amount potentially payable under the performance-

based earn-out is approximately 41.1 billion, or approximately $1.3 billion, and would be payable in cash or

common stock, at our discretion. The earn-out payments are contingent upon Skype achieving certain net

revenue, gross profit margin-based targets and active user targets. Base earn-out payments of up to an

aggregate of approximately 4877 million, or approximately $1.0 billion, weighted equally among the three

95